SynopsisAfter Reliance, Tata and Amazon, Walmart-backed Flipkart has marked its attendance to get a pie of India’s growing e-pharmacy market. The online retail giant’s Sastasundar Marketplace investment has made it a five-way fight as one can’t ignore Pharmeasy’s aggressive moves. The question now is how the deal stands in front of the competition.

On November 19, 2021, a little-known company, operating modestly at the peripheries of India’s up and coming online-pharmacy market, stole the thunder from Pharmeasy’s much-anticipated entry into public markets.

Sastasundar Marketplace, a step-down subsidiary of a listed firm, Sastasundar Ventures, suddenly captured the attention of business news portals and investors, as Walmart-backed Indian e-commerce giant Flipkart announced its acquisition of a majority stake in the company.

There has been a lot of activity lately in India’s online-pharmacy market. Reliance’s majority stake acquisition in Netmeds and Tata’s 1mg purchase had already opened up the market. Pharmeasy, the giant that it is in this space, is still fresh from buying an INR4,546 crore majority stake in diagnostics chain Thyrocare aside from its acquisition of hospital supply-chain portal Aknamed. Earlier, Medlife and Pharmeasy merged under API Holdings. There’s simply too much happening.

And Flipkart’s (read Walmart’s) entry makes things more interesting. But Flipkart’s deal with Sastasundar wasn’t something out of the blue.

There were murmurs about it back in May, when The Economic Times reported that the company is in talks with global private equity players and existing investors to raise USD100 million for expanding the reach of its pharmacy and diagnostic business across India.

The result? Sastasundar Ventures’ stock has been on fire since then. In the last six months, shares of Sastasundar Ventures have risen more than 164% while Nifty 50 has gone up only 10% during the same time.

Interestingly, 74% of the company is with the promoters, while the rest is completely owned by retail investors, who couldn’t be happier.

So, how does it impact the investors and the fast-developing Indian online-pharmacy market? Will it be all rosy from here on?

A ‘sasta sundar’ deal?

A person close to the development, requesting anonymity, thinks it is positive for both the parties, “This transaction would practically turn Sastasundar Marketplace (SML) into a joint-venture company between Sastasundar Healthbuddy and Flipkart Health+, where Flipkart will own the majority stake while Sastasundar Healthbuddy will have the opportunity to cross-sell its diagnostic and pharma-retail services.”

