Clipped from: https://www.financialexpress.com/money/86-taxpayers-shifted-to-new-regime-qampa-with-cbdt-chairman-ravi-agrawal-4131649/

The stronger FY27 projection reflects the full-year impact of last year’s rate rationalisation, including benefits under the new tax regime

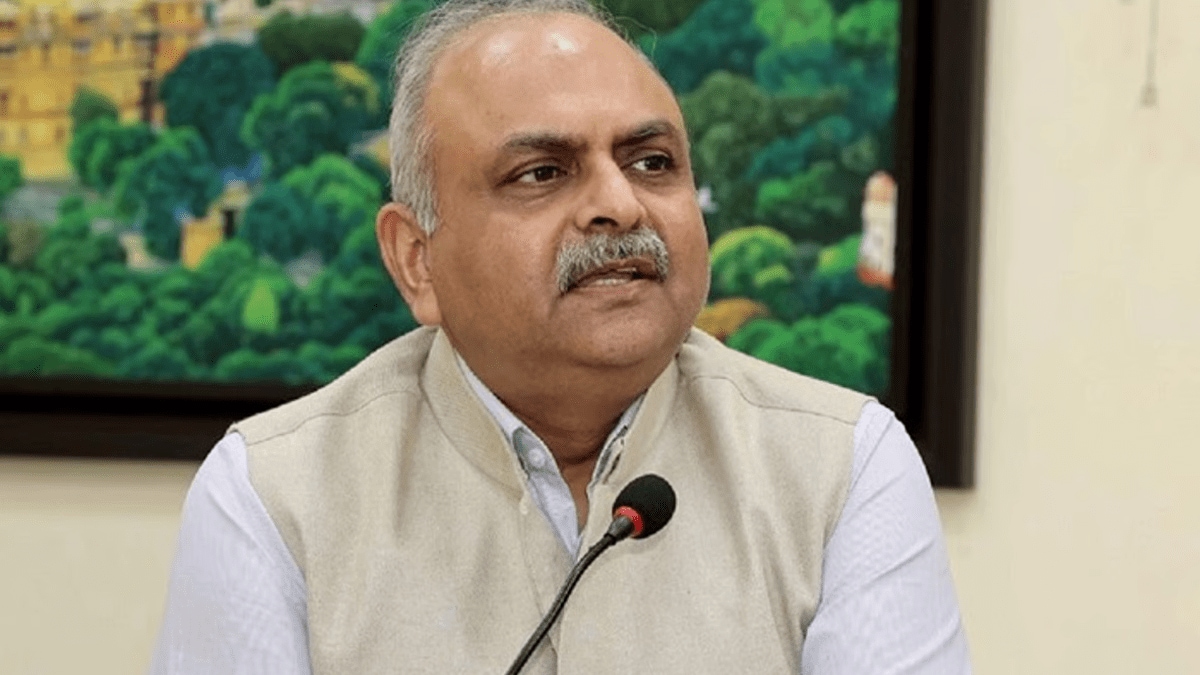

CBDT Chairman Ravi Agrawal on rising adoption of the new income-tax regime and tax reforms.

CBDT Chairman Ravi Agrawal on rising adoption of the new income-tax regime and tax reforms.

With a sharp rise in taxpayers opting for the new income-tax regime, the Central Board of Direct Taxes (CBDT) expects stronger personal tax growth in FY27, driven by lower refunds, better compliance, and economic momentum, while preparing for a smooth transition to the new Income-tax Act and a more trust-based administration, its Chairman Ravi Agrawal told Kuldeep Singh. Excerpts:

Personal income tax collections are projected to grow 11.74% in FY27, much higher than the revised 6.2% growth for FY26. What explains this optimism?

The stronger FY27 projection reflects the full-year impact of last year’s rate rationalisation, including benefits under the new tax regime. As more taxpayers move to the new regime, refunds tend to decline because it allows fewer deductions and exemptions, thereby boosting net collections. We are confident of achieving this growth, supported by sustained voluntary compliance and overall economic momentum.

How many taxpayers have shifted to the new tax regime so far?

About 86% of taxpayers have moved to the new tax regime in AY 2025–26, up 11 percentage points from last year. In terms of income coverage, around 60% of total reported income is now under the new regime. For individual and HUF filers — ITR-1, 2, 3, and 4 — nearly 88% of returns are under the new regime, compared to 76% last year.

Given this trend, is a sunset clause for the old tax regime being considered?

There are no immediate plans for a sunset clause. Taxpayers will continue to have a choice. However, the strong and growing preference for the new regime suggests a natural migration over time.

Refunds declined 16% up to January 11 this financial year. What drove this, and were refunds delayed to manage revenue?

The decline is mainly due to two factors: the shift to the new regime, which involves fewer deduction claims, and the identification of incorrect refund claims. A compliance campaign during November–December encouraged taxpayers to review and revise returns. This helped reduce erroneous claims by about ₹1,750 crore over two years. Refunds were only held pending clarifications and are now largely being released. There was no intent to delay refunds to manage revenues.

Non-corporate tax collections now exceed corporate tax. What explains this structural shift?

The change reflects evolving business structures. A growing number of enterprises now operate as LLPs, trusts, or business trusts — all taxed in the non-corporate category. While there are about 1.15 million corporate filers, only around half report taxable profits, which also affects corporate tax buoyancy.

What are CBDT’s key priorities for FY27, especially with the new Income-tax Act, 2025 coming into force?

The foremost priority is a smooth rollout of the Income-tax Act, 2025, effective April 1, 2026. Extensive preparatory work has been done, and the focus now is on stakeholder communication — taxpayers, professionals, and officers — to ensure clarity and minimal disruption. This includes new forms, processes, technology upgrades, and guidance support. The aim is a seamless transition, faster grievance redressal, and stronger taxpayer services under a trust-based system.

The Budget stresses simplification and ease of compliance. How will this reduce litigation and build trust?

We are moving away from an adversarial approach toward a cooperative, non-adversarial regime. The department is proactively sharing information it holds with taxpayers, enabling voluntary correction of discrepancies. Decriminalisation has reduced the punitive nature of tax laws, with more proportionate penalties. Taxpayers now have multiple opportunities to update returns and settle issues, even after notices or assessments. Presenting assessment and penalty proposals together also provides clarity and certainty. These steps are designed to reduce disputes, minimise litigation, and strengthen trust between taxpayers and the department.