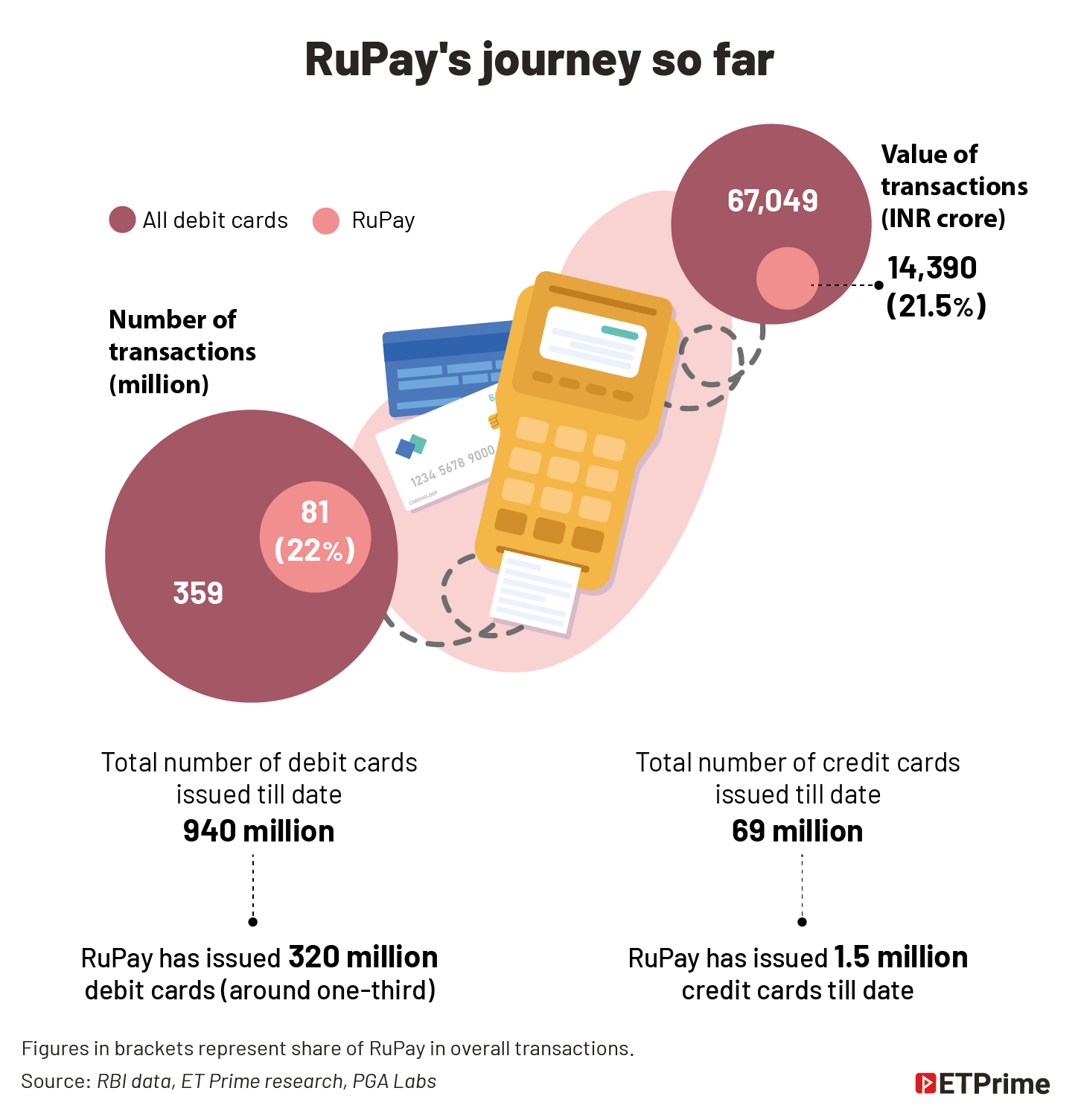

SynopsisNPCI-owned card platform RuPay dominates a third of the debit-card market. NPCI rules the mobile-payment market with UPI. But the credit-card segment will be a tough nut to crack, with the home-grown platform lagging its seasoned American rivals on many counts.

When National Payments Corporation of India (NPCI) launched RuPay in March 2012, the Atmanirbhar theme was loud and clear. The idea was to establish a domestic, open, and multilateral system for a card-payments infrastructure, which was thus far dependent on foreign technology. In the years that followed, public-sector banks (PSBs) were prodded to play along and RuPay debit cards managed to corner 35% market share within a short time.

