SynopsisIndia seems to have forgotten the fact that every debt has a price and risk-premium associated. Suddenly, various kinds of lending products – from buy now pay later to peer-to-peer and pay-day loans – are vying to make a mark. Are we experiencing a societal shift where credit is no longer a bad word?

Nowadays, there’s a loan for everything you want in life.

Buy a pair of jeans and pay back in EMIs till its threads wear out. Get a Botox done and shell out EMIs till you need a facelift the next time around. Order your favourite dish from a food aggregator and make the payment when you can. Get a loan if you have run out of salary and return in monthly installments. Dying to buy that high-tech smartphone and flaunt it? Don’t sweat. This, too, can be financed.

Everybody – from fintech players to cab-hailing apps and food aggregators to payments companies – wants to play lender these days. Like ‘strategy’, the much-abused word in the corporate world, ‘pivot’ seems to be the equivalent for the finance sector. Suddenly, to cover up for their lack of business focus as well as the inability to generate higher revenue, most new players seem to have pivoted to lending. They are trying to showcase some (new) revenues (in the name of new consumer avenue).

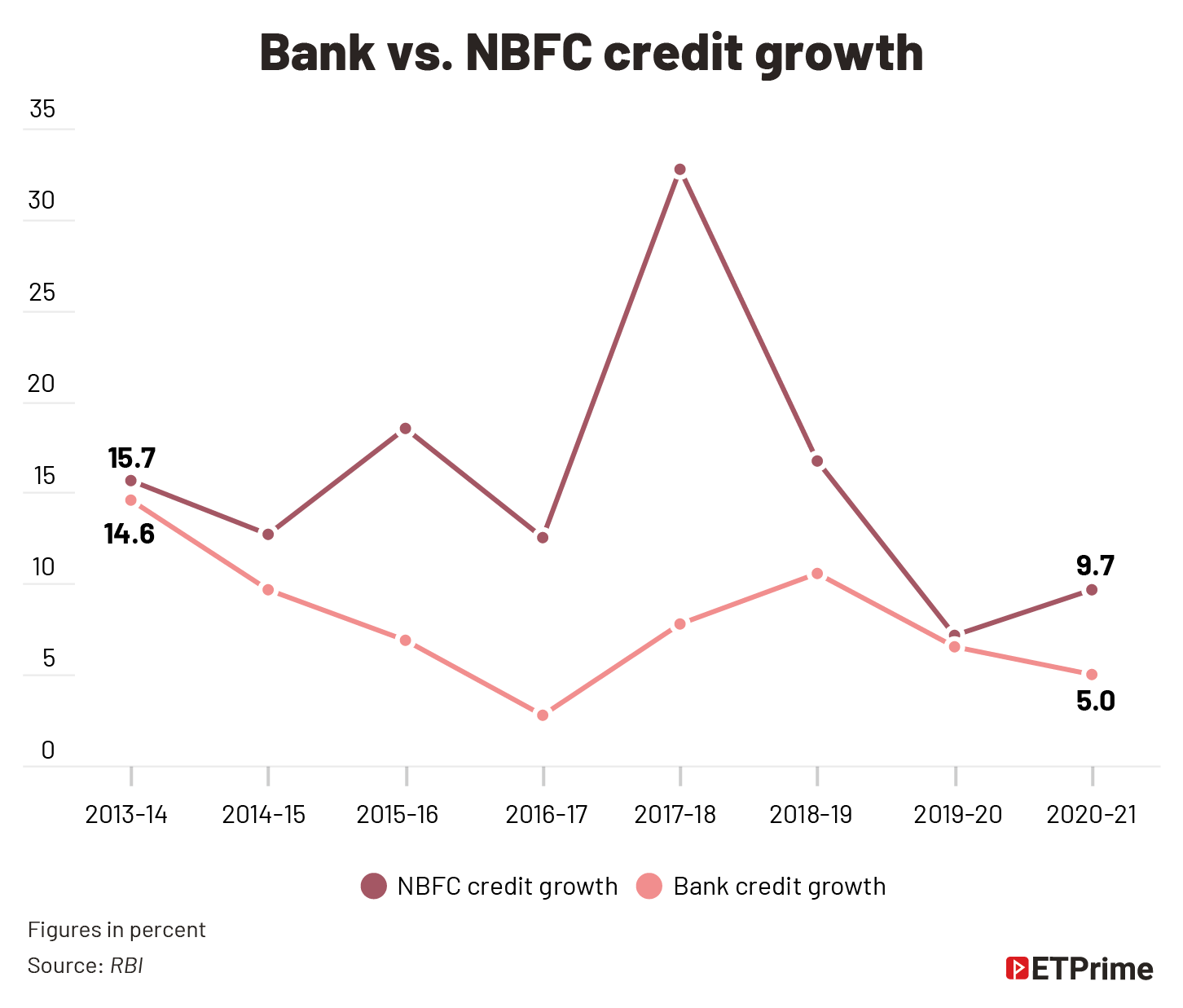

According to Crisil, a rating agency, assets under management (AUM) of non-banking financial companies (NBFCs) are set to grow 8%-10% in the next fiscal. They are riding on two tailwinds — improving economic activity and strengthened balance-sheet buffers. That compares with an estimated growth of 6%-8% this fiscal and 2% last fiscal.

