Synopsis–Paytm is trading at INR778, down 64% from its issue price. And a latest Macquarie report pegs the stock price around INR700. While Paytm is a massive company with multiple streams of revenues, it lacks competitive edge, say experts. This is bothering investors, who are now questioning its business model. Will Paytm even deliver profits anytime soon?

Suresh Ganapathy is an unassuming analyst at Macquarie, an Australian broking house. Hours before Paytm was to debut on the exchanges, Ganapathy had a report on the company that stated the stock price was overvalued by 40%, and it had “too many fingers in too many pies”.

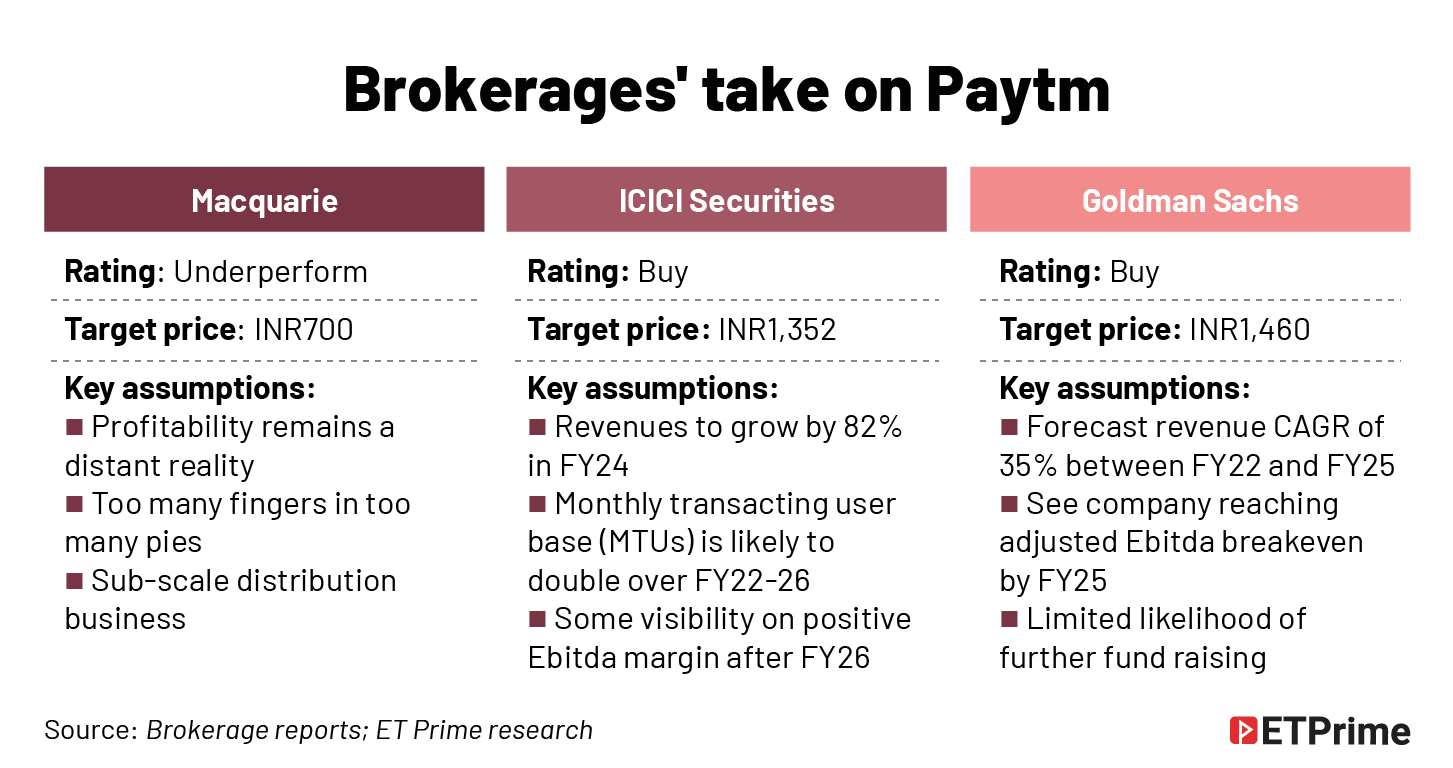

It is difficult to say if the report played any role in ramming Paytm’s share prices, but the stock closed 27% lower that day. Now, Ganapathy has a new report where he says the stock should fall to around INR700 — less than a third of the issue price. This coincides with the reports from other brokerages that believe Paytm’s downside is capped and from here onwards the stock can actually move up.

