SynopsisHandling two tough services of fulfilment and finance, the growth story of OfBusiness and Oxyzo is all about skill, hard work and determination.

When Vikram Vaidyanathan, a Managing Director at Matrix Partners, decided to make a seed investment in OfBusiness in 2015, he wasn’t entirely sure what he was investing in. He was betting on the co-founder, Asish Mohapatra.

Vaidyanathan had worked with him for about 8 years at McKinsey and Matrix Partners and knew Mohapatra’s capabilities. “Ashish has always been more of an entrepreneur than anything else. When he decided to start something, it was automatic and obvious for me to back him. It was more a bet on the individual,” he says.

The lack of clarity existed on the other side, too. Mohapatra and his four co-founders — Ruchi Kalra, Vasant Sridhar, Bhuvan Gupta and Nitin Jain — did not also really have a solid idea of their business in the beginning. The team had the knowledge and the experience of working with small businesses in logistics, fulfilment and procurement. They had multiple ideas for a venture. But finally decided to build a B2B online marketplace that connects manufacturers with suppliers for all kinds of raw materials. The co-founders soon realised that the transactions in this space were so large that they would also have to offer credit to be successful. So OfBusiness became one of both commerce and credit.

“Combining commerce and credit was something that has never been attempted globally because both commerce and financing are very tough businesses on their own,” says Mohapatra. The challenge was clear from the word go. “The idea got rejected by more than 70 investors. The investors we approached had no confidence that we would pull it off.”

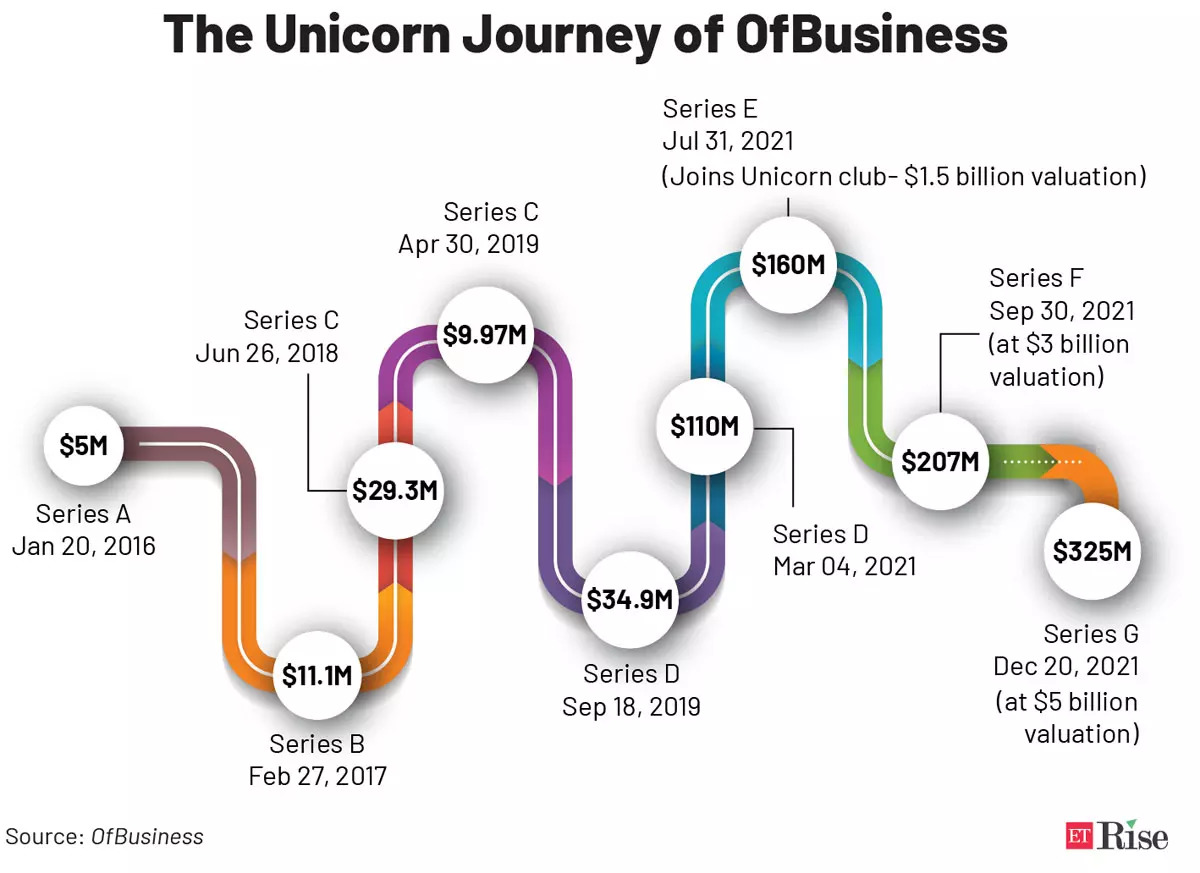

But six years later, OfBusiness is a unicorn. In December 2021, it raised $325 million, valuing the company at $5 billion.

