ITR filing AY 2025-26: Comparative ITR filing charges across 6 tax filing platforms

Individuals who are not liable for income tax audit have to file income tax return (ITR) by September 15, 2025, for FY 2024-25 (AY 2025-26). You can file the income tax return (ITR) yourself by logging into your account on the e-filing ITR portal or seek assistance from a Chartered Accountant to help you file the ITR.

Additionally, there are several third-party websites available that can assist you in filling up the ITR form and its schedules. In the end, all submitted and verified ITR forms are processed through the e-filing ITR portal, but the methods used to fill up the form may vary.

The tax department’s portal allows you to file your income tax return (ITR) for free, but if you require help from a chartered accountant (CA) or specialised third-party websites, there will be a fee involved.

If you need more specialized help such as data extraction, tax planning, or other services, you will have to either hire a Chartered Accountant or use services from various websites like Clear, TaxBuddy, TaxManager, Tax2Win, etc., for which you may also have to pay a fee.

Now, let’s look at the different filing options and the costs associated with filing income tax returns on popular portals.

What are the types of plans most ITR filing websites offer?

Broadly speaking, there can be three types of plans which most ITR filing websites offer:

- Self-filing: In this plan, you upload the documents and file the ITR yourself. You only get assistance with data handling and processing.

- Assisted filing: You upload the documents and then a computer algorithm designed with inputs from a Chartered Accountant will help you file the ITR.

- Consulting with a Chartered Accountant for ITR filing: Here, the website’s platform will set up a call or video call with their in-house CA/tax expert for a defined time, say 45 minutes. You can clear your doubts in this call and then file the ITR.

ITR filing charges compared across multiple different websites

| Service Type | TaxManager.in | ClearTax.in | MyItreturn.com | Tax2Win.in | TaxSpanner | Tax Buddy |

| Tax Expert Assisted Assisted Salary – Income Less than Rs 50 Lakh annually | Rs 1,250 | Rs 2,539 | Rs 1,000 | Rs 1,274 | Rs 899 | Rs 999 |

| Tax Expert Assisted Assisted Salary – Income more than Rs 50 Lakh annually | Rs 5,000 | Rs 4,719 | Rs 2,000 | Rs 1,274 | Rs 6,499 | Rs 999 |

| Tax Expert Assisted Assisted – Capital Gains | Rs 4,500 | Rs 4,719 | Rs 4,000 | Rs 4,249 | Rs 3,149 | Ras 2,999 |

| Tax Expert Assisted – Professional/ Self Employed/ Consultants | Rs 5,000 | Rs 4,719 | Rs 5,000 | Rs 2,655 | Rs 6,499 | Rs 2,499 |

| Tax Expert Assisted – NRI | Rs 5,000 | Rs 6,759 | Rs 2,000 | Rs 7,968 | Rs 5,399 | Rs 4,499 |

| Tax Expert Assisted – Foreign Income | Rs 7,500 | Rs 6,759 | Rs 6,000 | Rs 10,624 | Rs 5,399 | Rs 7,499 |

Source: Respective websites as of August 1, 2025

Note:

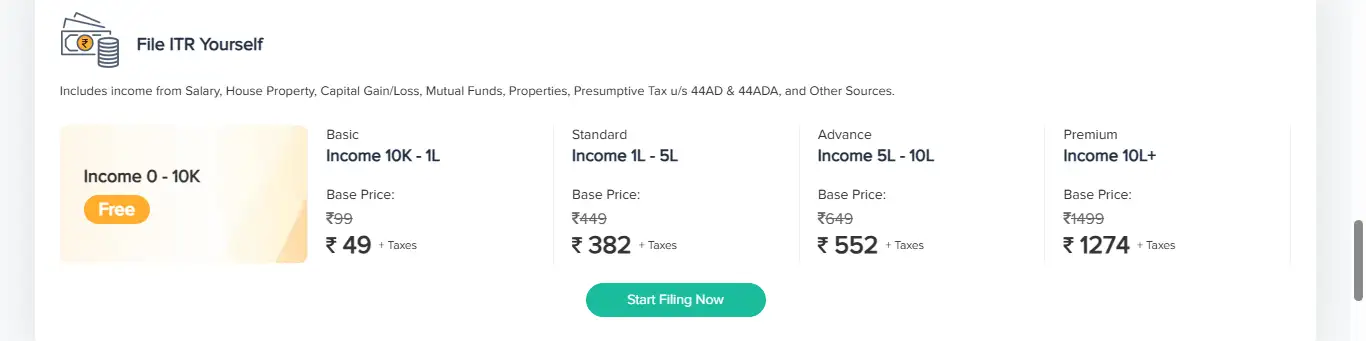

- Tax2Win has a plan starting from Rs 49 plus GST. In this plan you file the ITR yourself but use only the data extraction service of Tax2Win. You will not get the support of CA in this plan.

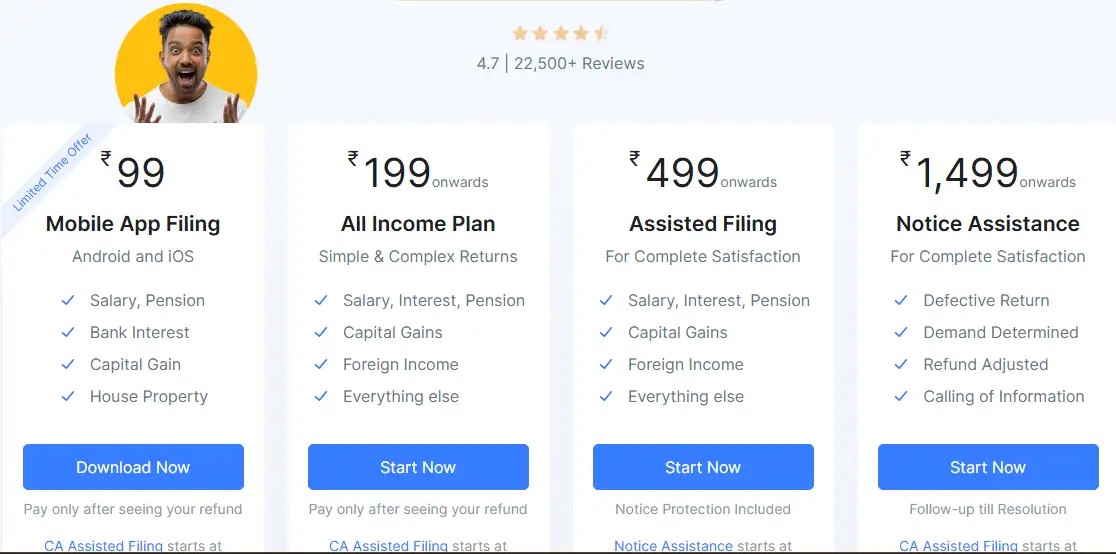

- Myitreturn has a plan starting from Rs 99 where you can file the ITR using their app, without any CA’s assistance.

Tax2WinSource: Tax2Win website