How claiming indexation benefit can help you pay lower long term capital gains (LTCG) tax on real estate sale transactions

Only transactions that involve real estate house properties are eligible for indexation benefits which can lead to lower capital gains tax in some cases. Previously, other assets were also eligible for indexation benefit. However, Budget 2023 eliminated indexation benefits for debt mutual funds purchased on or after April 1, 2023.

Simply put, the indexation benefit refers to incorporating the inflation factor into capital gains,transactions to determine the real value of the gains. The law describes Indexation as a tax mechanism that inflates the cost of acquiring a capital asset for inflation, thus lowering the taxable capital gain when the asset is sold.

However, indexation benefit does not always results in lowering the capital gain tax as some time it may do the opposite since it comes with higher tax rate of 20%.

Do notice the phrase mentioned is “lower capital gains tax in some cases”. This highlights the importance of carefully evaluating the impact of indexation based on the real estate asset’s acquisition year, sale year, and prevailing tax rates before making tax planning decisions.

However, this is where the eligible property owners got dual benefits through amendments in Budget 2024 due to which they can now opt for indexation benefit when it suits them and leave it when it does not suit them.

Read below to learn more about indexation in real estate transactions and how it can assist as well as when it may not help in reducing the net tax liability.

What is indexation?

Inflation is a significant factor contributing to the increase in the value of a capital asset over time. Applying indexation increases the inflation-adjusted acquisition cost of a capital asset, which leads to reduced net long-term capital gains (LTCG).

Chartered Accountant Suresh Surana says: “It aims to ensure that taxpayers are taxed only on the real gain (adjusted for inflation) rather than the nominal gain. By applying the Cost Inflation Index (CII), issued annually by the Income Tax Department, the purchase cost of an asset is inflated to reflect its value in the year of sale. This indexed cost is subtracted from the sale price to calculate the long-term capital gain (LTCG).”

When is indexation benefit available?

Only capital assets classified as immovable property such as land and buildings are now eligible for indexation benefits when computing long-term capital gains (LTCG).

Table showing the tax rate

| Particulars | LTCG tax rate |

| Property acquired prior to July 23, 2024 | 20% with indexation or 12.5% without indexation |

| Property acquired after July 23, 2024 | 12.5% without indexation |

Option 1: 20% tax rate with indexation

Only those house properties that are acquired before July 23, 2024 would continue to be eligible for indexation benefits. Consequently for these assets, long-term capital gains are taxable at the rate of 20% (plus applicable surcharge and cess) after allowing for cost indexation.

Option 2: flat 12.5% tax rate without indexation

Surana says: “Alternatively, for properties acquired before July 23, 2024, the resident individual / HUF taxpayer has the option to compute gains as the difference between the sale consideration and the actual cost of acquisition, without applying the CII, and subject to tax at a flat rate of 12.5%.”

The resident individual / HUF taxpayer can choose either of the aforesaid options in case of land or building acquired before 23 July 2024. For properties acquired after this date, only option-2 i.e. 12.5% without indexation can be chosen.

How claiming indexation benefit can help in paying a lower capital gains tax on sale of house property

For calculating the benefit of indexation, let’s assume Mr. A bought a property in FY 2010-11 for Rs 50 lakh and sold it in FY 2024-25 for Rs 1.5 crore.

The table below shows the capital gains tax calculation with and without indexation benefits:

| Particulars | Tax With Indexation (in Rs) | Tax Without Indexation (in Rs) |

| Full Value of Consideration (Sale Price) | 1,50,00,000 | 1,50,00,000 |

| Cost of Acquisition (Original) | 50,00,000 | 50,00,000 |

| CII for Year of Acquisition (2010-11) | 167 | Not applicable |

| CII for Year of Sale (2024-25) | 363 | Not applicable |

| Less: Indexed Cost of Acquisition | 1,08,68,263 (50,00,000 * 363/167) | Not applicable |

| Long-Term Capital Gain (LTCG) | 41,31,736 | 1,00,00,000 |

| Applicable Tax Rate (u/s 112) | 20% | 12.50% |

| Capital Gains Tax Payable | 8,26,347 | 12,50,000 |

| Effective Tax Rate on Sale Price | 5.51% | 8.33% |

| Tax Savings by Indexation | Rs 4,23,653 |

Source: CA Suresh Surana

The calculations mentioned above shows the significant tax benefit provided by indexation. Indexation lowers taxable gain, resulting in a reduced capital gains tax liability.