The success story does not stop here. The same founding team had in 2016 set up a company called Oxyzo as the lending arm of OfBusiness to tackle the challenge of combining commerce and credit. That entity too became a unicorn in March, and that too in its Series-A funding — not a common occurrence. The startup raised $200 million in a round led by Tiger Global and Alpha Wave Global, along with other investors such as Matrix Partners, Creation Investments and Norwest Venture Partners. Its valuation now stands at $1 billion.

While Mohapatra is the CEO of OfBusiness, the CEO of Oxyzo is Kalra. Mohapatra and Kalra are married to each other. They had met each other while at McKinsey.

The Origins

Kalra was a partner in McKinsey & Company’s India office. Her focus was on financial services that involved NBFCs and SMB (small and medium business) banking. Before joining Matrix and McKinsey, Mohapatra was with ITC, running a SME firm they had acquired called Asia Tobacco Company. Gupta was the CTO of Snapdeal before joining the OfBusiness team. He had also worked as CTO in Bharti SoftBank and Hike Messenger. Jain had an 8-year stint at Royal Bank of Scotland in London and Sridhar was with ITC before joining OfBusiness.

In late 2014-early 2015, Mohapatra noticed an increase in activity in the SMB space as new companies emerged in logistics, fulfilment and procurement. “It made me think ‘this is the place I come from, why not start something here’. It took me a while to come out of Matrix Partners but I used that time to get the initial team together,” he says.

OfBusiness brings together buyers and sellers of raw materials. Not just SMB, even large enterprises such as Jindal Steel and Power Plants and Shapoorji Pallonji Group are its clients. These raw materials vary from metals, petrochemicals like bitumen, industrial chemicals like acetone and agri products like grains and spices. “So, anything that is bulky in nature where logistics is done in full truckloads, we do those heavy transactions on the B2B marketplace. Over a period, OfBusiness has also branched out into several other things like packaging of these raw materials. But it is largely an aggregation platform,” the CEO explains.

OfBusiness also enables institutional credit (both secured and unsecured) to SMEs by aggregating several raw materials and getting the orders financed. Then it passes out aggregation benefits such as volume discounts to the SMEs. This model has also helped it gather data on SMEs and its finances.

Mohapatra says their biggest challenge was figuring out the best way to operate in a market that runs on credit even for larger players such as Larsen & Toubro. “So how do you solve for credit? We said we will do it ourselves. People have said we will only work after getting an advance or we will solve for credit through partnerships. In our view that does not work.” He immediately clarifies that there are millions of distributors across the country providing both credit and commerce to clients. “But they do not have institutional capital. They do it with their own capital. So, the ability to build a big business is limited.”

iStock

OfBusiness is a B2B online marketplace that connects manufacturers with suppliers for all kinds of raw materials.

So Oxyzo was born to provide finance for OfBusiness’ customers looking for credit. It later started serving outside customers also. Oxyzo now also serves as securities and fixed income platform and provides supply chain financing as well.

While OfBusiness has about 8,000 clients (both buyers and sellers) on its platform, Oxyzo has about 11,000.

The Growth

One of the primary reasons for their success is choosing the right companies to do business with. This became extremely important in a market where structured, unstructured and fragmented SMEs operate at the same time. There were about 5 lakh enterprises registered under the manufacturing category alone as on December 31, 2020, says the annual MSME Report (2020-2021). There were enough opportunities, but the situation could get really tricky, especially in lending.

So, the co-founders decided to work with only a certain category of SMEs. “We do not touch people who are unstructured. Typically, our customers have at least $2 million or Rs 15-16 crore in terms of annual revenue. They are typically customers who have been in business for about 20 years or so. They are customers who buy all these raw materials, which means that they are B2B themselves, which means that they deliver a product or a service for a large anchor. For example, the vendors of Havells — the guys who supply fan parts or electrical components to them — are our customers,” Mohapatra says.

The same goes for Oxyzo, which does not work with SMEs that do not have a credit history.

Where the twin businesses have an edge is that unlike banks, they can together provide the entire gamut of supply chain financing for SMEs. “Banks only do 20% to 30% of the requirement. The balance 70% to 80% is actually provided by the intermediary, which can be the distributor, large retailer, financier or some local financier. We do this job instead,” he says.

A major difficulty the company faced was the lack of technology adoption. Mohapatra says in the early days, both buyers and sellers wanted to meet face to face before entering into deals. The pandemic, however, helped to change this mindset.