Crisil, however, points out that NBFCs are facing three headwinds. First is intensifying competition from banks that, flush with liquidity, have sharpened their focus on retail loans. Second, gross non-performing assets (GNPAs) are expected to increase, mostly because of the revision in recognition norms and, to some extent, due to slippages from the restructured books. And third, funding access is yet to fully normalise for some of the players.

What this also means is that overall fragile assets (GNPAs plus slippages due to the impact of regulatory norms and from the restructured books) are seen at INR1.3 lakh crore-INR.6 lakh crore, tantamount to 5%-6% of the industry’s AUM as of March 2022.

While there is demand — people are desperate to borrow — there are more lenders in the market to satisfy the need of the average borrower. All this lending frenzy reminds one of a child whose fascination for a specific toy gets over and shifts to another one. Today, the fancy seems to be in doing something that would shore up revenues or showcase the potentiality of a business that can give short-term lofty valuations.

By far, lending seems to be the newest flavour of the season. Call it by any category or name: BNPL (buy now pay later/ peer-to-peer/pay day. When was the last time one heard of personal loans, car loans, SME loans, etc.? Is this reflective of a change in generational attitude in favour of digital natives?

A paradigm shift

Lending, over time, has seen troughs, plateaus, and peaks in disbursement volumes. Similar, but disproportionate, has been the behaviour in NPAs, too. Those cyclic shocks of loans going bad create overall stress in the credit-disbursement cycle.

In India, we have seen this cycle to be steep, forgetting the fact that every debt has a price and risk-premium associated. Instead, market sentiment buckets every similar debt as not-to-be-touched. We have also seen cycles when banks become disbursement-averse and face pressure to bring in additional capital. This is the time when non-banks take charge of the consumption mood. With non-bank slowdown and the gloomy debt markets as they are, digital lenders (armed with capital and in a listening mode to understand consumer needs) have developed newer lending products.