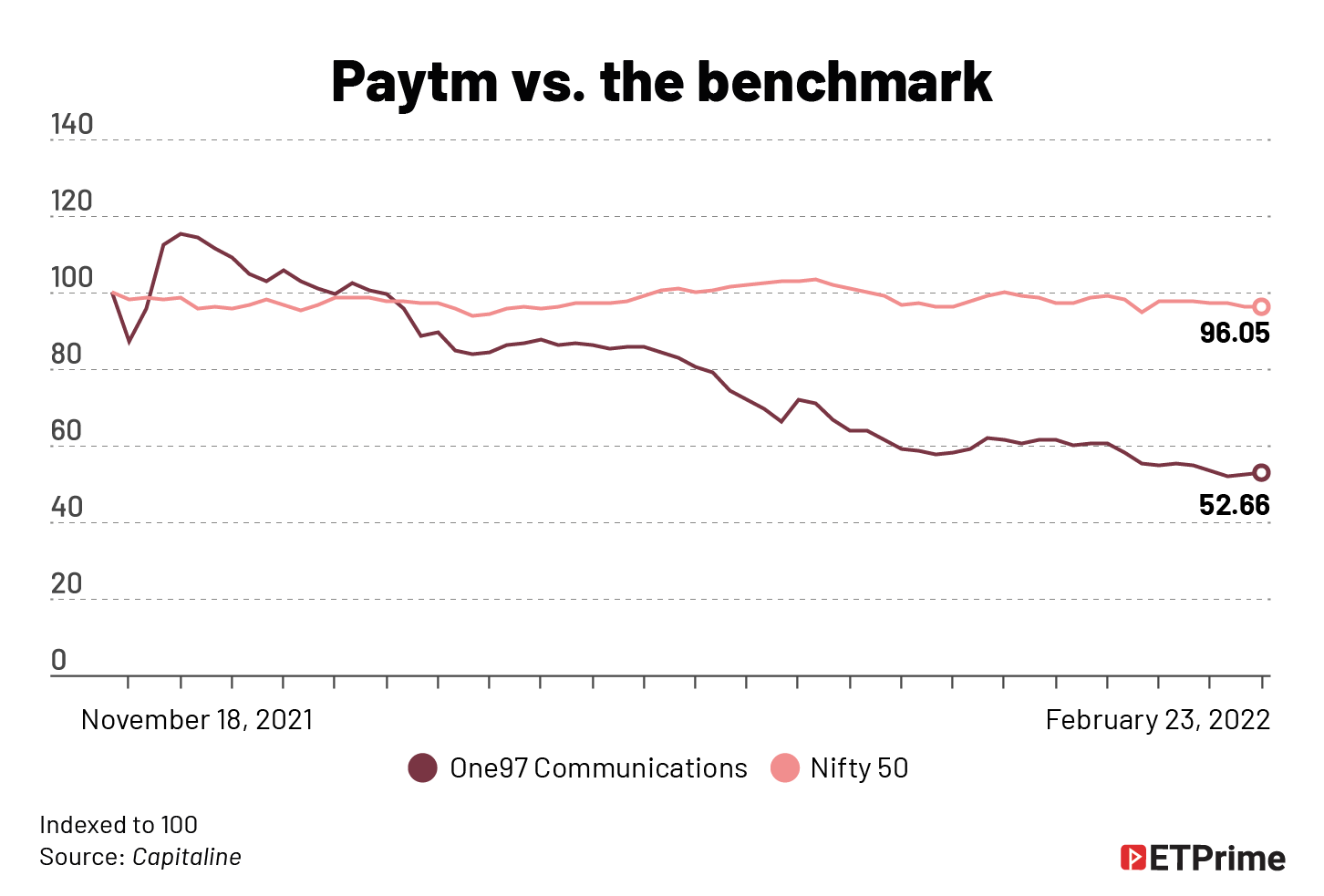

One97 Communications, better known as Paytm, came up with an initial public offering (IPO) in November 2021 at a valuation of USD20 billion (issue price of INR2,150). The stock is now trading at INR778, down 64% from the issue price.

If the plummeting stock price points to one thing, it is the dwindling investor confidence. The ardent followers to India’s long-term fintech story now question the company’s business model, and if it will even return profits.

