During his five-year tenure, the banking sector has become resilient, improving profitability and maintaining healthy capital

)

Photo: Bloomberg

Reserve Bank of India (RBI) Governor Shaktikanta Das is credited with many achievements, particularly how he navigated the pandemic challenge and then the war in Europe amid global central banks increasing interest rates.

During his five-year tenure, the banking sector has become resilient, improving profitability and maintaining healthy capital.

Click here to follow our WhatsApp channel

Business growth continued to be strong. India’s payments system has conquered new peaks with transactions through United Payment Interface clocking a fresh height in November, hitting Rs 17.4 trillion.

Under Das, the RBI launched a pilot on the central bank digital currency last year, with the target of hitting one million transactions a day.

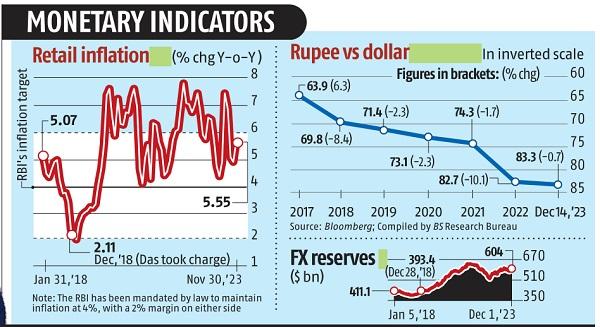

The rupee, which was hammered last year following Russia’s invasion of Ukraine, was remarkably stable in 2023. The Indian unit was most stable in 2023 in two decades, more than even the Chinese yuan. The RBI’s intervention in the currency market helped achieve this. At the same time, the central bank was able to hold on forex reserves of around $600 billion.

Das, who took charge in December 2018, is on course to become the longest-serving governor in almost seven decades. His term ends in December next year.

If there is one thing that keeps the central bank on its toes, it is inflation. The law mandates the central bank maintain the consumer price index (CPI) rate at 4 per cent, with a variation of 2 per cent on either side.

In 2022 the RBI failed in its mandate to maintain the average inflation rate in the 2-6 per cent range for three consecutive quarters. The central bank started raising the policy repo rate from May to address inflation. Between May 2022 and February 2023, the repo rate was raised 250 basis points to 6.5 per cent, and the RBI paused since then. But Das refused to drop the guard and, in his own words, maintained Arjuna’s eye — a metaphor used to communicate its focus on bringing down inflation to its target, which is 4 per cent.

The governor has not signalled to the market that the central bank is done with rate hikes and indeed paused, as the withdrawal of the accommodative stance has been maintained with frequent hawkish overtones.

“(The) target of 4.0 per cent CPI rate is yet to be reached and we have to stay the course,” Das said during the December review of the monetary policy.

While the average inflation rate is projected to be above 5 per cent in October-December and January-March 2023-24 as well as April-June 2024-25, it is expected to fall to 4 per cent during the second quarter next financial year.

The central bank has done well to bring down the core inflation rate, which eased to 4.2 per cent in November 2023 from 4.4 per cent in October 2023 — this was the lowest print since the pandemic came.

The worry is food inflation, on which the central bank has limited control.

“The CPI rate expectedly retraced to 5.6 per cent in November 2023 from 4.9 per cent in October 2023. The uptick was entirely driven by the food and beverages segment, with all other groups either reporting a lower or an unchanged year-on-year inflation print in November 2023 relative to October 2023,” said Aditi Nayar, chief economist, head, research and outreach, ICRA. The surge in the food and beverages inflation rate to 8 per cent in November was largely led by a sharp increase in vegetables prices.

Despite volatile food prices, it goes to the credit of the central bank that it has not allowed inflation to be generalised — yet another indicator of how inflation expectations have been anchored.

“We expect the CPI rate to move towards the 4 per cent target from Q2FY25 onwards, assuming crude oil prices stay moderate. Core inflation continues to show broad-based moderation spread across goods and services, indicating that inflation pressures haven’t spread from food to non-food,” said Gaura Sen Gupta, economist with IDFC First Bank.

“Over the medium term, headline inflation tends to move towards core inflation. The key risk to inflation remains from food prices. Adverse weather events have resulted in multiple food price shocks, which will need to be monitored,” Sen Gupta said.

Das had said the central bank would remain alert to any signs of derailing of the disinflation process.

“Based on the evolving situation, the Monetary Policy Committee will take appropriate action to reach the 4 per cent target,” Das said during the December policy review. Low inflation should be sustainable, he added.

Suyash Choudhary, head, fixed income, Bandhan AMC, said: “Given climate change and repeated disruptions, it is possible that the food component will see periodic volatility. However, so long as the underlying dynamic is benign, the headline inflation rate will likely keep returning to trend as the shocks dissipate.”

If the inflation rate hits the target, that is, 4 per cent, Das can claim he has ticked all the right boxes in his illustrious six-year at Mint Road.