But now the toughest part of the journey has begun, as RuPay aims to make it big in credit cards. A stronghold of Visa and Mastercard, credit cards will be a tough nut to crack.

RuPay has so far issued over 1.5 million credit cards. This is puny compared with a whopping 69 million credit cards that are in circulation in India. Visa has close to 63% market share, Mastercard has 32%, and American Express 2%-3%. RuPay is expected to close the current financial year with more than 2% market share in value terms. It is looking to double or triple this by the end of next fiscal.

Can RuPay do it?

The answer is hidden in the challenges the home-grown platform faces.

Apart from the backing of PSBs, RuPay debit cards and UPI’s (Unified Payments Interface) growth was fuelled by government policies ensuring zero merchant discount rate (MDR or the commission earned for enabling transactions). Last December, the government announced INR1,300 crore to subsidise RuPay and UPI. The money would be distributed among the banks facilitating these payments. Again, in last week’s Union Budget, the government made its intentions clear that it would continue to support the two in the next financial year as well. Click here to read about how NPCI gained an advantageous position due to policy decisions.

It seemed like a cakewalk for NPCI as UPI dislodged existing payment methods due to its simplicity and ease of use. But in credit cards, where it does not offer any special feature, the narrative could be different.

Challenge #1: scope of incentives, value-adds

In the credit-card system, the card-issuing banks take the cake. A major share of MDR, or the commission for each transaction, goes to them. The bank that deploys the point of sale (PoS) machine (also called the acquirer bank) gets the next best share as it collects money from the customers. A small fee is paid to network companies like Visa, Mastercard, and RuPay. For instance, if the MDR is 2.1% (it could range between 1.5% and 3% in India), the issuer bank takes 1.75%, the acquirer bank gets 0.25%, and the payment network (say Visa) gets 0.1%.

This commission powers credit-card reward points and freebies such as lounge access, etc. For debit cards, the Reserve Bank of India (RBI) caps MDR at 0.9% and hence the margin is less for everyone in the ecosystem.

In the credit-card segment, MDR is driven by market forces and NPCI charges interchange — the commission of card networks — which is on a par with the industry. So, gaining market share in credit cards could be a money-spinner for NPCI, which is why it is eager to capture the market.

Because of the higher share of margin for the issuer banks, they are powerful and, therefore, get incentivised by card networks. These incentives run into high double-digit crores of rupees for each bank. The incentives are passed on to the banks under several heads such as marketing expenses or the cost of launching a new card.

Most of the highly active credit cards in the country are issued by HDFC Bank, ICICI Bank, SBI Cards (a separately listed subsidiary of government-owned State Bank of India), and Axis Bank.

The incentives are also linked to the banks growing the end-customer spending on the network every year, at the same rate as the growth of the overall card payments in the country. So, it becomes difficult for the banks to shift some of their businesses to a new network (RuPay in this case) where the scope and size of the incentives would be much smaller.

“Credit cards have ended up becoming an issuer-led business, with most of the marketing support provided by the payment networks going to the top five issuers. NPCI tried to support the network by reducing the charges that it recovers from the interchange, but that doesn’t really move the needle. Had the sharing of interchange between issuer and acquirer been more equitable, it could have reduced the gap between NPCI and the global payment networks. It is not easy to displace incumbents such as Visa and Mastercard, which are not just well-entrenched, but also have deep pockets,” says Shishir Mankad, head of financial services at consulting firm Praxis Global Alliance.

