Getty ImagesOur panel of experts will answer questions related to any aspect of personal finance.

Getty ImagesOur panel of experts will answer questions related to any aspect of personal finance.

These are a set of queries raised by ET Wealth readers, which have been answered by our panel of experts.

Income Tax Guide

Income Tax Union Budget FY 2026-27 LiveIncome Tax Slabs FY 2025-26Income Tax Calculator 2025

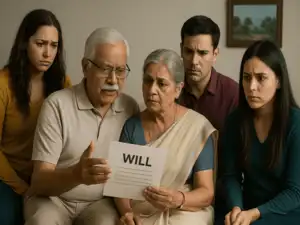

I have been living in the UK with my family for the past 50 years and all of us have OCI cards. My parents, who had bought two properties in Delhi, passed away recently. Their will states that the wealth is to be distributed equally among all three children. Which documents do we need to sell the properties and repatriate the amount to the UK?

Rajat Dutta, Founder & Initiator, Inheritance Needs Services: All three children must have PAN cards and NRO bank accounts in India. Based on the will, all the siblings will need to file a probate petition in the competent court having jurisdiction in Delhi. While one can act as the petitioner, other siblings can submit consent affidavits. Following the document scrutiny, court-mandated advertisements, and completion of procedural formalities, the probate order will be granted. On the strength of the probate order, a registered transfer deed must be executed with the office of the sub-registrar/registrar of assurances, recording all three children as joint owners of the properties.

The sale process can then be initiated, with the sale consideration— net of applicable TDS—received by each co-owner in his/her bank account. The siblings will be required to file individual income tax returns in India to report the capital gains from the sale. Under FEMA regulations, an NRI can repatriate up to USD 1 million per financial year from the sale of inherited assets, after payment of all applicable Indian taxes. The authorised dealer bank will require submission of a chartered accountant’s certificate along with Form 15CA/CB to process the remittance.

Under the Income Tax Act, 1961, the transmission of securities from a deceased individual to their legal heirs is not regarded as a “transfer,” as such movement of assets occurs purely by operation of law. As a result, no capital gains tax is levied at inheritance. In cases where a legal heir subsequently decides to allow their spouse, who also happens to be the nominee in the deceased person’s demat account, to retain the heir’s share of the inherited securities, such movement of assets is typically treated as a gift. Gifts exchanged between spouses are exempt under the tax law. However, any income subsequently earned from them, whether in the form of dividends, interest, or capital gains may be required to be included in the income of the transferor (the spouse) for tax purposes. In conclusion, heirs should be mindful of the ongoing tax treatment of future income generated from those securities.

Our panel of experts will answer questions related to any aspect of personal finance. If you have a query, mail it to us right away. Email ID: etwealth@timesgroup.com