The Goods and Services Tax Network (GSTN) has enabled the Form DRC-01C for dealing mismatches between GSTR 2B and GSTR 3B. The Form DRC-01C is the form to intimate the difference in input tax credit available in auto-generated statements containing the details of input tax credit and that availed in return.

A new rule 88D is inserted to the CGST rule via this amendment which details the Manner of dealing with difference in Input Tax Credit (ITC) available in Auto-Generated Statement containing details of ITC and that availed in Return, that is GSTR-2B and GSTR-3B.

The government has introduced a new Form GST DRC-01C, a system generated form for the Intimation of difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return with respect to newly inserted Rule 88D.

Read about Rule 88D: CBIC notifies new Rule for Manner of dealing with difference in ITC available in Auto-Generated Statement containing details of ITC and that availed in Return

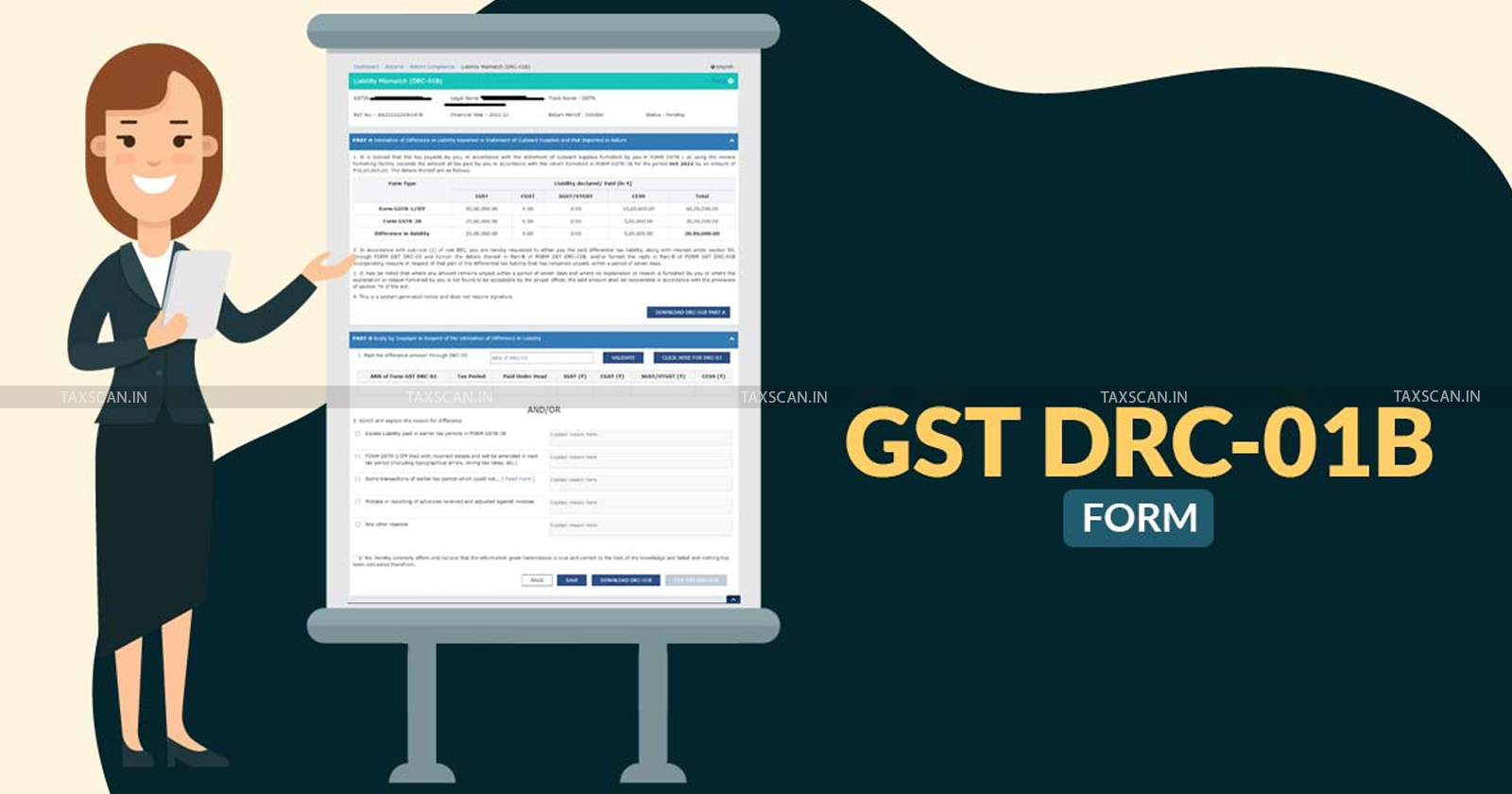

Steps to access Form DRC -01C

- Go to GST Portal – https://www.gst.gov.in/

- Navigate to ‘Services’ and further to ‘Returns’

- Click on ‘Return Compliance’ under Returns

- Click on ‘View’ option of ITC Mismatch (DRC-01)

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates

Be the First to get the Best

Join Our email list to get the latest Tax Updates , Special Offers, Events delivered right to your Inbox

Email Address *

Fields of Interest

AllIncome TaxGSTCustomsOther TaxationsIBCPMLACompany Law

Please select your fields of interest