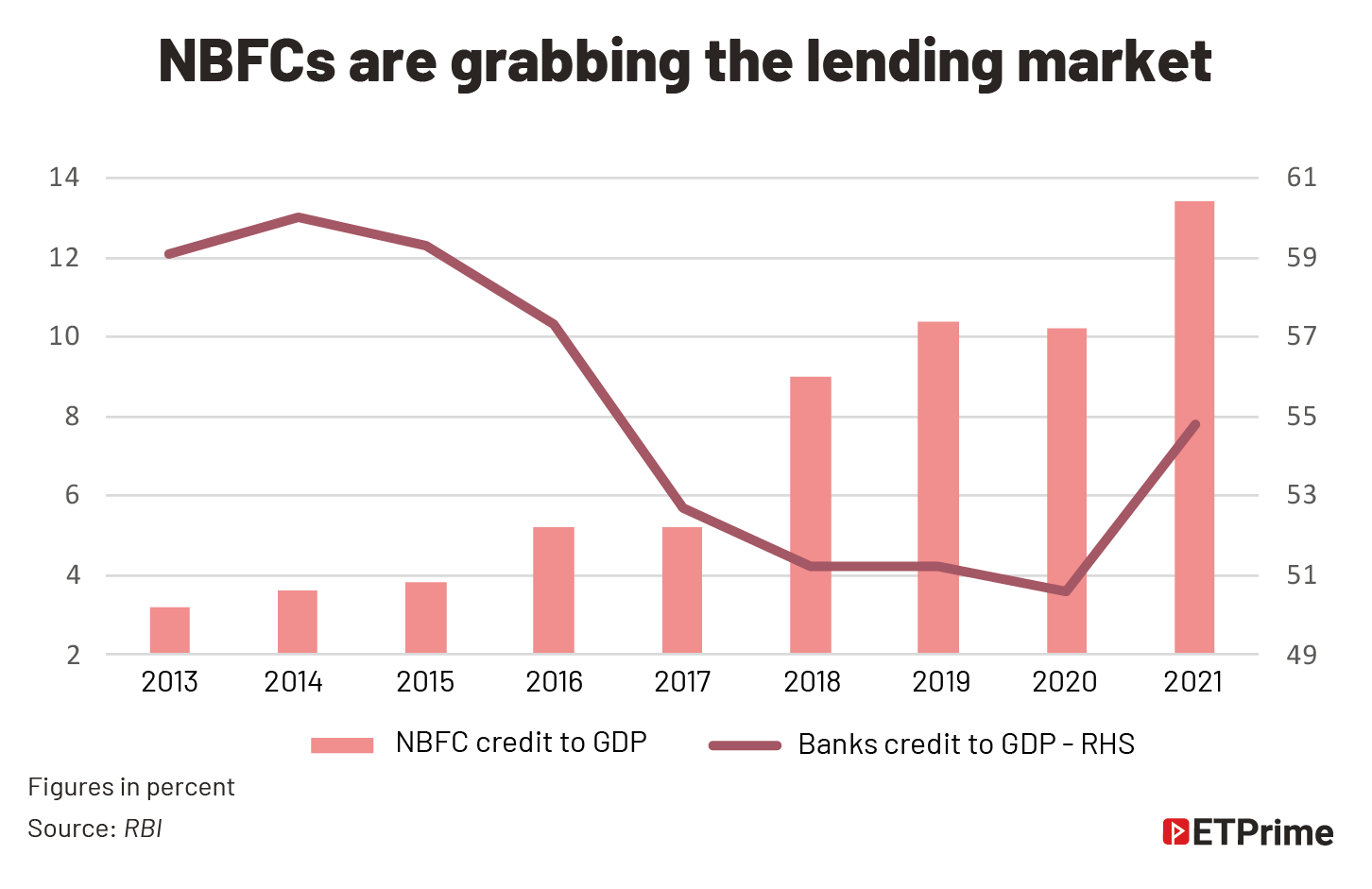

RBI data shows NBFCs’ credit intensity measured by the credit-to-GDP ratio has been consistently rising. In 2021 it was at a high of 13.7%. In 2013, the same was at 8.6%. On the other hand, commercial banks have seen the same ratio fall from 59% in 2013 to 55% in 2021.

This brings up some key questions: Are banks giving up their space in lending? Are they losing their understanding of what the market wants? Is lending becoming a popular business, with a societal shift where credit is no longer a bad word?

Most stakeholders are rational enough to say that there is space for all types of lenders to coexist, and to further increase the consumption economy. Yet there is a catch: With a shallow debt market and banks lending to non-banks, won’t they compete for the same set of consumers?

When one hears about co-lending models, there is an existential question: In a market where both banks and non-banks compete for the same customer, and where non-banks have the banking system as their major source of funding, isn’t it utopian to expect such co-existential relationships to survive, unless the size and scale of one of the two partners are almost subservient?

Most of the New Age entities are using their equity capital as funding source for lending. With the domestic debt market being shallow, this practice of using capital as a lending source makes those entities both attractive to the consumers (for credit availability) as well as vulnerable to loan-portfolio performance (as NPAs erode capital). But with investors betting on equity capital, that too in large amounts, to change consumer behaviour around credit availability, usage, and personal data sharing to access such credit, no one seems to be complaining yet.

Jargon and cool industry phrases aside, this goes back to the fundamental premise that consumers need financial products for only three basic reasons — borrow for a reason (lending industry); invest surplus funds (investments); or insure their life, property, health, etc. (protection).

The easier way to simply bucket any product sold by the financial services sector is to figure out which is a LIP (lending/investing/protecting) product. In fact, our regulatory system is also based on a similar thinking.

Lending by any bank or non-bank like NBFC, HFC (housing finance company), or MFI (micro-finance institution) is regulated by RBI. Investment products like mutual funds are regulated by Sebi (Securities and Exchange Board of India). Protection products come under insurance sector regulator Irda (Insurance Regulatory and Development Authority). Pension products come under PFRDA (Pension Fund Regulatory and Development Authority) regulations.

And yet, we have everyone who can afford or is allowed to use the words finance, fintech, or neo-bank (technically it’s a grey area, and hopefully the RBI will look into its usage) out there offering loans.

Pricing the risk

Simply put, lending has to be the easiest business theoretically. It’s all about pricing the risk, correctly. And to collect every loan, when it’s due, on time and every time. Practically it has broken many banks and non-banks.

Yet, when you look at the fundraising pitches of most lending entities, the importance of risk management is missing. Just the NPA and provisioning numbers don’t constitute risk measurement. Most pitches speak about consumer onboarding velocity, accelerating the disbursements, and many superlative positive self-glorifying adjectives.

Globally, many successful New Age entities have showcased that their ability to change consumer behaviour with enormous capital deployment over a long period of time could make them pip their competition. Valuations are an outcome of this. But to have the same yardstick applied on much younger startups, and to expect the high valuations to sustain, is like expecting “hope as a strategy”.

Anyone can lend (indiscriminately). Doing the right pricing for each of the consumer segments is critical. Very few lenders talk proactively of their business risks and how they use technology and predictive analytics in their business operations to anticipate any bumps.

When even the first principles of risk management are not practised by lenders, they can’t hide behind the wall preaching that “technology is being used”, “data scientists are being employed”, or “the latest digital tools are available”. Risk management, despite any name given to the type of lending or the entity’s category, needs high discipline and prudence as a culture.

Of course, it is nice to see so many players joining the lending bandwagon. Hopefully, most of them will be in existence to fully collect the lent monies. After all, recovery is the core of the lending business.

(The author is a corporate advisor and an independent markets commentator. He tweets @ssmumbai)

(Graphics by Sadhana Saxena)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.