SynopsisWeb3, which has been in the works for over a decade, has now picked up pace and will see more products and services being built around it. While it gives users control over their data, there are challenges that will not allow Web3 to become mainstream so soon. That’s one reason why Web2 won’t go away in a hurry.

It was a watershed moment for digital rupee when on November 1 the Reserve Bank of India (RBI) kicked off a pilot leveraging the distributed ledger technology, which also underpins Web3.0 — the new iteration of the Internet. With this pilot, the RBI joined more than 20 countries, including South Korea, Japan, Australia, and Russia, that are testing out a Central Bank Digital Currency (CBDC) to see whether such transactions can reduce settlement times and bring more liquidity into the economy.

The RBI pilot may not have been a pure Web3 kind of decentralised application. But it is definitely one headed in that direction, making digital transactions at scale easier, cheaper and frictionless, compared to paper-based transactions.

We at ET Prime got down to decode Web3, its multiple parts, applications and challenges, and why Web2 will continue to be relevant, at least for now.

The term Web3 was coined back in 2014 by Gavin Wood, a co-founder of the Ethereum blockchain. Simply put, Web3 places data and content into the user’s hands. Web3 doesn’t have a central authority that owns all the data and profits from it. It is a democratised web-based on an open-source application that gives users control of their data and the means to share the revenue generated by their content, be it Tweets or Instagram posts.

“Such proof of concepts is bringing Web3 into the mainstream. In the next 18 months, there will be a lot more products on decentralised platforms or Web3 backbone,” says Ashootosh Chand, emerging technologies expert at consultancy PricewaterhouseCoopers (PwC).