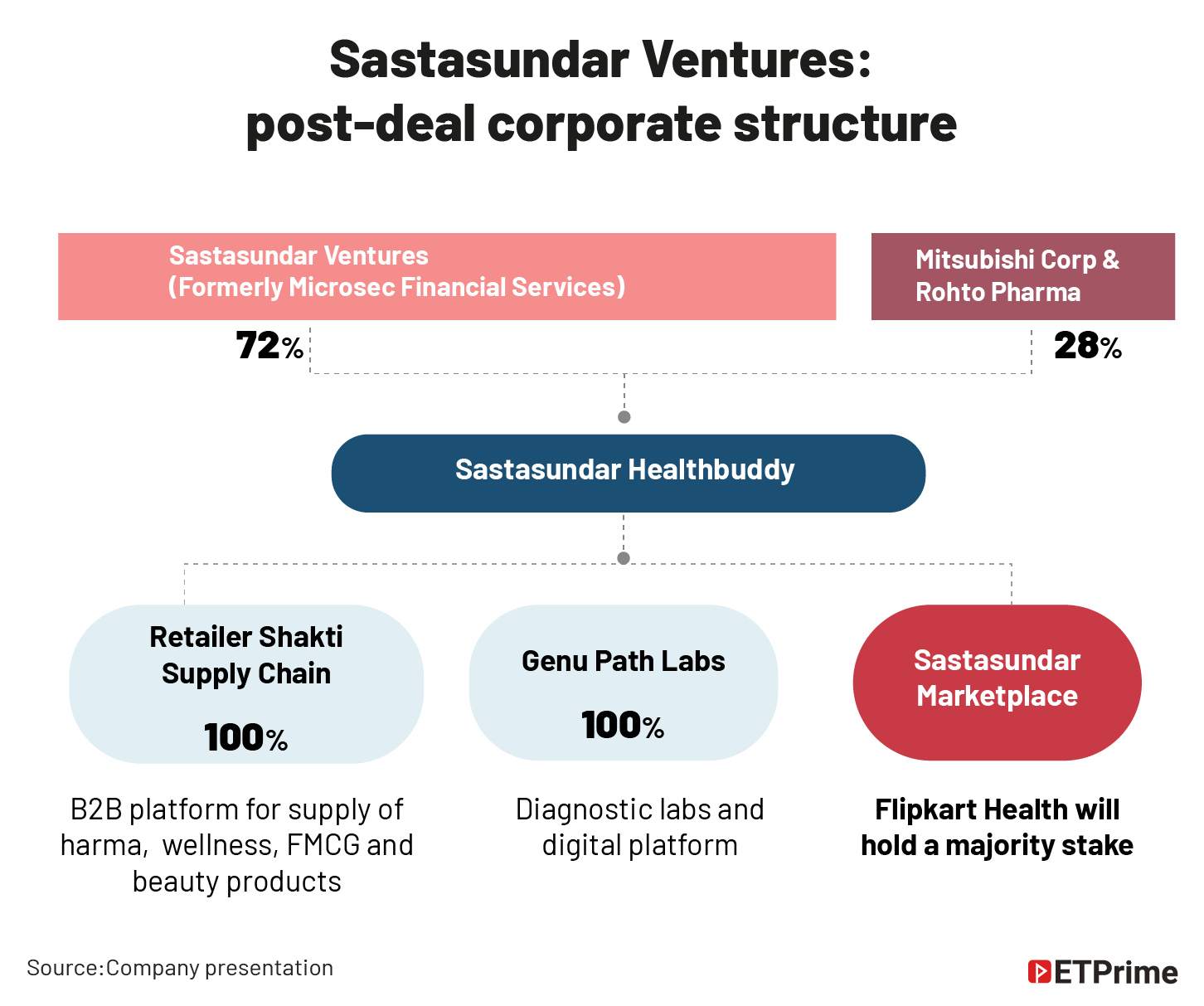

In effect, Sastasundar Ventures’ subsidiary Sastasundar Healthbuddy will be selling its stake in SML to Flipkart Health+. SML owns the domain name and the entire business-to-customer retail-pharmacy operations.