Surana says: “As seen in the example, Mr. A’s effective tax rate drops from 8.33% without indexation option to 5.51% with indexation option, resulting in substantial tax savings of over Rs. 4 lakh.’

Chartered Accountant Ashish Karundia explains: “The second proviso to section 112(1)(a) is applied solely for the limited purpose of calculating tax, and the tax computed at the rate of 12.5% needs to be capped at the amount of tax that would have been payable prior to 23rd July 2024. Thus, if the application of indexation under this proviso results in a capital loss, no tax is payable on the resulting long-term capital gain (LTCG).”

Karundia says: “It is for this reason, any loss arising from indexation under this proviso cannot be carried forward under section 74. This is because, for a loss to be eligible for carry forward under section 74, it must be computed in accordance with section 48. However, section 48 does not allow indexation for asset transfers occurring on or after 23rd July 2024.”

When claiming indexation benefit increases the tax liability instead of reducing

While indexation generally helps reduce the tax burden on long-term capital gains by adjusting the cost of acquisition for inflation, there are certain cases where claiming indexation can actually lead to a higher capital gains tax liability.

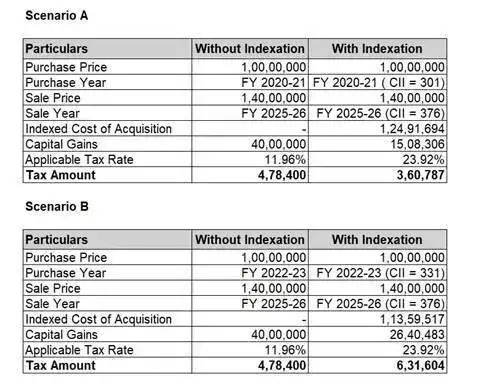

Punit Shah, Partner, Dhruva Advisors, explains two likely scenarios:

- Scenario A: For properties held over a long period, indexation can significantly boost the purchase cost, thereby reducing the taxable capital gain. In such cases, opting for the 20% tax with indexation often leads to meaningful tax savings.

- Scenario B: On the other hand, if the property was acquired recently, the indexation adjustment is minor due to a shorter holding period and limited inflation impact. Here, choosing the 10% tax without indexation may actually result in a lower overall tax burden.

Punit Shah, Partner, Dhruva Advisors.

Surana says the reason why sometimes claiming indexation benefit may result in higher tax liability is because when the tax rate applicable with indexation (20%) is significantly higher than the flat tax rate (12.5%) applied without indexation. To explain this concept better, see the example below which illustrates a situation where, despite a lower taxable gain due to indexation, the overall tax payable is higher because of increased tax rate.

Example: Mr. B bought a property in FY 2022-23 for Rs 50,00,000 and sold it in FY 2025-26 for Rs 1,50,00,000. The table below shows the capital gains tax calculation with and without indexation benefits.

| Particulars | Tax With Indexation (in Rs) | Tax Without Indexation (in Rs) |

| Full Value of Consideration (Sale Price) | 1,00,00,000 | 1,00,00,000 |

| Cost of Acquisition (Original) | 50,00,000 | 50,00,000 |

| CII for Year of Acquisition (2022-23) | 331 | Not Applicable |

| CII for Year of Sale (2025-26) | 376 | Not Applicable |

| Less: Indexed Cost of Acquisition | 56,79,758 (50,00,00*376/331) | Not Applicable |

| Long-Term Capital Gain (LTCG) | 43,20,242 | 50,00,000 |

| Applicable Tax Rate (u/s 112) | 20.00% | 12.50% |

| Capital Gains Tax Payable | 8,64,048 | 6,25,000 |

| Effective Tax Rate on Sale Price | 8.64% | 6.25% |

| Tax Savings | Rs 2,39,048 |

Source: Suresh Surana

As shown in the above calculation, even though indexation reduces the taxable capital gain from Rs 50 lakh to Rs 43.2 lakh, the higher tax rate of 20% applicable with indexation results in a greater tax outgo of Rs 8,64,048. In contrast, without indexation, the lower flat tax rate of 12.5% results in a tax liability of Rs 6,25,000.

Surana says: “This leads to an additional tax burden of Rs 2,39,048 when opting for indexation as per the above computation. Such scenarios demonstrate that indexation is not always beneficial and can, in some cases especially in case the property is held for a smaller duration/ period, increase the effective tax liability.”