It is no secret that in the last couple of years, it has become easier to do transactions and supply chain flow has become smoother in the B2B marketplace. Dinesh Agarwal, the founder and CEO of Indiamart, says this is because of an increase in the internet footprint.

Agarwal started Indiamart, a B2B platform for SMEs, way back in 1996. “There was very low penetration of computers and the internet in India. Information flow was not that easy. If you’re sitting in the US or Australia and trying to find something, some products or services from India or China, the most information you’d get was in the print directories or at the export promotion councils. Information exchange and trade would happen through embassies and trade fairs, which was expensive and not many people used to do that,” he says.

iStock

Both OfBusiness and Oxyzo work with only structured SMEs in the formal space and do not cater to businesses in the informal economy.

Then in 2002, the BPO industry boomed in India. Slowly internet usage spread, computers became cheaper and information flow over email and other digital modes became common. Then came widespread adoption of smartphones and cheaper internet services. “Once 3G and smartphones were launched, internet penetration grew tenfold. Smaller businesses from the hinterlands could find out prices or suppliers in Delhi, Mumbai and other places. The entire ecosystem changed dramatically,” he says.

This change got a further push with demonetisation, GST adoption and other things like the use of the Unified Payments Interface.

More Challenges

Another challenge Mohapatra talks about is building a platform like theirs. “For example, if your marketplace is selling steel, it is very easy to sell one brand of steel. But to get many brands in is tough because one producer will say ‘hey, you are already working with someone else, so why should I come in? You throw him out’. That is how the distribution system in India works.” OfBusiness also had a limitation of reach as most small businesses operated in non-metro locations. Mohapatra says his company’s workers did not want to work in non-metros. But the work was important as it included meeting buyers and suppliers in person in smaller towns, going to their warehouses back and forth and convincing them to use the platform.

But the company managed to solve these issues and stand out. There are hardly any structured firms like OfBusiness doing financing and fulfilment together. “We believe that if you do not do both together in the manner in which we have done, there is no chance of survival in this market,” he says.

The startup’s clients are in agreement with Mohapatra.

A senior employee at Jindal Steel and Power Plants says OfBusiness’ marketplace is very robust for a lot of products. The company has been working with Jindal almost from 2016. “Although we still sell some products directly to our customers, OfBusiness’ platform is very vast and helpful to find buyers for a lot of products. They have also taken the credit risk out. As a supplier, we are always more concerned with producing the material, getting it out of our gates and getting our money as soon as possible. There are a lot of customers with whom we are not so comfortable with the credit risk. That is where OfBusiness helps,” says the employee who refuses to be identified because he is not authorised to speak to the media.

Profit and Growth

This business formula has paid off. Mohapatra says OfBusiness in the year 2021-22 did a revenue of about Rs 9000 crore. “In the coming year we will do somewhere around Rs 45,000 crores in OfBusiness as revenue.” Its gross margin is about 8.2%. The company’s annual profit in FY21 jumped by 72.4% to Rs 55.7 crore from Rs 32.3 crore in FY20.

The next wave of challenge for Oxyzo is dealing with competition across specific niches, technology penetration and getting like-minded talent.

As for Oxyzo, it had a loan book of close to Rs 2,650 crore and a profit of close to about Rs 100 crore in FY21-22. This year, it estimates the loan book to grow to Rs 6,000 crore and the profit to touch Rs 280 crore.

Kalra attributes the company’s success to the team. “For a financial services entity to be successful, it is important to have the right balance across various metrics of growth, quality, compliance and leverage. This has been built by people at Oxyzo. They have had a sharp focus on sales, risk and processes,” she says.

The next wave of challenge for Oxyzo is dealing with competition across specific niches, technology penetration and getting like-minded talent, says the CEO.

The head of OfBusiness also has his growth vision mapped out: “just add one more zero to whatever number you made and do it in the shortest possible time”. He says they are involved in behemoth markets: $500-billion market for raw materials, $1-trillion market of agri-commodities. “There is no need to do different things when you are already the market leader. The important thing is to scale up, be profitable, and grow.”

For Oxyzo, his vision is different. The platform has to first reach a level of prominence in B2B financial services. “We are probably a year to 18 months away from that happening.”

Kalra, the CEO of Oxyzo, says they plan to continue to innovate in this space across origination, deployment, curated structuring and distribution. “We envision it to be a $1-billion book at 25% RoE through addition of fee income streams.”

As of now, OfBusiness is preparing for an IPO of $2 billion. Vaidyanathan says the company has to now graduate to that level. “We have not seen many companies scale up like this. OfBusiness is like an execution machine. Continuing to execute at that scale is the most important thing OfBusiness has to focus on,” he adds.

(Edited by Ram Mohan. Illustrations by Mohammad Arshad)

(Originally published on Apr 19, 2022, 10:12 AM IST)

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now