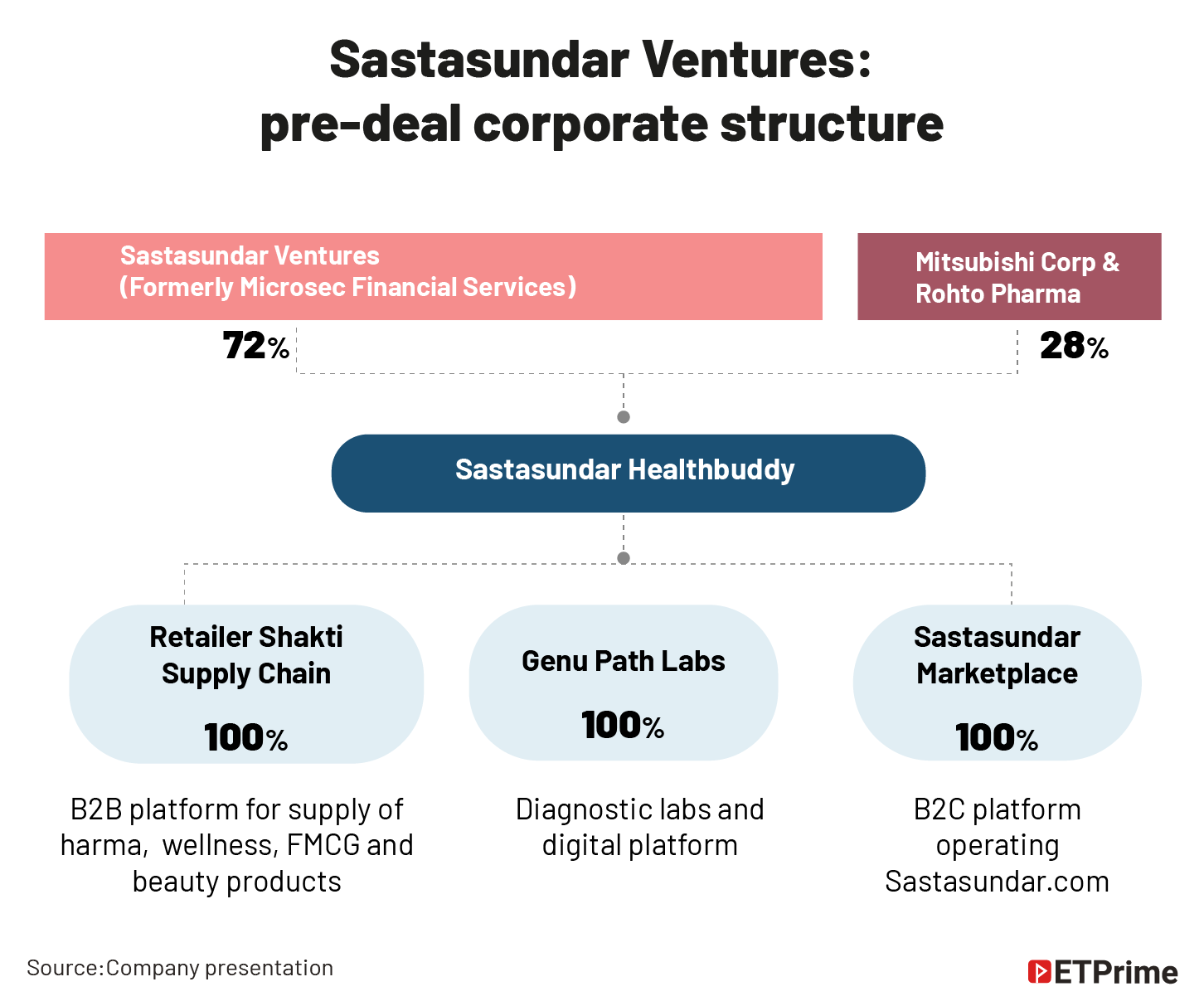

For the record, Sastasundar Ventures owns 72% stake in Sastasundar Healthbuddy, while Japan’s Mitsubishi Corp and Rohto Pharma own 28%.

