Clipped from: https://www.financialexpress.com/business/news/reforms-to-continue-beyond-budget-fm-nirmala-sitharaman/4131461/?ref=hometop_hp

Sitharaman to visit Norway and Canada soon for outreach.

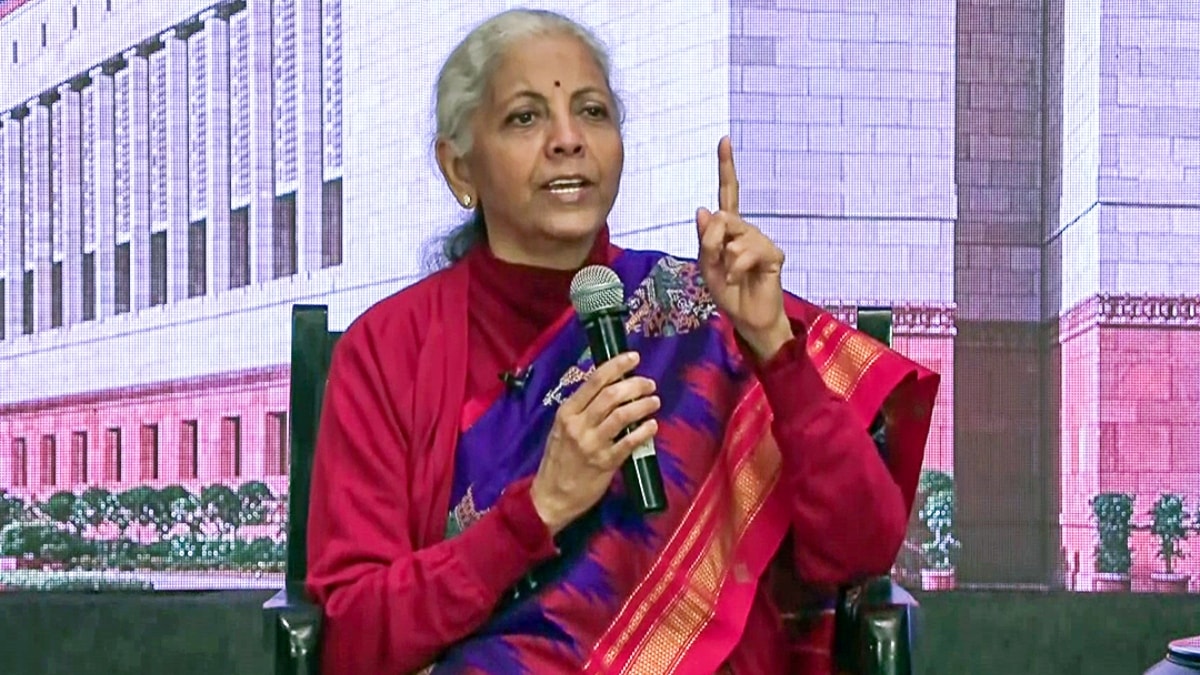

Reforms to continue beyond Budget: FM Nirmala Sitharaman. (Image: PTI)

Reforms to continue beyond Budget: FM Nirmala Sitharaman. (Image: PTI)

The Budget 2026-27 would have been no different – less or more aggressive or ambitious– even if the India-US trade deal had preceded it, Finance Minister Nirmala Sitharaman said on Wednesday, but stressed that more reforms would now take place even outside its explicit ambit in the coming months.

In an exclusive interview with Financial Express, the minister said the government would now be reaching out to global investors, including those from European Free Trade Association (EFTA) countries like Norway and Canada. It would also continue to work to improve the investment climate.

Reforms don’t happen only through the Budget, they are continuous. So the budget need not be the only instrument or platform through which I got all this (robust economic fundamentals). Outside the Budget also, (policy measures) happen and will continue,” Sitharaman said. Asked what broad message she would like to send out to the investor community abroad, now that the US tariff on India has been reduced to 18%, at par with or even lower than its major competitors in the largest export market, the minister said: “I would tell them if China-Plus one is for the world’s benefit, they should be in India.”

The minister’s comments came in the backdrop of concerns about the outflow of portfolio capital from India for an extended period, and a thinning of net foreign direct investments into the country.

While the trend could be traced backwards, many global investors seem to have developed cold feet on India particularly following the United States’ imposition of 50% additional tariff on most of its exports. The Economic Survey called this a paradox, as India’s “stringest macroeconomic performance in decades” collided with a global system which refuses to reward such success with currency stability, capital inflows, or strategic insulation.

Sitharaman said a vast and growing community of global investors were wanting to raise their investments in India’s real economy. The minister’s planning visits to Norway and Canada soon as part of a global outreach. “In a way, (India is) the best place in terms of return on investment. I’ve in the recent past heard Norwegian investors and funds from Canada wanting to come to India. There is indeed a realisation that India is the place to be,” she said. The EFTA countries’ $100 billon investment pledge for India under the recently concluded free trade agreement “is very much in the pipeline,” she added.

Exposure to India’s real economy

Sitharaman said the policy focus would clearly be on “growth through manufacturing,” with both big and small firms to be taken in stride. “Technology infusion, efficiency, skilling, education, health, and allied services will be encouraged.”

Sitharaman defended the reduced pace of fiscal consolidation in the Budget, saying that since growth was accorded topmost priority (as stated at the outset of the Budget speech), fiscal tightening could not be “excessively aggressive or agonisingly slow.”

With tax giveaways – of GST, Income-Tax earlier and lately of Customs tariffs– the revenue buoyancy might take “a bit of a time” to pick up, she said. “So I will have to balance (fiscal consolidation and growth).”

On the scope of the new “High Level Committee on Banking for Viksit Bharat”, the minister said its mandate would be different from the previous such panels Narasimhan I & II, PJ Nayak committees.

“This (new panel) is more for the Viksit Bharat objective. I’m asking the committee to look at what is needed for 2047. So we are talking from a position of strength. The banks were not so strong when the earlier committees were formed. But thanks to their recommendations, the banks have come to good health.” Asked if the reported plans to undertake more bank mergers be put on the backburner till the committee made its recommendations, the minister said: “Nothing has really crystallised on that. That’s a decision we’ll have to take as we go on. Now that we will appoint a committee, I’ll also have to hear what they have to say in terms of banking for the future. But what was already agreed to, that is very much on the same track.”