Web3: The Internet is owned by the users

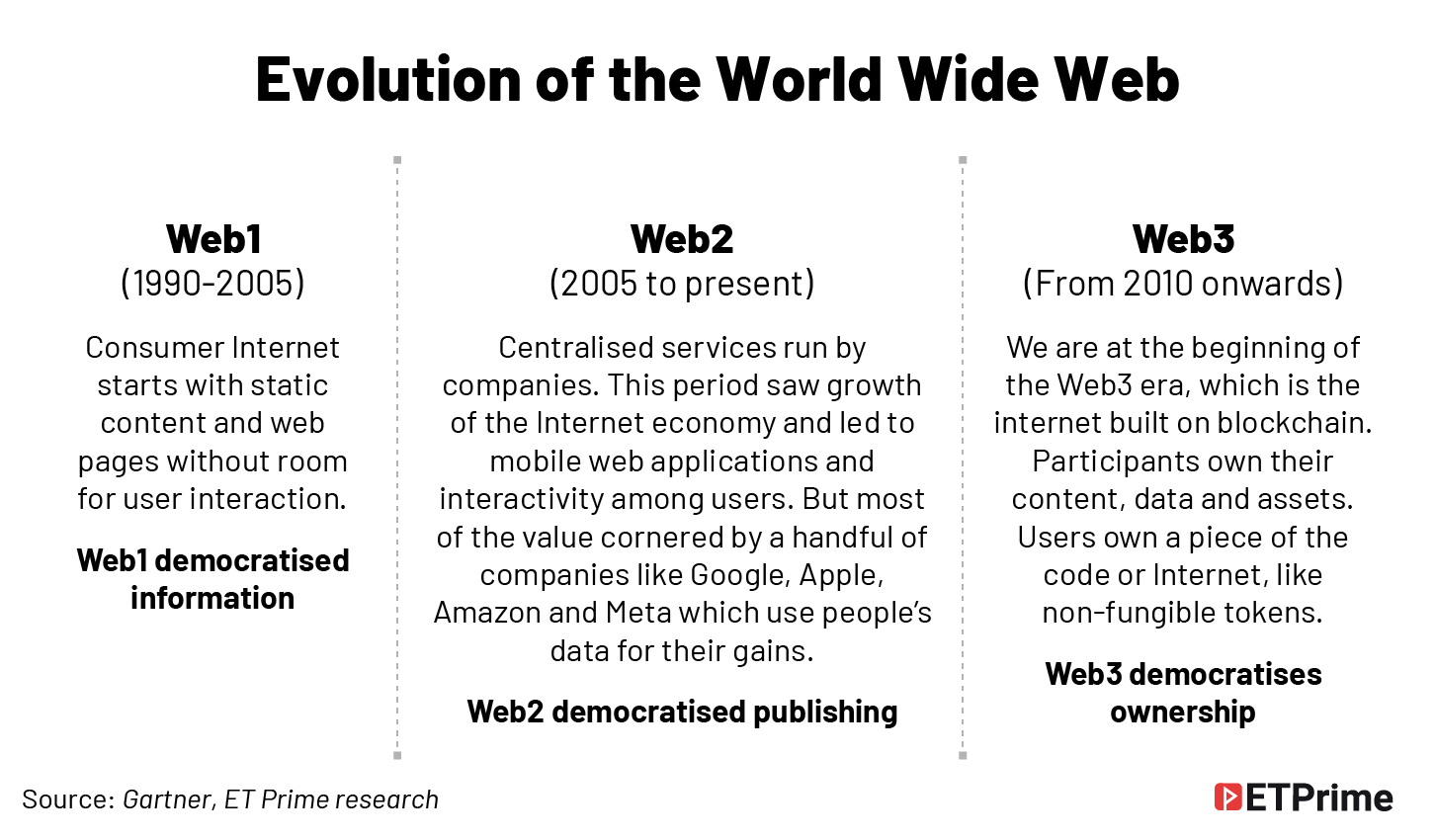

When consumer Internet started around the early 1990s, it was a lot about one-way consumption. It was static content — web pages didn’t have any room for user interaction. With Web1, users came to the Internet to consume or read content. The next version, Web2, started around 2004-2005. It saw the emergence of siloed, centralised services run by the companies. This period has seen better Internet speeds, growth of the Internet economy including e-commerce and digital payments. This led to mobile web applications. There is interactivity among users (like editing Wikipedia, writing blogs, responding to social-media posts etc.). But most of the value is accrued to a handful of companies such as Apple, Amazon, Google, Meta, and others that use people’s data for their gains (like advertising revenue).

Web3, with blockchain as its foundation, combines the decentralised, community-governed ethos of Web1 with the advanced, modern functionality of Web2. Participants have ownership of their content, data, and assets. Web3 is the Internet owned by the builders and users.

Avivah Litan, vice-president and distinguished analyst at Gartner, says, “Web1 democratised information, Web2 democratised publishing — anyone can publish content — while Web3 democratises ownership. Web3 is really a blockchain with cryptocurrency, NFTs built into the protocols.” She argues that when the Internet for consumers was first released, there was no money involved as that would have commercialised the Web and limited mass access. So, the only way companies could make money was advertising. “We ended up in surveillance capitalism, spam, fakes, and all kinds of problems. Now with Web3 applications, users own the content,” adds Litan.