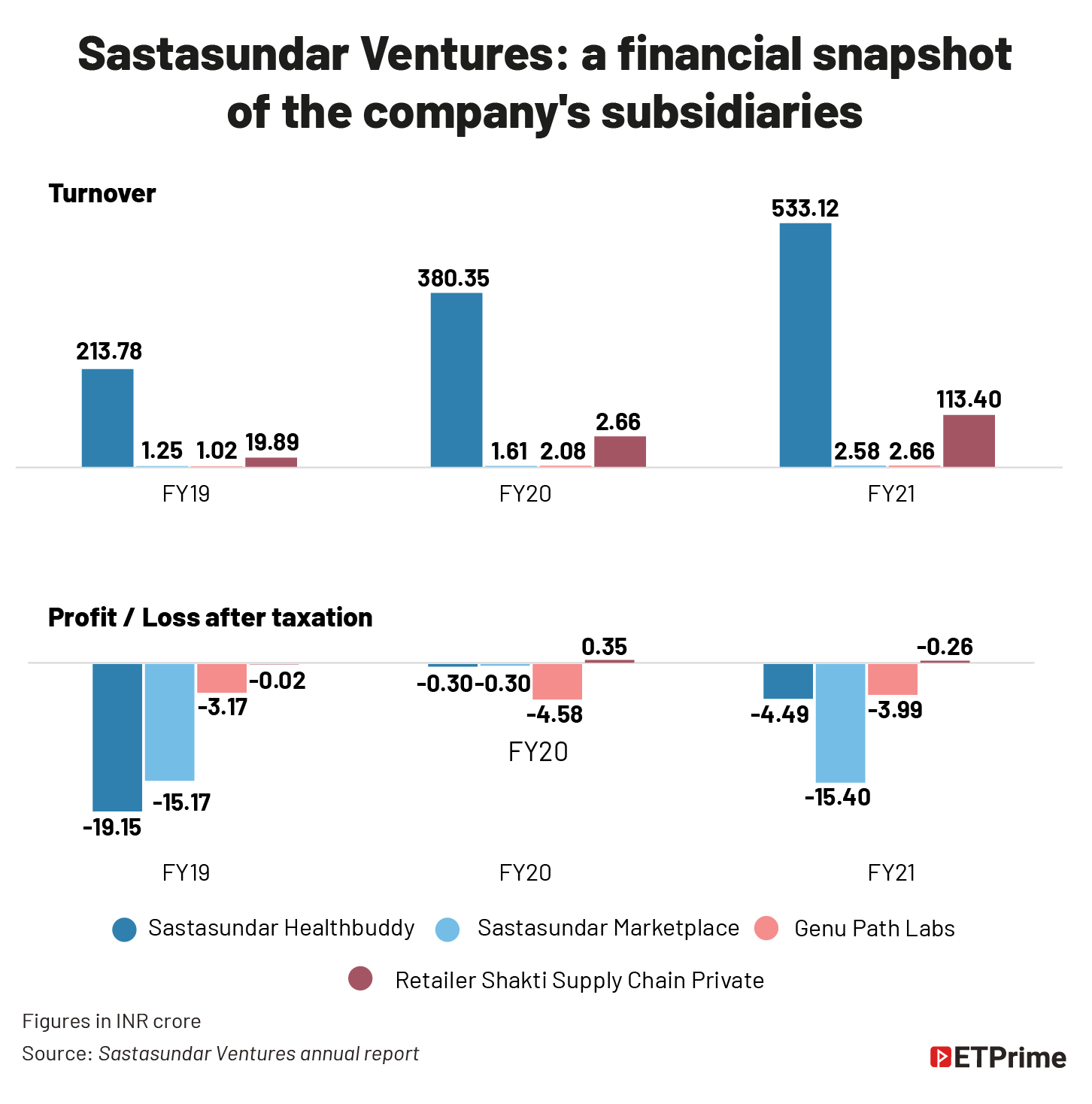

SML, however, is a wholly owned subsidiary of Sastasundar Healthbuddy. Its standalone turnover was INR2.58 crore in the financial year ended March 31, 2021, while its net worth was INR4.17 crore, according to a release by Intellecap’s Investment Banking Group which acted as the exclusive sell-side advisor for the deal.

Neither Flipkart nor Sastasundar Ventures have disclosed details of the valuation or the total deal size yet. But according to the filings with the exchanges, Sastasundar Ventures will not be receiving any funds from the transaction.

As we had highlighted earlier, two years of the pandemic have seen major consolidation in the online-pharmacy space. There are several names eager to enter India’s e-pharmacy market. Retail giant Amazon is building its own e-pharmacy service organically. Apollo Hospital, given its strong offline pharmacy footprint and hospital chain, is also a strong contender.

So, is Flipkart entering late?

“For Flipkart this is a deal out of compulsion. All its competitors are present in this space, and Flipkart cannot be left out. It has a history of using inorganic routes to enter new segments like what it did via the acquisition of Myntra, Jabong in the fashion business,” says a veteran healthtech investment banker.

As we’ve written in one of our ET Prime analyses, Flipkart has a long history of preferring acquisition for growth and many of those acquisitions have been successful.

So, its late entry can’t be held against it. But is the job to capture the market easy?

If you see the online-pharmacy space currently, the lego-blocs are more or less stacked in the favour of Pharmeasy. The merged entity (Pharmeasy plus Medlife) reportedly accounts for 60%-70% of the online-pharmacy market.

But that can change drastically. Currently, of the total pharmacy-retail market in India, existing e-pharmacies have a market share of just 2.8%, according to a report by Technopak Analysis. More than 88% is controlled by traditional retail, while modern retail-pharmacy chains have a market share of 8.5%, the report says.

