Centre to issue circular soon outlining scenarios, which could trigger tax liability

)

Listen to This Article

The personal guarantee offered by directors and promoters to a bank against credit sanctioned to the company may be subject to goods and services tax (GST), if there is a “consideration” of any manner.

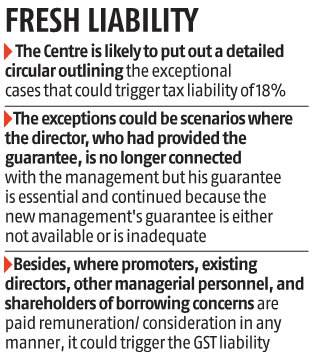

The Centre is likely to put out a detailed circular outlining the exceptional cases, which could trigger tax liability of 18 per cent, in case of personal guarantee, said a government official. Those exceptions could be certain scenarios where the director, who had provided the guarantee, is no longer connected with the management but his guarantee is essential.

It may be because the new management’s guarantee is either not available or is inadequate.

Besides, where the promoters, existing directors, other managerial personnel, and shareholders of borrowing concerns are paid remuneration/ consideration in any manner (directly or indirectly), it could trigger GST liability, the official added.

The GST Council, in its just-concluded meeting on Saturday, has addressed the conflict over applicability of levy on personal guarantee provided by directors and promoters. It has clarified that no tax will be levied on such transactions where the underlying value or consideration is nil.

“The clarity with respect to personal guarantee is also aligned with the Reserve Bank of India’s (RBI’s) guidelines, which prohibit companies to extend any consideration to directors in return for guarantees provided by them. However, there are certain exceptional cases where a consideration is allowed to be paid and that could trigger levy on reverse charge,” said Saurabh Agarwal, tax partner, EY India. Reverse charge under GST means the tax will have to be paid directly by the receiver instead of the supplier.

Conversely, the council has also decided to impose tax at 18 per cent on the corporate guarantee provided to related persons, including the holding company to its subsidiary, for valuation at 1 per cent of the amount of guarantee offered or the actual consideration, whichever is higher. Sources said the decision would be prospective in nature and is unlikely to impact past litigations.

“While this decision should largely settle the question of taxability, it would be beneficial if the council also addresses whether it is applicable prospectively or retrospectively. It is important to consider whether this update will prompt the reopening of previously closed audits and assessments or freezing of demands for ongoing litigations,” said Sanjay Chhabria, director, Indirect Tax, Nexdigm.

Prescribing 1 per cent as deemed consideration with respect to corporate guarantees issued free of cost for subsidiaries provides the much needed clarity, though one hopes that the amendment is taken as prospective. In many cases, GST paid would become a cost as these guarantees are issued in case of power and infra projects where input credit is not available, said Pratik Jain, partner Price Waterhouse & Co LLP.

The issue was taken up by the GST Council following extensive deliberations, where it was decided to adopt valuation rules in line with safe harbour rules under the Income Tax Act. The move aimed to bring uniformity and remove ambiguity.

Some experts feel that the decision with respect to corporate guarantee is not aligned with commercial reality.

“Deemed valuation of 1 per cent for guarantees between group entities is not in alignment with commercial reality and Organisation for Economic Co-operation and Development (OECD) guidelines on shareholder activities. This will open a Pandora’s box in relation to ongoing investigations for both domestic and international transactions with implications under Foreign Exchange Management Act (Fema) and transfer pricing,” said Asish Philip Abraham, partner, Lakshmikumaran & Sridharan.