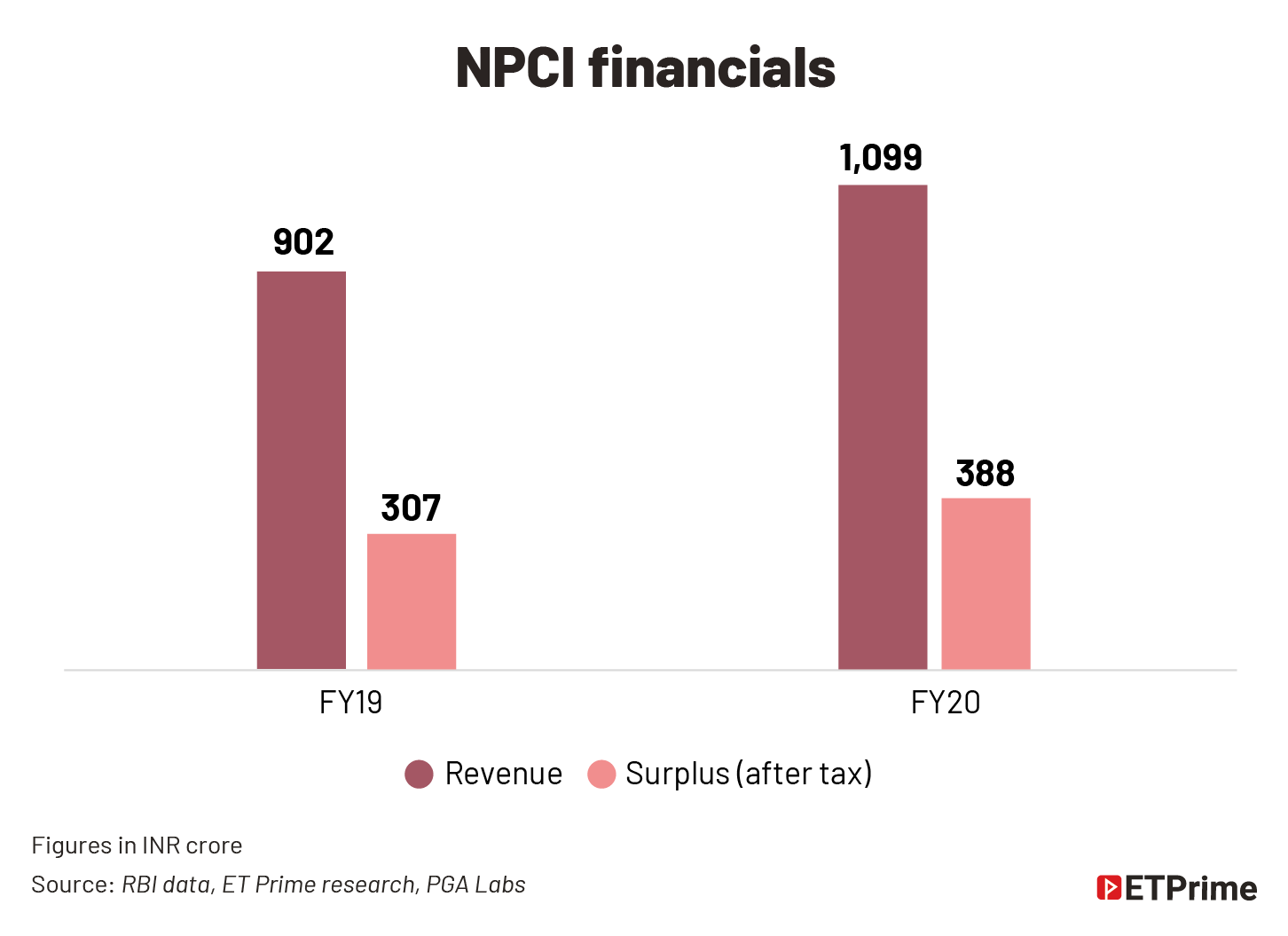

While NPCI cannot match the might of Visa or Mastercard, it does have decent profits that can be invested to grow the credit-card business. It had reported a surplus of INR388 crore and INR307 crore during FY20 and FY19, respectively, indicating that it can match the incentives once banks come on board. However, NPCI might have been under financial pressure over the last two financial years owing to the explosive growth of UPI and RuPay debit cards. Its financials for the last couple of financial years are not available.

“It is a function of the overall deal that a bank does with the network and what additional value-adds a new network brings to the table. It could be offers, interchange, incentives, analytical inputs, or market intelligence, among other things,” says the card-division head at a large private-sector bank. Experts believe that owing to RuPay’s current low market share, it struggles to compete with the American giants on these counts.

Challenge #2: brand perception

Used by less than 5% of the population, credit cards have an aspirational value in India. One of the biggest challenges that RuPay faces is that it is considered as a card used by poor people.

Despite the RBI banning Mastercard and American Express from issuing new credit cards, most banks did not choose RuPay. They rather decided to go with Visa. “RuPay has the image of a poor man’s card because of massive debit-card issues by public-sector banks. It is not considered as a premium product and is not a good positioning for us while building a new brand,” says the founder of one of the new credit-card companies.

To be sure, over the last couple of years several new non-bank private credit-card companies such as Uni, Slice, and OneCard have emerged. Unlike issuer banks, these companies don’t get any incentives. Still, they have preferred not to use RuPay.

During the last year or so, ICICI Bank and Axis Bank together issued around 50% of all credit cards, partly because of RBI’s ban on HDFC Bank from issuing new credit cards. But these two banks had not integrated the RuPay credit-card system. Industry estimates say NPCI can grow its market share only once these banks are onboarded by RuPay, which will likely happen this year.