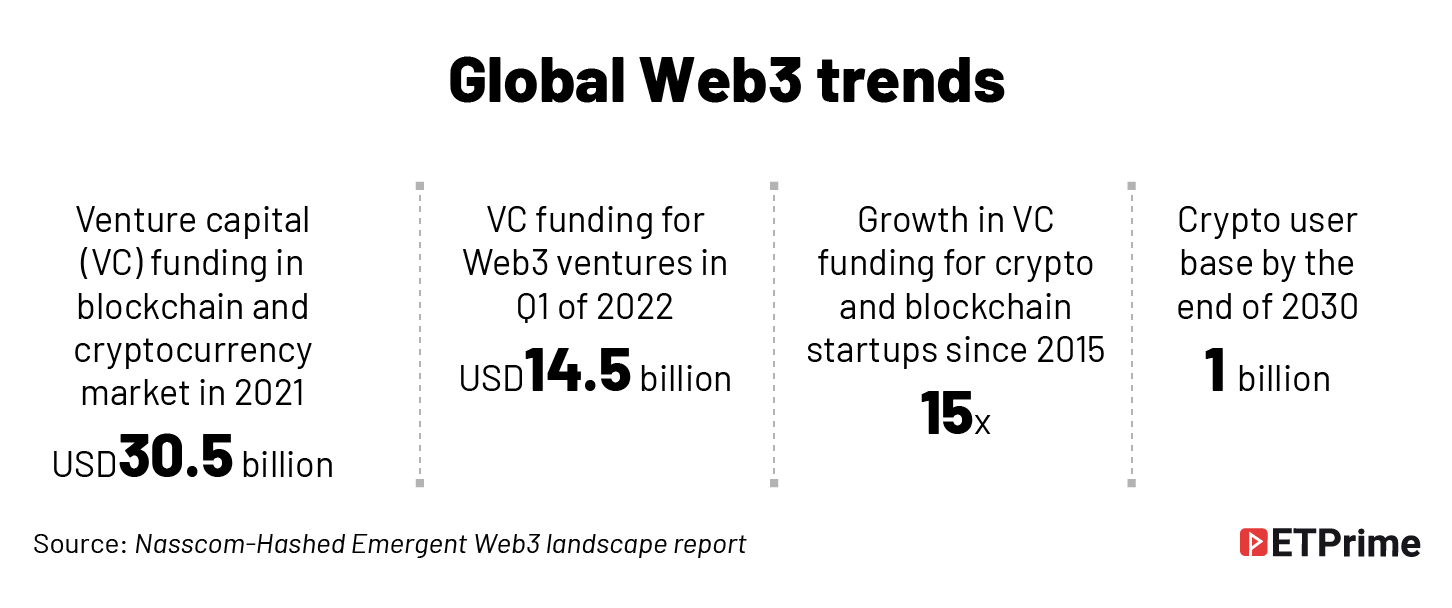

Web3 will enable digital entities to control, use and own content for economic value and differentiated experiences. While it has been around for over a decade, only now Web3 is getting traction. Sample this. According to a recent Nasscom-Hashed Emergent report, Web3 received USD30.5 billion venture-capital (VC) funding in 2021 and more than USD14.5 billion in Q1 of 2022 alone, led by investments in DeFi (distributed finance) and NFTs (Non Fungible Tokens), which are part of Web3. Hashed Emergent is an early-stage VC fund focused on investing in companies that are at the intersection of Web2 and Web3, based out of Bengaluru, Singapore, and Dubai.