Analysts are divided. Two out of the three brokerage firms that recently came out with reports on the stock, are upbeat about its future prospects. However, Ganapathy is one guy who refuses to budge. He still feels the stock is overvalued. Since he had called off the company on the listing day, one needs to take such views seriously.

The missing edge

While ICICI Securities and Goldman Sachs are positive on the company, even they are not very clear about when it will become profitable. As of now, of all the businesses Paytm has, only the payments bank has generated profits. Investors are questioning other businesses and asking for a profitability timeline. They want to take the stock seriously only if it shows some serious value.

“I buy businesses which have some core profitability, and to justify their valuations, such New Age stocks have to fall up to 90%. The main problem is in the way they were valued,” says Shankar Sharma, founder, GQuant Investech, a global investment management and fintech company

“I think the business model of not only Paytm, but almost the entire fintech community in India, hardly has any innovation or competitive edge. For any business to survive, it has to have some edge,” he asserts.

Sharma points that Paytm got itself into too many businesses — payments, stock broking, wealth management — and profitability does not seem on the horizon for now. “If you are nothing but a lender dressed up as tech, 3-4 times book value multiple is fair. You are still far, far away from being fairly valued,” he adds.

The company doesn’t have a moat or an edge and that is what really bothers investors. Paytm is now a massive company with multiple streams of revenues. This is something that actually goes against valuations, especially when these streams are loss-making. Analysts like clear linear cash flows from one single area, particularly in technology businesses where the focus is clear.

Or, a company needs to be innovative like Amazon, where the cloud business was subsidising the retail business that made losses for many years but eventually turned profitable. Closer home, we have Reliance Industries where the oil business subsidised the retail and telecom businesses.

In the case of Indian fintech, multiple business streams have worked as an attractive proposition initially when businesses were new and unlisted companies were getting money from private-equity firms. Again, these companies had less competition. But as competition increased, the entire fintech community didn’t have anything new to offer.

They are busy competing against one another and at the same time trying to increase the offering, many through super apps. For example, PhonePe, which started as a payments app, is now also a platform to invest in mutual funds and bullion, and buy insurance. Messaging app, WhatsApp, has launched WhatsApp Pay, an in-chat payment feature that allows users to make transactions via the app to their contact list.

Time and again, stock markets have given high valuation to businesses that generate cash flows and ideally have simple and easy streams of profits. Today, India’s fintech industry is more like finance and less like tech.

Analysts who normally look at banks are following the fintech business. They have many reservations when it comes to the balance sheets of these companies. They find fintech too complex as compared to banks that try to reduce NPAs and increase net interest margins to drive return on equity.

Analysts feel the only hope is that a big bank will buy Paytm provided the stock price falls even further. But the other view is — if Paytm has no unique business proposition, are there chances of big private banks showing any interest?

Numbers speak

Macquarie analysts have been bearish on the stock even before it was listed. The brokerage has tracked the stock the most and come out with seven notes on the digital payments and financial services company, slashing target price three times. It currently has an underperform rating, with a target price of INR700.

In its latest February 7, 2022 note, Macquarie flags higher ESOP (employee stock option) costs as a major drag, and says the key problem is that Paytm has issued ESOPs at a strike price of INR9 which is quite nominal.

To be sure, employee costs have surged for the company over the years and are a major expense. Employee costs have compounded at a rate of more than 40% over FY19 to the first nine months of FY22, as the company invested in its technology and sales team. It also built the financial services vertical and has borne the brunt of high attrition rates.

“I think the business model of not only Paytm, but almost entire fintech community in India, hardly has any innovation or competitive edge. For any business to survive, it has to have some edge.”

— Shankar Sharma, founder, GQuant Investech

Macquarie analysts point that a simple back-of-the-envelope calculation suggests that for the 27.5 million ESOPs issued in April-October 2021, leads to a total ESOP cost of INR6,000 crore for five years, assuming the IPO price of INR2,150 if one were to go by the intrinsic value of determining the ESOP costs incurred by the employer. This roughly translates to INR1,200 crore per year or roughly INR300 crore per quarter for the next five years.

Of the 27.5 million ESOPs, around 76% were issued to Vijay Shekhar Sharma. In fact, the IPO employee quota meant for Paytm staff was actually undersubscribed. Does this mean employees know better?

