SynopsisIf a shortage of parts has further extended the waiting period for new cars and SUVs, fewer people replacing their old cars for new and a fall in repossession of vehicles by financiers due to the moratorium benefits have affected the supply in the used-car market.

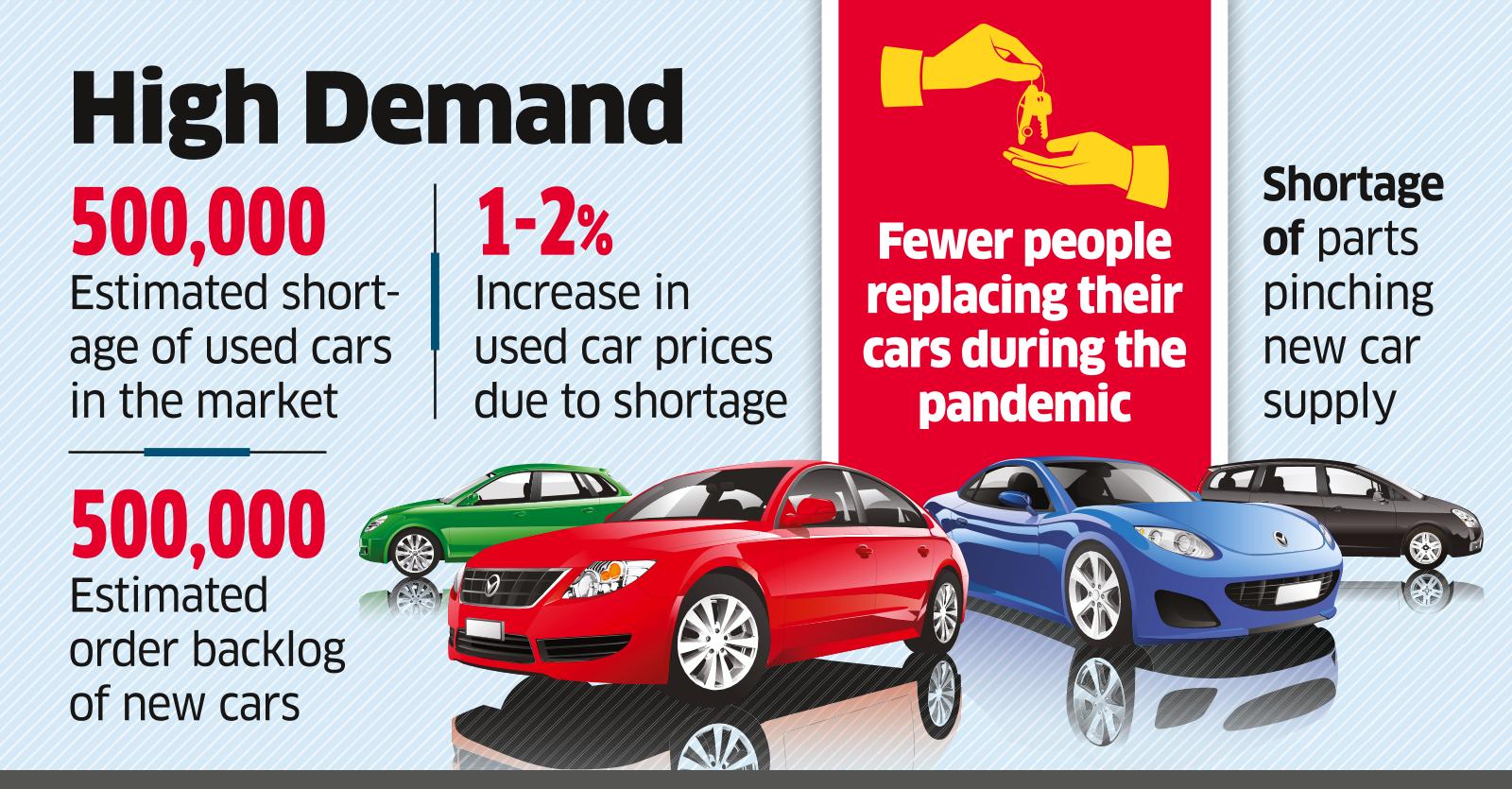

Half a million Indians are waiting for an affordable used car to buy, while another half a million are waiting to take delivery of the new vehicle they have booked, as the passenger vehicle market faces a severe shortage because of a significant rise in personal mobility needs amid the pandemic.

If a shortage of parts has further extended the waiting period for new cars and SUVs, fewer people replacing their old cars for new and a fall in repossession of vehicles by financiers due to the moratorium benefits have affected the supply in the used-car market.

“This is a supply-constrained industry,” said Ashutosh Pandey, managing director of Mahindra First Choice Wheels, one of the top organised players in this space.

If the supply constraint was taken care of, used-car sales in the fiscal year ended last month could have matched that in the previous year, despite the lockdowns impacting business for two months, he told ET. “The industry could have easily sold over half a million more cars or that is the amount of shortage faced by the industry today.”

In India, the supply source is still largely unorganised with only 10-20% of the entire used cars coming through the route of auctions — mostly of vehicles repossessed by financial institutions from defaulting borrowers. Brokers account for 20-40% of the supply, while 20-40% of the inventory comes from new car dealers, who sell the old cars exchanged for new by customers in the used-car market, according to the India Blue Book report published by Mahindra First Choice.

About 3.9 million used cars were estimated to have been sold in India in the just ended fiscal 2021, 7% less than FY20, as per the report. At the beginning of FY21, the industry estimated that sales could decline by 35-40% due to the economic impact of the pandemic.

Despite the economic slowdown and other externalities which have impacted the automotive industry, the used-car industry has overall shown a compounded annual growth rate of 6.21% between FY16 and FY20, when sales of new passenger vehicles fell 0.09%, the report added.

“The wind has blown in favour of the pre-owned car market in India and has nudged the industry en-route to faster consolidation, organisation, and growth,” the report said. Key drivers of this have been a mismatch between supply and demand, preference of personal transport over public modes amid the pandemic, reduced usage of vehicles due to lockdowns and the impact on disposable income that could be used for the purchase of a car.

While very few people are selling their existing cars to buy new ones, the number of people buying their first car has gone up by 5 percentage points to 50%, said Maruti Suzuki that sells one in two new cars in India. Additional car buying has also increased by about 3 percentage points.

Replacement buying in the new car market has meanwhile gone down by 8 percentage points to about 18-19% of all new purchases, as per data from Maruti Suzuki.

“Replacement buying significantly adds to the used-car pool. In an unprecedented time like this, replacement of old for a new one has fallen, leading to a shortage of supply. As a result, the buying price as well as selling price have gone up,” Maruti Suzuki executive director Shashank Srivastava told ET.

Used-car prices have gone up by 1-2% across the board in the last one year, but the price increase has been higher for popular models like the Maruti Suzuki Swift and DZire, the Toyota Fortuner and Innova and the Hyundai Creta.

The replacement cycle for cars at 4.5 years in India is longer versus 3-3.5 years in the US. In the developed markets, a little more than two used cars are sold for every new car sold, but in India, the ratio is 1.7 to 1.

Pandey expects the volumes to grow by a healthy double digit and the ratio of used cars to new cars to touch 2:1 in the next couple of years.

By FY25, the used-car volume is estimated to be 1.9 times the size of the new car market in the country at 7.1 million units, representing $40 billion of gross merchandise value and offering $7 billion of revenue-generating opportunities for value-chain participants, according to the India Blue Book report.