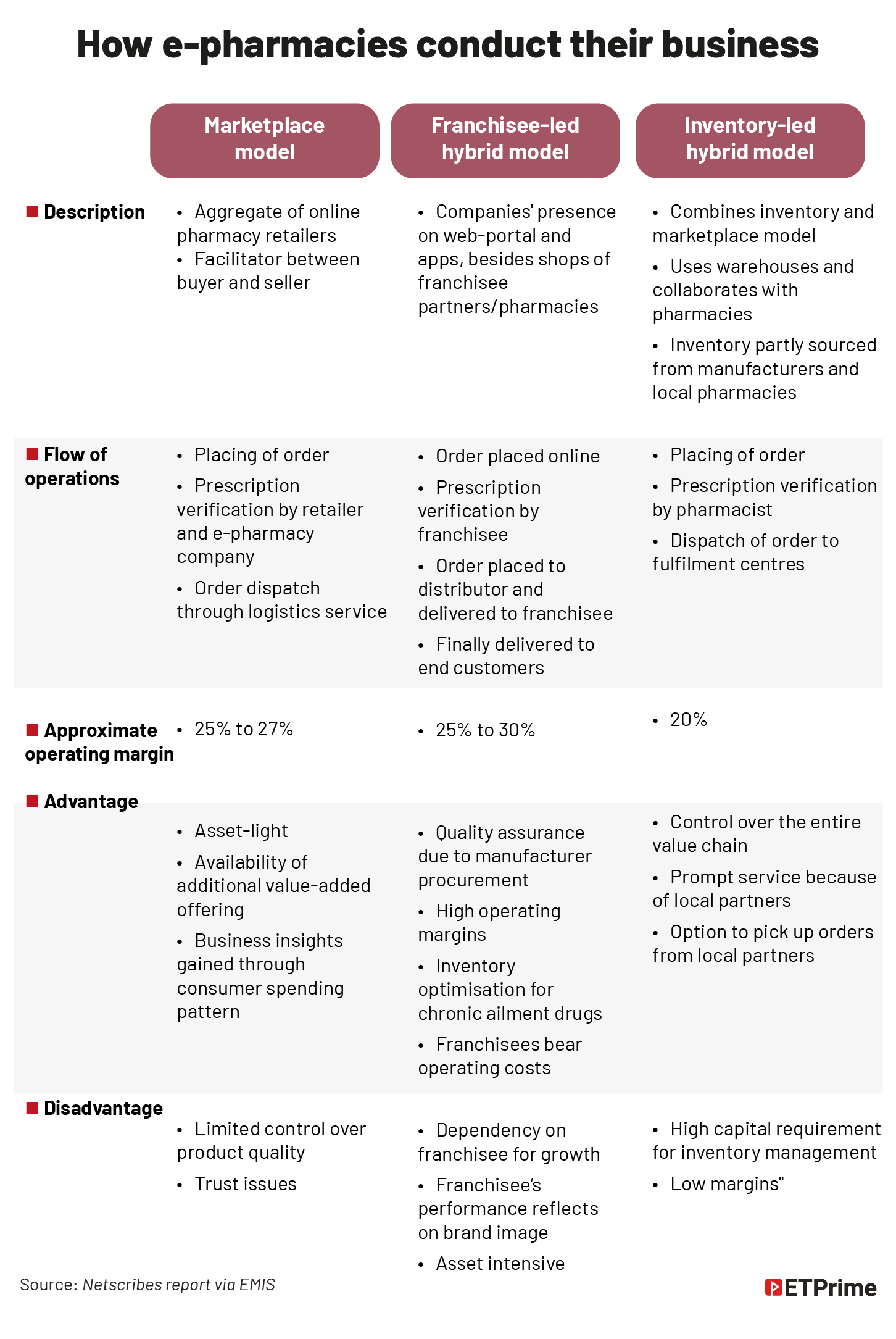

Flipkart with SML will have a tough fight to carve a niche. But SML has a unique model that is the envy of the entire online-pharma business.

What is Sastasundar?

Sastasundar Ventures, known as Microsec Financial Services before November 2016, got listed on the exchanges in 2010.

Both its founders, Banwari Lal Mittal and Ravi Kant Sharma, are chartered accountants and according to its IPO DRHP, the company’s sole area of operations back then was financial services including advisory services, investment banking and wealth management.

But the company’s journey, post-listing, has been a tumultuous one.

Most of the big clients of the company were based out of Kolkata and were related to the coal-mining business. According to news reports, the unearthing of the coal scam in 2011 and drying up of the booming IPO market both dented the growth plans of Sastasundar (then Microsec).

In 2013-2014, the company pivoted towards digital services by entering into digital marketing and advertising space via foreseegame.com and health and pharmacy service portal Sastasundar.com.

By 2017, the company had sold off most of its financial-services business and was focusing entirely on the digital business with Sastasundar.com being the mainstay.

The first geography, which was captured by Sastasundar was, naturally, Kolkata. According to customers using the service since 2016, Sastasundar could provide same-day delivery even in the distant suburbs of Kolkata such as Bandel.

This was achieved by creating a unique model where Sastasundar would establish a no-inventory franchise store. The medicines ordered by customers were daily shipped from the company’s regional warehouse to these franchise stores each covering a 3km-4km service radius. A local courier employed by the franchise would make the local deliveries.

“In the pharmaceutical distribution business, there are margins of around 30% of which customer discounts account for around 15%. Six percent margins are for the franchise partner and the cost to the company (Sastasundar Marketplace) is 5%-6%,” says the person in know of the deal.