How India is faring in the Web3 play

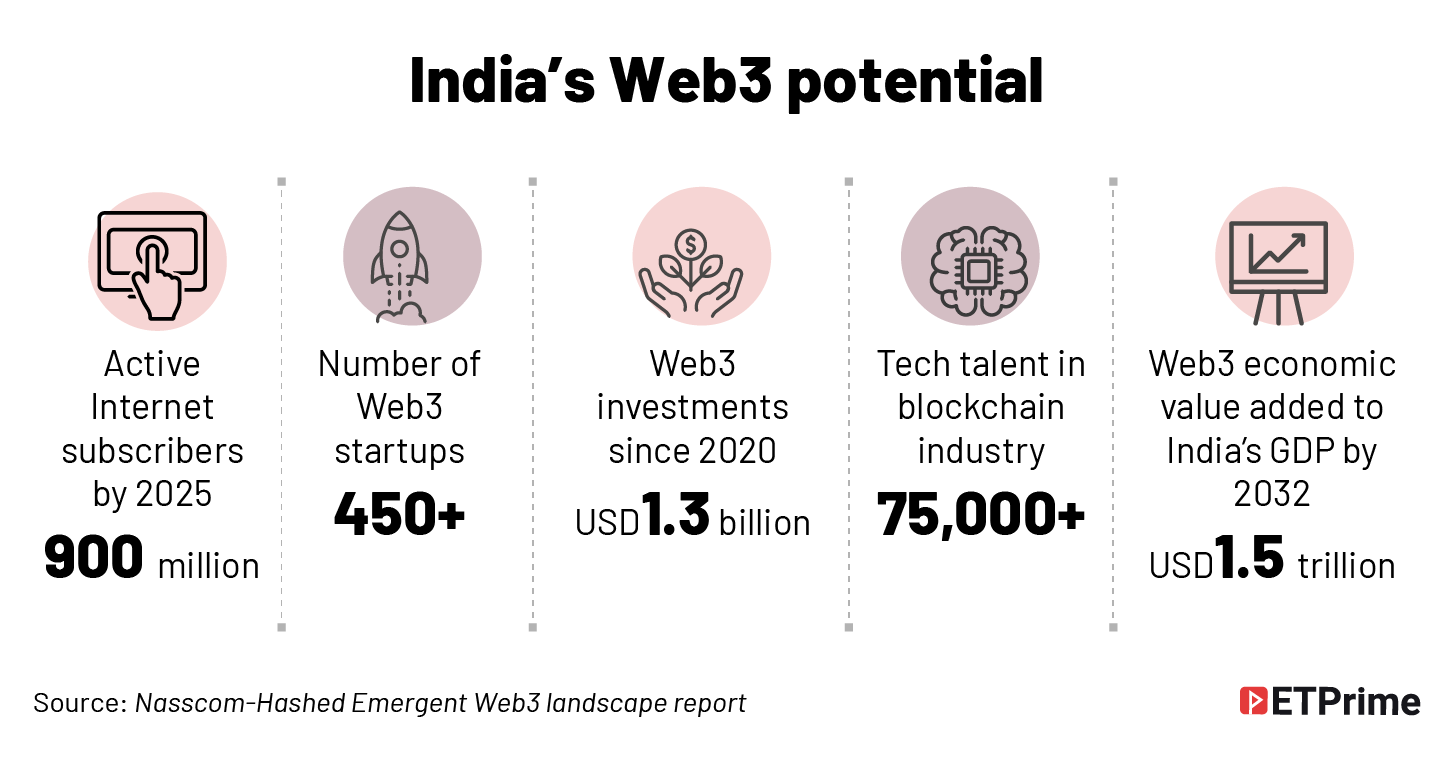

According to Gartner, by 2025, one-fourth of mainstream enterprises will use centralised services wrapped around Web3. Interestingly, entrepreneurs in India who missed Web1 and Web2 waves — which saw the rise of tech majors like Google, Amazon, Microsoft — are betting big on Web3. The Nasscom-Hashed Emergent report points out that India will become the highest growth market for Web3 globally.

In the last two years, there have been more than 450 Indian Web3 startups including four unicorns that have raised USD1.3 billion till April 2022. In 2021-22 alone, India registered over 170 new Web3 startups. The country is also home to 11% of global Web3 talent, making it the third-largest Web3 talent pool globally. Around 75,000 blockchain (foundation for Web3) professionals are working in India across startups and big tech companies. Most of the Web3 ventures in India are focused on building consumer-facing applications in areas of DeFi and entertainment (gaming, NFT marketplaces, metaverse).

Applications that can push Web3 forward

Web3 is an umbrella term applied to any application using the blockchain technology. It has so far been used for crypto-currency (decentralised digital cash, not controlled by any single entity, like Bitcoin) transactions, Initial Coin Offerings (ICOs), NFTs, etc. NFTs are a form of crypto and each NFT is unique. They are linked to digital or physical assets similar to paper title deeds for, say, property’s ownership rights.