Challenge #3: international acceptance and experience

The Achilles heel for RuPay and its ambitions to grow in the credit-card segment would be its lack of wider acceptance in foreign countries. RuPay’s tie-ups are restricted to Discover, Diners Club, JCB (Japan), and Union Pay (China) terminals that have limited reach compared to Visa and Mastercard, which have universal acceptance around the world.

Most users in India would prefer a credit card that is accepted across the globe even if they don’t have an immediate plan to travel abroad. Of the total credit-card spend annually, only around 3% is spent overseas. Most Indians travel overseas for leisure once in a few years. According to major private banks, international acceptance is one of the most sought-after requirements for credit-card customers, which makes the issuing banks wary of giving out RuPay credit cards.

Fraud detection and risk management is another area where industry executives believe Visa and Mastercard might score better. They have years of data and experience. RuPay lags on this count.

“There is also a fear that the government will someday reduce or cancel MDR on RuPay Credit Cards, similar to what was done to RuPay debit cards and UPI. This will make RuPay credit cards a loss-making proposition for banks,” says an industry observer, seeking anonymity.

NPCI wants to overcome the challenges mentioned above and become a force to reckon within the credit-card space.

“It is not easy to displace incumbents such as Visa and Mastercard, which are not just well-entrenched, but also have deep pockets.”

— Shishir Mankad, head of financial services, Praxis Global Alliance

The bet on co-branded cards

When it comes to spending money on giving rewards or cashbacks, Visa and Mastercard hardly indulge in any direct offers through banks. When there are card-related offers on platforms such as Amazon, Flipkart, Reliance Retail, or Croma, they are often sponsored by banks such as HDFC, ICICI, SBI, and Axis on their Visa or Mastercard networks. But in the case of RuPay, most of the offers on e-commerce platforms are initiated by NPCI or the card network, not the banks.

Launching co-branded credit cards is one of RuPay’s key focus areas. NPCI is banking on large PSU corporates to bolster its credit-card portfolio. It had launched co-branded credit cards with IRCTC and oil-marketing companies such as IOC and BPCL. Last week, it launched a credit card in partnership with Patanjali. Given the latter’s reach through retail outlets, RuPay could see a sizeable market share gain. It is also matching Visa, Mastercard, and American Express in terms of premium offers like lounge access and golf-course memberships.

Co-branded cards have become extremely important for growing the credit-card market in India. Almost 50% of new credit cards issued by ICICI Bank in the last three years were the Amazon Pay ICICI co-branded ones. For Axis Bank, the co-branded credit card with Flipkart accounted for almost 35% of the total cards issued by it since the launch.

“NPCI has done well in terms of trying to support member banks by reaching out to merchants and corporates to pitch their products. This could give them an edge at least for new products that they launch,” says Mankad.

But above all, RuPay has the blessings of the policymakers.

“With the kind of support [from the government], it is quite likely that it (RuPay) might achieve those targets [to double or triple its market share]. Most of the cards issued are co-branded cards with government brands like oil companies and IRCTC. It (NPCI) has a new CEO focusing on growing international presence in regions like south-east Asia and the Middle East and North Africa (MENA),” says the banker quoted earlier.

But does credit card as a segment deserve all the toil?

The future of swipe

While credit cards are not going away any time soon, emerging payment paradigms such as the instant mobile-payment systems being developed across the world could change payment behaviour. In India, UPI is increasingly eating up market share even from credit cards. It is, however, not as much as to replace debit-card payments and ATM withdrawals. In several parts of Asia, mobile wallets have partly replaced card payments.

The only country where Visa and Mastercard have been dislodged is China. But the move was driven by the government. Similarly, South Korea, Japan, Brazil, Singapore, Russia, and Indonesia have developed or are developing local payment networks to challenge Visa and Mastercard.

However, the larger threat to card networks is the seismic shift in consumer behaviour. The emergence of buy now pay later (BNPL) is challenging the credit-card market as the primary form of debt for monthly small-ticket customer purchases, wherein a card transaction is not necessarily involved. Even when a card transaction is involved in a BNPL scheme, if it is a debit card, the transaction-facilitation commission is much lower compared to credit cards.

Another emerging threat to card-technology platforms is cryptocurrencies and central bank digital currencies. In the Union Budget last week, the government had announced the launch of digital rupee in the next financial year. Some of these transactions will pass through a blockchain channel or a settlement platform such as UPI, IMPS, or NEFT, bypassing card networks for domestic as well as international transfers.

(Graphics by Sadhana Saxena)

(Originally published on Feb 8, 2022, 12:01 AM IST)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.