SynopsisNifty IT Index saw itself underperforming the broader markets on relative terms. However, over the past few sessions, this pocket has tried to improve its relative momentum and performance against the broader markets.

Expert: Milan Vaishnav

While the market was witnessing a strong run until the middle of this month, there were pockets that grossly underperformed and just did not participate in the up move.

Nifty IT Index saw itself underperforming the broader markets on relative terms. However, over the past few sessions, this pocket has tried to improve its relative momentum and performance against the broader markets. Few stocks have shown some signs of putting their base in place and attempting a trend reversal.

is one such stock.

ET CONTRIBUTORS

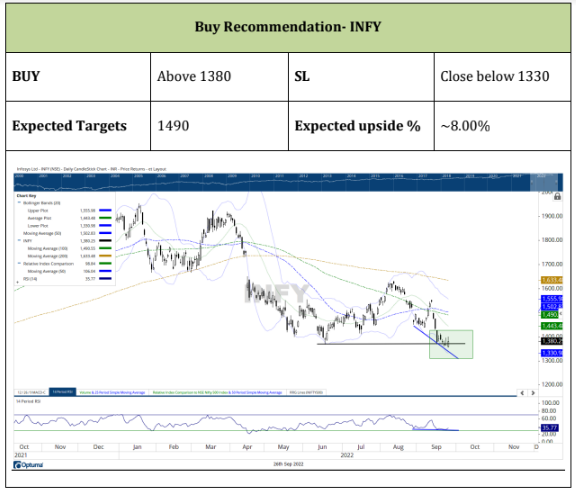

When it comes to the relative underperformance of the IT stocks, Infosys was no exception. The stock saw itself coming off from 1625 levels. The most recent price action has seen the stock forming classical Double Bottom support near the 1360-1370 zone. A few technical signs have emerged that show that Infosys may start trying to outperform the general markets.

Importantly, a strong bullish divergence of the RSI is seen against the price. While the price formed lower bottom, the RSI did not. This led to a bullish divergence of the RSI against the price. A bullish engulfing candle has emerged. This bullish emerging candle has been formed following a decline and near the strong double bottom support. This raises the formation of a potential reversal point at the current levels. The increase in volumes near the low point also leads to a strong possibility of a potential bottom in place. If the price trend reverses on the anticipated lines, the stock may test 1480-1490 levels. Any close below 1330 would negate this view.

(Milan Vaishnav, CMT, MSTA, is a Technical Analyst and founder of EquityResearch.asia and ChartWizard.ae)

Expert: Foram Chheda

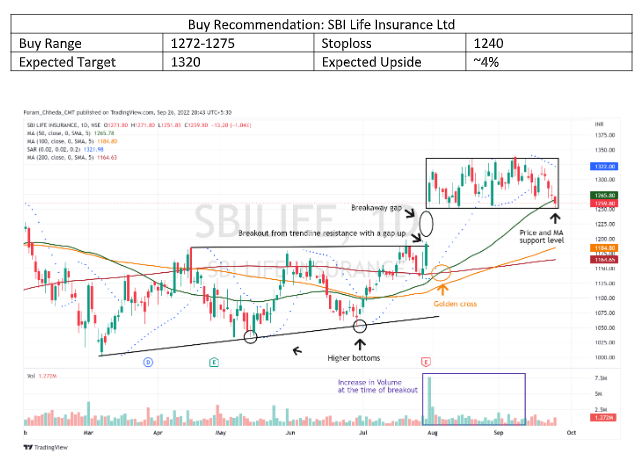

This life Insurance stock has the potential to outperform the broader Nifty 500 Index. Yesterday, the Nifty 500 fell 2.2% whereas this stock closed just a percentage point down as it relatively outperformed. The stock price is at a safe level where it presents a buying opportunity with a favourable risk-reward ratio. The stock is not only near the price pattern support but also near the 50-day moving average which makes the stock an attractive buy.

ET CONTRIBUTORS

The stock price of

had made a breakout from the technical price pattern of an ascending triangle at 1185 levels. This breakout was accompanied by an exponential increase in volume confirming the price action. This breakout from the ascending triangle had come with a breakaway gap, following which the stock price has been consolidating for the past 2 months in a range of 1250-1330 levels. During this consolidation period, there was a golden crossover where the 50-day moving average moved above the 200-day moving average, confirming that the underlying trend remains bullish.

Later, within the consolidation, the 100-day moving average crossed above the 200-day moving average which made the uptrend in the stock more significant. Currently, the stock price is very close to the lower side of the consolidation range and the 50-day moving average coincides almost at the same level near 1250 which brings in buying opportunity with lesser risk.

There is buying opportunity in this stock above 1272 with a potential upside of 1320. Any price move below 1240 would be a sign to move out of the stock.

(Foram Chheda, CMT is a Technical Research Analyst and Founder of ChartAnalytics.co.in.)

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)

(Originally published on Sep 27, 2022, 09:05 AM IST)

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now