This is where Flipkart comes in and why Sastasundar Ventures has specifically decided to sell a majority stake in its customer-facing business to the e-commerce giant.

The biggest cost to this model is the customer-acquisition cost with deep discounts being a norm within the sector. On an average, most e-pharmacies offer 15%-20% discount to customers to get them onboard.

With Flipkart’s brand name, the expectation is that the customer-acquisition cost would come down. Flipkart could also funnel more business to Retailer Shakti or Genu Labs, which are the two other wholly owned subsidiaries of Sastasundar Healthbuddy.

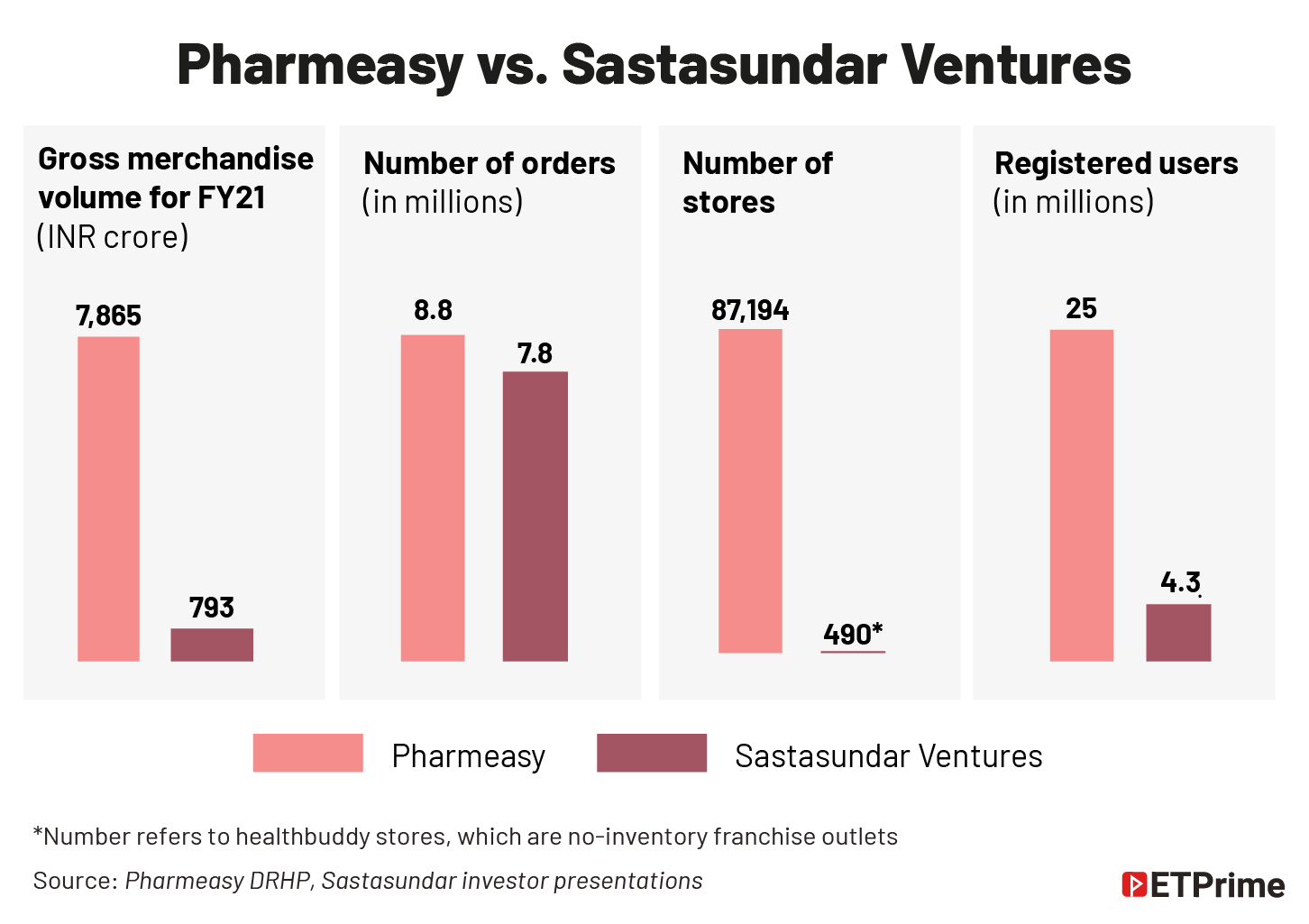

According to Sastasundar Ventures’ disclosures to the exchanges, it has 4.3 million registered customers on the business-to-consumer or B2C business and some 28,000 retailers registered on the business-to-business or B2B business Retailer Shakti.

