Estate planning may ensure a smooth transition of assets to legal heirs, but many inheritors remain unaware of how the income from investments and inherited assets will be taxed. The process of filing tax returns after a person’s death involves its own set of procedures and compliance requirements. If any taxes remain due after death, the responsibility of settling these liabilities falls on the heirs, raising questions about whether these dues must be paid from their personal income or can be adjusted against the inherited assets.

Many heirs and beneficiaries find themselves grappling with these tax-related tasks after the demise of their loved ones. To avoid the stress and confusion of dealing with such queries at an emotionally wrought time, it’s best to be prepared beforehand. Here are some taxation dilemmas the inheritors are likely to face.

Who files the deceased’s tax returns?

The tax return for income earned by the deceased up to the date of his death must be filed. “Any lawful legal heir is entitled to file the income tax return of the deceased as a ‘representative assessee’ in accordance with Section 159 of the Income Tax Act, 1961,” says Raj Lakhotia, Managing Partner, LABH & Associates. The legal heir can do so by following these steps:

Step 1: Register on the income tax e-filing portal by logging in with his/her own account.

Step 2: Go to ‘Authorised partners’ and select ‘Register as representative assessee’.

Step 3: Enter the deceased’s details and upload the documents, including the deceased’s PAN card, death certificate and proof of legal heirship.

Step 4: The heir may also have to submit an indemnity bond in case of loss to the tax department if someone else claims the refund.

Step 5: After uploading the documents, submit the request for approval. After the tax department grants approval, the heir can file returns for the deceased.

Step 6: The heir should log in to his/her e-filing account, select ‘Logged in as legal heir’, and file returns.

Who gets the tax refund?

In case of a tax/TDS refund, it is received by the legal heir in his capacity as the representative assessee. It can either be received in the deceased’s bank account if it is operative or the legal heir’s account.

“If the deceased’s bank account has been closed or is not operative, the legal heir must add his/her bank account details on the tax e-filing portal, validate the bank account, and ensure that the refund is credited to the validated account,” says Kuldip Kumar, Partner, Mainstay Tax Advisors.

Is the deceased person’s income taxed?

Yes, the deceased’s income is taxable up to the date of death and is assessed through the legal heir acting as a representative assessee. “However, the legal heir’s liability to discharge tax, interest, or penalties of the deceased is restricted to the value of the estate inherited. There is no personal liability of the legal heir beyond the assets received from the deceased,” says Lakhotia.

How are income & profit from inherited assets taxed?

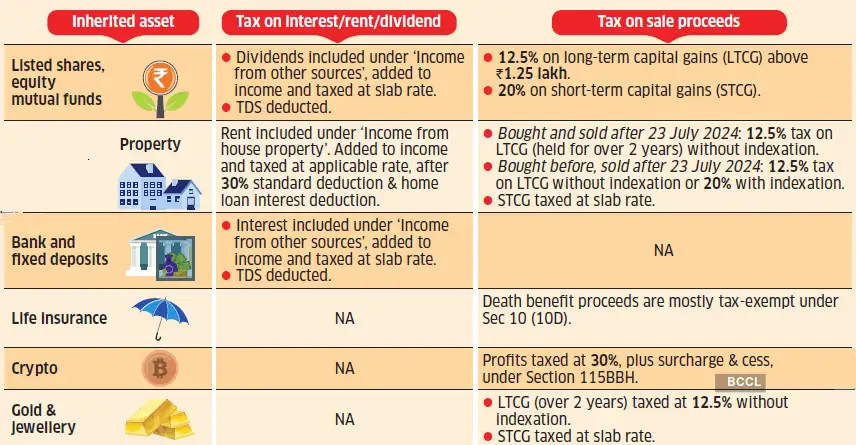

While inheritance is not taxed in India, “once the assets are inherited, any future income from those assets is taxable in the hands of the inheritor,” says Sudhir Kaushik, CEO and Co-founder, TaxSpanner.

Agrees Kumar: “There is no separate or concessional tax treatment merely because an asset is inherited. The key distinction lies in the determination of the cost of acquisition in certain cases.”

Capital gains: When calculating capital gains on an asset, whether property or shares, the cost of acquisition is the price at which the original owner (deceased) bought it, and the holding period starts from the time he acquired it. It is important for the inheritor to secure the original purchase documents and the asset’s ownership records to claim the cost/holding period benefit, as these may be required during assessment or audit proceedings, says Kumar.

Interest/ dividend: The interest from bank savings accounts, fixed deposits and bonds earned after the demise of the owner is taxed in the hands of the inheritor, while the future dividends received as inheritance are also taxable.

House rent: The rent received on properties inherited after the date of death is taxable in the hands of the inheritor(s), and if there are multiple heirs, rental income is taxable in proportion to the ownership share, says Kaushik. The inheritor is eligible to claim applicable deductions, such as the standard deduction under Section 24(a) and on the interest on a housing loan under Section 24(b), subject to the conditions prescribed under the Income Tax Act.

Is life insurance death benefit taxed?

The life insurance death benefit received by the beneficiary or nominee is almost always tax-exempt under Section 10 (10D), but under certain conditions, it can be taxable. For instance, if the payout is in instalments or delayed, the interest component is taxable, or if the payout goes to the estate, it is taxable. Even if exempt, the proceeds must be disclosed under Schedule EI (Exempt Income) in the tax return.

The insurer pays the death benefit proceeds to the nominee, but if the nominee is not the legal heir, (s)he only acts as a trustee and will have to pass on these to the legal heirs. “However, if the nominee is the spouse, child, parent, or spouse and children, they are treated as ‘beneficial nominees’ under Section 39 of the Insurance Act, 1938,” says Kumar. In this case, the nominee becomes the absolute owner and the money does not form part of the estate for succession purposes and legal heirs cannot claim it.

Is debt inherited?

“Debts and liabilities do not automatically become the heir’s personal liability in the same way as assets,” says Kaushik. “If there is a guarantor or co-borrower, liability can extend to them separately,” he adds.

The personal liability of heirs is limited to the extent of the assets they inherit. While loans can be recovered from the sale of the mortgaged asset or the sale of the deceased’s assets, “if the liabilities exceed the value of the estate, legal heirs are not personally liable to discharge these and may disclaim inheritance to that extent”, says Lakhotia.

However, insurance proceeds passed on to the beneficiary or the balance in a provident fund account are protected and cannot be attached to settle debts.