Decentralised apps are also part of Web3. When you use cloud-based services — like Microsoft Teams, Instagram, or Google docs — you are using centralised apps. These tech giants, Microsoft, Meta, and Google, respectively, have access to information and can read it and use the information to maximise their advertising revenue. The user benefit is that he can store information on the cloud, collaborate with others, and enjoy other cloud-app conveniences like alerts based on his interest, reduced costs and improved data security.

Can you get the benefits of these cloud services without a middleman (read Big Tech)?

That’s where decentralised apps or “dApps” come into the picture. Most dApps use the Ethereum blockchain (designed to support Web3 technologies) to do their online computation, and that computation is paid for using Ethereum `gas’ fees. dApps conform to Web3 requirements to be public, open source, and secured through cryptography. So, dApp users control their data and who can see it while benefiting from cloud-based computing power to run functions that a specific dApp is designed for.

Smart contract is another Web3 application. If you buy a car or take an education loan from the bank, there’s a lot of paperwork involved. With this paperwork, the bank sets up a contract with you, detailing the rights and obligations of both parties. If you default on your payment, the bank can enforce specific actions (such as taking possession of the car, or the collateral linked to the education loan). Smart contracts do the same job, but they don’t require a central entity to enforce or monitor things. It all happens according to the rules and logic of the contract. Smart contracts make it possible to provide financial services, or draw up legal agreements between parties, in a much more affordable, less time-consuming way than traditional contracts.

The buzzword Metaverse also has elements of Web3, as the transactions are enabled with crypto currencies and assets like virtual land authenticated by use of NFTs. Decentralized Autonomous Organizations (DAOs) is yet another example of Web3. An organisation typically has a centralised structure.

DAO is a legal structure that has no central governing body and whose members share a common goal to act in the best interest of the entity. Every member of the organisation has a voice and decides when and on what project money is spent. Now, this could get complex, and this is where Web3 rules step in. The organisation’s rules are encoded using an innovative contract technology based on blockchain. DAOs every transaction and its history are open to public scrutiny, much like a cryptocurrency transaction, making fraud difficult.

“We ended up in surveillance capitalism, spam, fakes, and all kinds of problems. Now with Web3 applications, users own the content.”

— Avivah Litan, vice-president and distinguished analyst at Gartner

Despite such benefits, all organisations won’t shift to Web3 in a hurry. Web2 and Web3 will both continue to co-exist and use cases will depend on specific applications and their benefits. For instance, for land records and loans, it makes sense to use NFTs and smart contracts to eliminate cumbersome paperwork and ambiguity like in the case of property titles. Litan of Gartner says, “Mainstream organisations are going to have a blend of Web2 and Web3. Much like consumers might use NFTs and crypto currencies in the metaverse but won’t completely abandon centralised services.”