Paytm reported a widening consolidated net loss of INR778.5 crore for the quarter ended December, compared with INR535 crore a year ago, mainly hurt by ESOP costs to the tune of INR390 crore. The company had posted a loss of INR481.70 crore in the September quarter. Its consolidated revenue from operations surged 89% YoY to INR1,456 crore in the quarter from INR772 crore a year ago.

Paytm’s key businesses are spread over three verticals – payment service, cloud and commerce and financial services, and it derives revenue from transaction, processing, convenience, distribution and collection fees. It also has a stock broking and mutual fund investment app, Paytm Money.

Paytm has more than 350 million registered users, and 68.9 million average monthly transacting users. While the company’s customer interest is high, the shifting preference and the robust growth of UPI continues to bother.

Paytm’s lending business continues to see strong momentum across — Paytm postpaid (BNPL), personal loans and merchant loans, with share of higher commission personal and merchant loans going up, resulting in 201% YoY revenue growth for its financial services vertical. The value of loans disbursed in January was INR921 crore, an increase of 334% YoY.

A few have concerns though.

Analysts are divided

Macquarie pointed out that 98% of loans by volume for the quarter ended December were BNPL (buy now pay later) loans where ticket sizes are less than INR3,000, and the brokerage remains sceptical of the scalability of this vertical in a pure-distribution model.

“I don’t see how the lending business can contribute significantly to profits going ahead. The quality of customers is not the best. BNPL is not surviving even in an organised market like the US. It is more chaotic in India. The bottom of the pyramid in banking doesn’t work,” says Anurag Singh, managing partner of the US-based Ansid Capital.

Goldman Sachs recently upgraded the stock to ‘buy’ from ‘neutral’, but cut its target price to INR1,460 from INR1,600 earlier to account for the rising interest rate environment. ICICI Securities initiated coverage on the stock with a ‘buy’ rating, and a target price of INR1,352.

ICICI Securities anticipates enriched unit economics following positive payment business contribution and scale up of financial services. It arrives at lifetime customer value of INR2,000 per MTU (monthly transacting users) and INR29,600 per merchant.

Goldman Sachs expects the growth momentum to sustain. According to the investment bank, Paytm’s FY23 EV/sales multiple has declined from around 20 times in November to around seven times, and the stock now trades at a 10% discount to global fintech peers. This, when Paytm’s revenue growth that the brokerage expects to grow at an annual 35% between FY22 and FY25, is higher versus global peers at 28%.

While Goldman Sachs uses EV/sales multiple model, Macquarie opts for the PSG (price-to-sales growth ratio) methodology to value the company.

Paytm has a cash balance of INR3,023.6 crore or USD1.4 billion. According to Goldman Sachs estimates, at the company’s current annual cash burn rate of around USD210 million, there is limited likelihood of the company needing to raise capital again. It also expects Paytm to turn profitable at adjusted Ebitda level by FY25, and estimates the company to have about USD1 billion cash remaining on the books by then.

While BNP Paribas Asset Management sold its holding in Paytm, HDFC Asset Management trimmed it, according to data from Value Research. On the other hand, Mirae Asset Management has upped its holdings after the correction, while Aditya Birla Asset Management held on to it.

The bottom line

Lesser-informed retail investors, who typically chase sharp declines, have raised their holdings in Paytm. However, the conviction seems to be missing for many.

Like Macquarie many doubt whether the company will turn profitable anytime soon. The path to profitability seems long to many, and a key dampener for some investors.

“Why should the market be so charitable to wait for the company to turn profitable for another five years? There are enough good companies and themes to invest in,” says Singh of Ansid Capital.

“At the time of IPO, my initial hypothesis suggested a fair value of INR300 – INR400. I don’t even see that as a fair value anymore, as I don’t see much meat in the business model, and the revenue model,” he adds.

Vijay Shekhar Sharma’s ambition to float the country’s largest IPO ever, has clearly proved costly for investors and his own repute as well.

When he celebrated the success of the IPO even before it opened, he was oblivious to the fact that celebrations were perhaps too early, or actually not called for.

“Bharat Bhagya Vidhata, these words (from the National Anthem) overwhelm me. Uttering these words bring tears to my eyes. It says one who will define the fortune of this country, and I can say with enough conviction that everyone at Paytm has actually done that,” he had said with pride, adding, “Today is a day when a commoner surname seems like an outlier in this country. What a feeling!”

For now, if anything, Paytm has defined the investor sentiment on all New Age companies — once bitten, twice shy!

(Data support by Rochelle Britto; graphics by Mohammad Arshad)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.