CEOs to take advantage of Rs 1 trn innovation fund

)

Illustration: Ajay kumar Mohanty

Listen to This Article

With the Interim Budget indicating the road ahead for the economy, Indian companies are planning to invest more in coming months as they expect consumer demand to revive substantially.

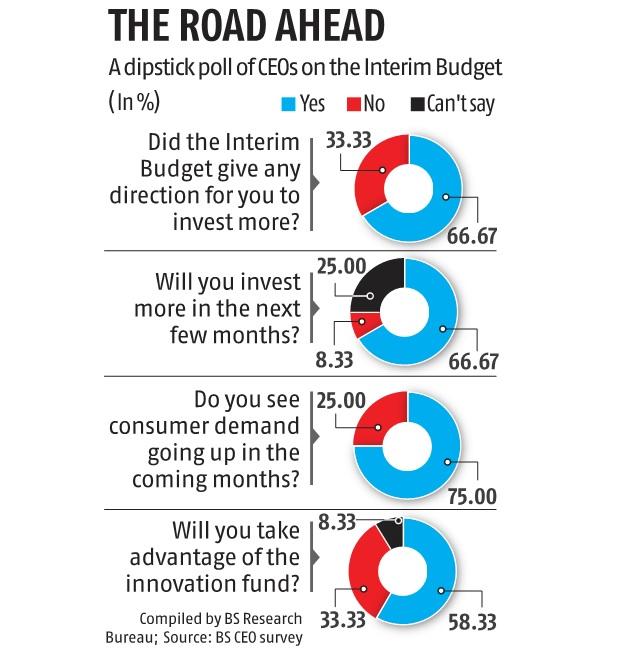

A dipstick poll of 12 chief executive officers (CEOs) after the Interim Budget shows 66.67 per cent of the respondents are planning to spend on creating fresh capacities because the Budget has given clear directions to companies to be ready for government orders.

Click here to follow our WhatsApp channel

Interestingly, 25 per cent of the respondents do not expect consumer demand to revive though an overwhelming number of them (75 per cent) expect it to pick up.

Union Finance Minister Nirmala Sitharaman announced a 17 per cent increase in infrastructure spending to Rs 11.11 trillion for 2024-25 (FY25).

The bulk of the fresh investment is expected to be made by infrastructure companies, which are expecting a jump in orders from the Indian Railways, including metro; roads and highways; and existing and new airport companies.

“This is a good indicator of what will come in the Budget in July. There is a significant increase in capital expenditure for infrastructure, taking the outlay to Rs 11.1 trillion. However, if we look at the likely spending in FY24, it will be about Rs 9.5 trillion. So, essentially, the increase will be about 17 per cent in real terms. This should translate into robust domestic demand, spurring private investment and job creation,” said the CEO of a large firm.

Of the CEOs, 58.33 per cent said they would take advantage of the Rs 1 trillion innovation fund announced in the Budget. The minister said the fund would encourage the private sector to scale up research and innovation significantly in “sunrise domains”.

“India’s Interim Budget has ignited the entrepreneurial spirit. The massive innovation fund, coupled with infrastructure investments in sunrise sectors like artificial intelligence and quantum computing, is a game-changer. This push unleashes a wave of opportunity for new-age businesses, empowering us to accelerate technological advancements and propel India towards economic leadership. We will see major capex in sunrise domains, energy, infrastructure, and digitisation over the next few years,” said the CEO of an oil company.

Another CEO said the finance minister’s decision to continue the push to capital expenditure would further help the country overcome the slowdown of the economy due to the pandemic, and help in giving domestic industry confidence and the room to invest.

At present, top conglomerates led by Reliance Industries, the Adani group, Tata group and JSW are planning a massive expansion in the renewable energy sector, airports, telecom and steel. The Adani group is planning to invest $100 billion by 2030 to create fresh capacity in renewable energy and doubling cement capacity.

(Dev Chatterjee with Sohini Das, Aneeka Chatterjee, Ajinkya Kawale, Ishita Dutt and Subhayan Chakraborty)