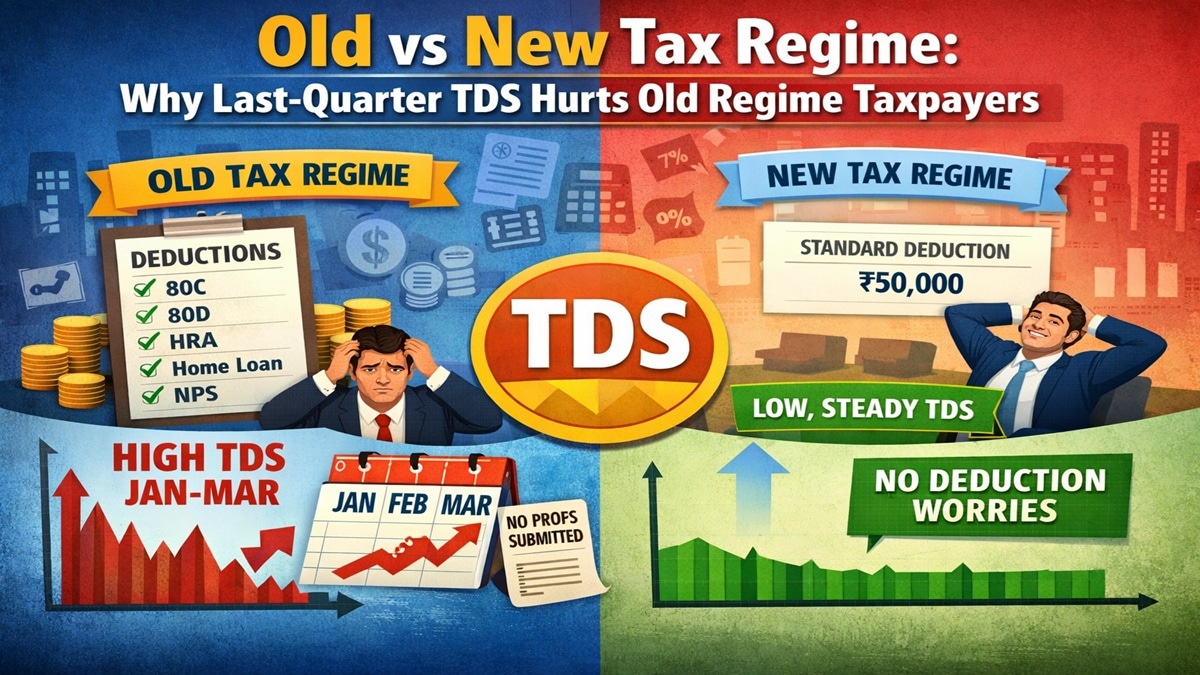

Many salaried employees see a sudden spike in TDS between January and March because employers recalculate taxes after verifying actual investment proofs. This usually impacts those under the old tax regime, where deductions depend on investments made during the year.

Missed tax-saving investments? Here’s why Jan–March TDS spikes (AI-generated image)

Missed tax-saving investments? Here’s why Jan–March TDS spikes (AI-generated image)

For many salaried individuals, the last three months of the financial year—January to March—often come with an unpleasant surprise – a sharp jump in tax deducted at source (TDS). This is especially common for employees who have opted for the old tax regime.

The reason lies in how salary tax is calculated and adjusted during the year.

How TDS works through the year

At the beginning of every financial year (usually in April), employers ask employees to declare their expected tax-saving investments and expenses — such as PF, ELSS, insurance premiums, home loan interest or HRA. Based on these declarations, employers estimate the employee’s annual tax liability and spread the TDS evenly across 12 months.

For the first nine months (April–December), TDS is deducted purely on the basis of what the employee plans to invest, not what has actually been invested.

However, towards the end of the financial year—usually in January—employers ask for investment proofs. This timing is deliberate. By January, most employees have a clearer picture of their actual income for the year, bonuses or incentives received and whether they have actually completed their planned tax-saving investments.

Employers need these proofs before March so they can recalculate the final tax liability and ensure correct TDS before the year closes.

Where the problem starts

Many employees declare tax-saving investments in April with good intentions—but as the year progresses, things change.

Some may be unable to save enough to invest; delay investments and forget to complete them; or overestimate deductions like 80C, home loan interest, or NPS.

As a result, actual investments fall short of the declared amount.

When proofs are finally asked for in January and the employee cannot submit them, the employer has no choice but to withdraw those deductions from the tax calculation. This increases the taxable income—and the remaining tax for the year now has to be recovered in just three months (January–March).

That’s when monthly TDS shoots up.

A simple example

Let’s say an employee earns Rs 12 lakh a year and opted for the old tax regime.

In April, he declares Rs 2 lakh of deductions (80C, NPS, insurance, etc.)

Based on this, his employer deducts around Rs 6,000 per month as TDS from April to December.

But by January:

The employee has actually invested only Rs 1 lakh and he doesn’t submit proof for the remaining Rs 1 lakh. Now, his taxable income increases by Rs 1 lakh, pushing up his final tax liability. The extra tax that should have been deducted over 12 months is now adjusted in just 3 months, increasing his monthly TDS sharply between January and March.

What if investments were made but proofs weren’t submitted?

There’s another common situation. An employee may have genuinely made all eligible investments but fails to submit proofs to the employer within the deadline.

In such cases, the employer will still deduct higher TDS. But the employee can claim all eligible deductions while filing the income tax return (ITR) and any excess tax paid will be refunded by the Income Tax Department. So, while cash flow takes a temporary hit, the money is not lost.

Why this affects only old tax regime taxpayers

This entire exercise applies only to employees under the old tax regime, because it allows multiple deductions and exemptions.

The new tax regime works differently. It offers lower slab rates but almost no deductions, except the standard deduction. Since there are no investment-linked benefits, employers don’t need to verify proofs, and TDS usually remains stable through the year.

Deductions available: Old vs New tax regime

Old tax regime – key deductions and exemptions

Under the old regime, taxpayers can reduce taxable income using several sections, including:

-Standard deduction: Rs 50,000

-Section 80C: Up to Rs 1.5 lakh (PF, PPF, ELSS, LIC, tuition fees, etc.)

-Section 80CCD(1B): Up to Rs 50,000 for NPS (additional over 80C)

-Section 80D: Health insurance premiums

-House Rent Allowance (HRA): Subject to conditions

-Home loan interest (Section 24): Up to Rs 2 lakh for self-occupied property

-Education loan interest (Section 80E)

-Donations (Section 80G)

-Savings account interest (Section 80TTA/80TTB)

These benefits are the reason employers need documentary proof before finalising tax calculations.

New tax regime – what you get

The new tax regime offers:

-Lower slab rates

-Standard deduction of Rs 50,000

-Employer’s contribution to NPS (up to limits)

But most popular deductions—80C, HRA, home loan interest—are not allowed. As a result, proof submission is largely irrelevant.

The takeaway for salaried employees

If you are under the old tax regime, January is the month when intent meets reality. Any gap between what you declared and what you actually invested will reflect immediately in higher TDS.

To avoid last-minute shocks, declare conservatively in April, track investments through the year, complete tax-saving investments well before January and submit proofs on time. If you prefer predictability and minimal paperwork, the new tax regime may offer peace of mind—even if deductions are fewer.