The challenges Web3 faces

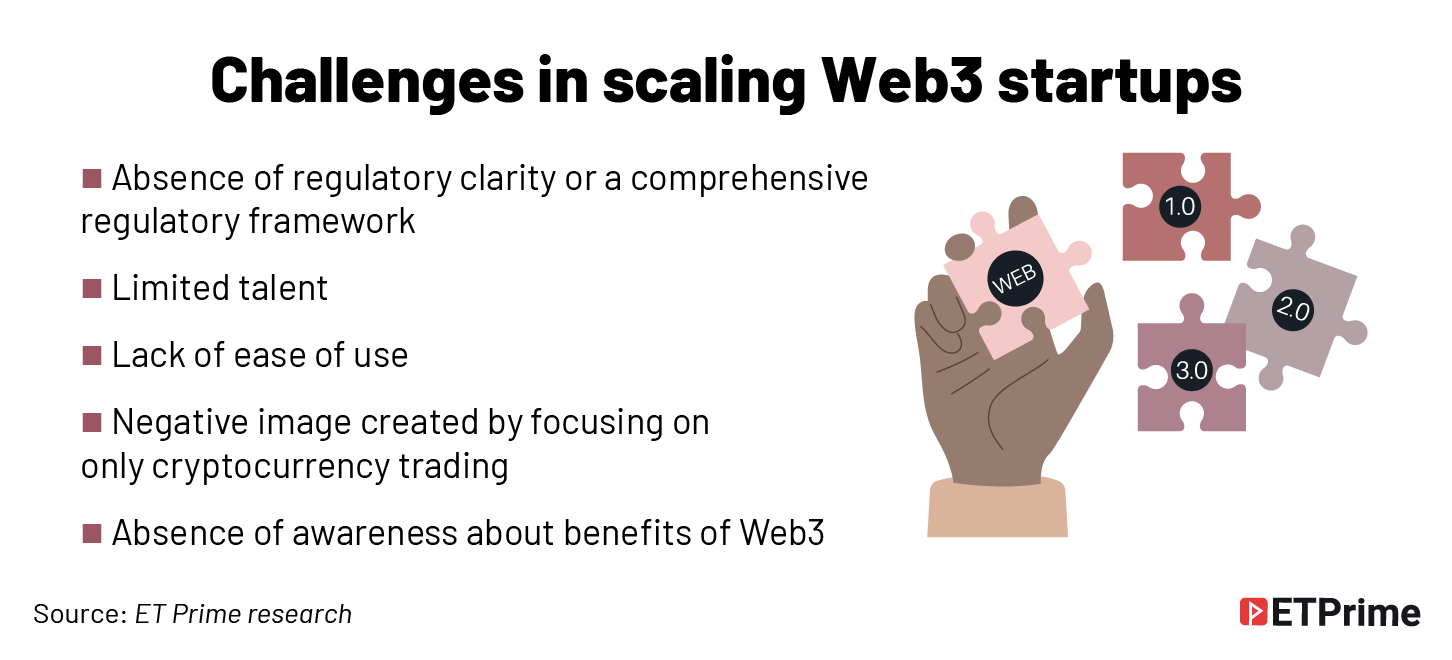

On paper, Web3sounds exciting with the promises of empowering users, making transactions transparent and so on. But there are challenges that will not allow Web3 to become mainstream in a hurry. There are a bunch of roadblocks from the ease-of-use point of view, making it tough for the masses to understand Web3 and something that only geeks and few others know about. There are also question mark on whether the government approves such transactions.

In fact, the biggest problem with Web3 is not technology but politics. There are questions about privacy, fraud, and manipulation. Can we completely move away from certain central authorities, like the RBI controlling currency?

Web3 is radical in concept and in some cases, the risks of abandoning tried-and-tested systems might be too high. That’s why Web3 has been in the works for a decade and will continue in tandem with Web2

Pandurang Kamat, CTO, Persistent Systems, points to four specific challenges. First is to bring speed and scalability. Second is to ensure privacy and security. Third is the way governments and regulators view it. And finally, the costs of using Web3. “Everybody is looking from their own prism and trying to figure out — is it an asset, is it money or something else? If you have very strict controls (like a blanket ban on crypto currencies) it may not work.”

Chand sees migration to Web3 like in the case of cloud. “Cloud computing has been around for more than a decade. But enterprises that had big investments in on-prem resources didn’t shift to cloud in a hurry. It is a gradual process which has picked up pace only in the recent years. There has to be a compelling return on investment to shift to any new platform.”

Google started with the philosophy: Don’t be evil. The subsequent rise of Internet and Big Tech has shown that maximisation of shareholder value has driven companies to control the Web, use data whichever way they liked, and do just about anything but empower the users. “Web3 brings a concept of can’t be evil,” Kamat adds.

While pilots like the one by the RBI will help bring Web3 applications to the mainstream, governments are unlikely to give up control of assets like currencies. That’s one reason Web2 won’t go away in a hurry even as Web3 becomes more mainstream in coming months and years.

(Graphics by Sadhana Saxena)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.