The average order value is INR840, and the company so far has three regional-distribution hubs — one each in Kolkata (east), Bhiwandi (west), and Noida (north).

What’s in it for investors?

Simply put, as per the company’s annual report, Sastasundar Marketplace accounted for 90% of the consolidated loss of Sastasundar Ventures in FY21.

Joining hands with a cash rich e-commerce player like Flipkart to share the losses arising from the thin-margined online retail-pharmacy business seems like a good idea.

According to data from Trendlyne, ace mid-cap and small-cap investor, Ashish Kacholia acquired 1% stake, or 330,785 shares, in Sastasundar Ventures in the quarter ending September 2021. But FIIs and DIIs are yet to show their presence on the company’s shareholding charts.

To be sure, capturing a customer through a profitable path has been a dilemma for the last 20 years for businesses.

Even during the dot-com era, there were attempts made to launch new pharmacy businesses but they disappeared with time, says Mahesh Singhi, founder and managing director of investment-banking firm Singhi Advisors.

“Quite a few players have found it wise to build a convergence between traditional brick-and-mortar and New Age tech-enabled e-commerce by merging or acquiring traditional businesses, such as Thyrocare acquired by Pharmeasy, Aakash acquired by Byju etc.,” says Singhi.

He adds, “These highly valued tech platforms will leverage their equity as currency and financial muscles to combine real/traditional businesses in the consumer-centric businesses like diagnostics, healthcare, insurance broking, ed-tech, pharmacy retail or even specialised manufacturing, in order to consolidate and eliminate marginal players to capture the middle delta, which is distribution or trade margin, even while building barriers against new disruptors,” he adds.

“Quite a few players have found it wise to build a convergence between traditional brick-and-mortar and New Age tech-enabled e-commerce by merging or acquiring traditional businesses, such as Thyrocare acquired by Pharmeasy, Aakash acquired by Byju etc.”

— Mahesh Singhi, founder and managing director, Singhi AdvisorsThe bottom line

It is raining unicorns.

Those mystic companies that are valued above USD1 billion are on the rise. There were 12 startup unicorns in 2020. In a single week in April 2021, four new ones joined the group.

One of them was Pharmeasy. It became the first and only unicorn in the sector to achieve this coveted title in April this year.

In June, it acquired 66% stake in listed diagnostic chain Thyrocare for more than INR4,500 crore. In October, it raised more than USD220 million from a bunch of global private-equity investors, just six months after it raised USD350 million in April. In November, API Holdings, the parent company of Pharmeasy, filed its papers for an initial public offering.

Is it moving too fast? Seems it is not.

Shares of food-delivery services startup Zomato listed in July at a 100% premium to its IPO price. Shares of Nykaa, an online beauty and fashion retailer, also listed at 100% premium. Online travel company Easy Trip Planner, which listed in March, is currently trading at more than double the IPO price.

Yes, some of the recent fintech IPOs such as Paytm did disappoint investors after listing, but not enough to break the morale of upcoming unicorns.

Much like Nykaa, Pharmeasy too is a story of vertical e-commerce (a company which specialises in e-commerce in a special segment). So, the odds are stacked in favor of Pharmeasy having a glorious listing.

According to a Redseer report, the Indian healthcare market was worth a little over INR10 lakh crore, of which hospital treatment makes up for INR5.5 lakh crore while pharmaceuticals, diagnostics and over-the-counter products account for close to INR3 lakh crore.

With the entry of Flipkart, with acquisition of a majority stake in SML by Flipkart Health+, the stage is set for a five-way fight to create India’s leading healthcare service ecosystem — providing online/offline pharmacy, diagnostic solutions and even doctor consultations.

Flipkart has a brand and SML has a business model.

It is going to be a tough and uphill battle given the healthcare industry, especially with the majority of retail pharmacy and diagnostic businesses, exist in a highly fragmented setup among unorganised traditional players. And while these industry titans may compete with one another, the real prize will be to become the biggest consolidator of the unorganised business.

Till then, we can simply wait for the next thunder to strike, and in fact, also hope for it to be taken away.

(Graphics by Sadhana Saxena)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.