The last few days had seen prices of cotton rising in India with reports of a Russian invasion

After being hit by the pandemic, container shortage and raw material price hike, India’s largest garment hub Tirupur is keeping its fingers crossed after the Ukraine crisis. This is because any supply disruption or demand dip in the European Union (EU) and the UK may wipe out business of more than Rs 1,200 crore per month.

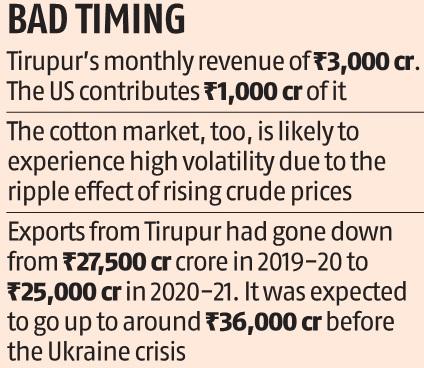

The region contributes to around 40 per cent of Tirupur’s monthly revenue of Rs 3,000 crore. Other major regions where Tirupur garments are sold include the United States. The US contributes around Rs 1,000 crore or 35 per cent of its monthly foreign exchange earnings. “So far, we have not seen any cancellations. However, any supply disruption or demand decline in the region due to the ongoing war will hit our revenue by more than Rs 1,200 crore per month from the EU and the UK,” said Raja M Shanmugham, president, Tirupur Exporters Association.

The current concerns come after a rise of 80 per cent in cotton prices last year, followed by a rise in yarn prices. According to another industry source, the cotton market, too, is likely to experience tight supply. It is expected to see high volatility due to the ripple effects of rising crude prices.

Brent crude prices were seen at $98 a barrel at one point on Friday.

The last few days had seen prices of cotton rising in India with reports of a Russian invasion. According to a report, the price mill delivered price of some varieties climbed by around 6 to 8 per cent in the last 20 days. Cotton accounts for around 80 per cent of the yarn cost. And, the yarn cost accounts for 25 per cent of the cost of garments and made-ups (the term refers to articles manufactured from any type of cloth). “We enter into contracts three to six months in advance. Owing to the rise in raw material prices, we were seeing higher garment prices too this year,” Shanmugham said. Between April and June, many units in Tamil Nadu were shut due to the raging pandemic.

Tirupur is home to around 10,000 garment manufacturing units, employing over six lakh people. Prior to Covid, the textile cluster exports were pegged at Rs 2,500 crore a month. If domestic sales were included, it came to around Rs 5,000 crore. Exports from Tirupur had gone down from Rs 27,500 crore in 2019-20 to Rs 25,000 crore in 2020-21. It was expected to go up to around Rs 36,000 crore before the Ukraine crisis, driven by rising prices. During the April-December, India’s overall exports saw a rise of 18 per cent (in dollar terms) compared to the same period in FY21.