SynopsisAccording to data from the Ministry of Housing and Urban Affairs, RERA authorities across states have disposed of 82,750 complaints since the Act came into force in May 2017. These include several rulings in favour of homebuyers and errant builders being directed to toe the line.

Booking a flat in an under-construction project can be a minefield for homebuyers. The introduction of RERA in 2016 was thus celebrated as a gamechanger. Nearly five years on, the law has taken big strides. According to data from the Ministry of Housing and Urban Affairs, RERA authorities across states have disposed of 82,750 complaints since the Act came into force in May 2017. These include several rulings in favour of homebuyers and errant builders being directed to toe the line. However, developers continue to play foul. RERA is coming up short in giving relief to homebuyers. What ails the legislation?

Lack of enforcement

Fifty one-year-old Noida based homebuyer Avinash Gupta got a favourable verdict under RERA in mid 2020. Accordingly, the builder who had promised possession to Gupta in 2017 but abruptly stopped work on the project, was asked to refund the money. When the builder did not oblige, Gupta approached the authority again and got a Recovery Certificate issued against the builder in October 2020. However, Gupta is yet to get his dues and continues to fork out a monthly EMI of Rs 33,000 towards the home loan. Many other homebuyers remain in the dark, still waiting to get possession of the booked apartment or refund of money.

Experts say the biggest gripe with RERA is a weak enforcement mechanism, which makes it a toothless law. Homebuyers who have got judgments passed in their favour are not able to get the orders implemented.

Harsh Parikh, Partner, Khaitan & Co, says, “It is not so straightforward that once an order is passed in your favour, you will get the refund or possession.” In cases where developers are being fined and asked to pay compensation to homebuyers, there isn’t much actual disbursal happening. Instead, the appeal option is being used to further delay matters, observes Prashant Thakur, Director & Head Research, ANAROCK Group.

While the apex court has now mandated that such developers must at least deposit 25% of the total fined amount despite the appeal, there are other cases (such as related to construction quality) that continue to have loopholes. “The need of the hour is not just disposing cases and passing judgements but also focusing on actual on-ground implementation of judgments,” Thakur says. On paper, there are strict provisions for non-compliance with RERA orders. Section 63 of the RERA Act provides for levy of penalty for each day that the builder fails to comply or acts in contravention of the order. This penalty may cumulatively extend up to 5% of the estimated cost of the entire project. But this is not how it transpires in reality.

“Builders continue to have the upper hand despite enacted law, as execution machinery in many states is practically non-existent,” laments advocate Vinod Sampat, Founder and President, Cooperative Societies and Resident Users Association. If the developer refuses to comply, aggrieved homebuyers are forced to go to civil courts to get the decree enforced. There are instances where homebuyers are yet to receive final judgments years after filing a complaint against the errant builders, despite multiple hearings. “Builders are not afraid as they can keep getting court hearings prolonged, giving them enough time to pressurise the buyers,” Sampat adds.

RERA authorities are also accused of taking longer time to dispose of a case than what provisions allow. In December 2017, 41-year-old Ashish Sardana, a resident of Gurgaon, approached the local RERA court for relief in relation to his booked flat in a delayed project that did not have the requisite title clearance and approvals. The matter was subsequently investigated by the authority and its report in 2019 even concluded that the construction was illegal. Yet, no order has been passed in the matter. “Equitable justice is still a pipe dream when a builder can forfeit amount equivalent to 10% of the value of property if it wins the case but home buyer doesn’t get any compensation,” laments Sardana.

What is more concerning is that some RERA authorities often push aggrieved homebuyers to get differences resolved mutually with the builder via a conciliation forum. Buyers complain that a builder cannot be expected to obey any conciliation forum order unless it is in line with what the builder wants. Instead, pressure tactics are employed to get the buyers to come to a settlement. They are actively discouraged from taking grievances to court. So it can be surmised that a conciliation forum is just a place where the homebuyer is forced to toe the builder’s line, remarks Abhay Upadhyay, a member of the RERA central advisory council under the housing ministry.

Gaps in law

RERA contains several stringent provisions to deter builder malpractices like diversion of funds towards other projects or businesses, alteration in plans, leaving project unfinished etc. Yet there are several gaps within prevailing law that allow builders to work around existing provisions. For instance, while RERA provides for strict adherence to delivery timelines, developers find convenient routes to escape falling foul of existing provisions. “The execution timeline itself is left to the discretion of the developer,” observes Parikh. So a builder can indicate project completion several years in the future. This way he gets more than enough breathing space to finish the construction before he is legally required to hand over possession.

At times, builders offer possession to the buyer within a stipulated timeframe after procuring a occupancy certificate. When the buyer moves in, he finds that his allotted unit is ready but the common areas and project-related amenities are far from complete. Upadhyay says, “Builders are able to get the OC and hand over possession of the unit to the buyer. But then they leave the rest of the project in an unfinished state.”

The law is helpless in giving relief to homebuyers in cases where the project is stuck due to delay in securing various clearances from local authorities. Builders are able to get off the hook simply by pointing to the bureaucratic red tape. Parikh remarks, “The law doesn’t put any onus on authorities to grant timely approvals.” At times, final approvals get delayed as the builder violates norms or deviates from original plans. But the law fails to make this distinction to put the responsibility at the builder’s doorstep.

“Dilution of penalty provisions by providing for compounding of offences and unreasonable delay in grant of statutory approvals due to or without any fault of the developer considerably weakens the effect of RERA,” argues Ashoo Gupta, Partner, Shardul Amarchand Mangaldas & Co. The law also does not have any provisions barring an errant developer from starting new projects till work at the delayed project is finished. It is another matter that the RERA rules have been watered down in many states for the benefit of developers.

Further, the force-majeure clause in the buyer-builder agreement offers a convenient way out for builders to delay completion of project. Under this clause, the promoter cannot be faulted for delay in delivery of possession, if such delay is caused by any reason beyond his control. Many developers have sought reprieve under the garb of covid-induced lockdowns. RERA authorities in multiple states gave blanket extensions of up to a year despite resumption of normal activity. Thakur reiterates, “After the second wave, some developers delayed their projects by three to six months even though the state government-imposed construction restrictions lasted just 14-15 days. Labour shortage or supply disruptions can be genuine reasons in some cases, but these reasons have been over-stretched in many instances.”

Another lacuna in laws is in respect to lack of a uniform builder-buyer agreement. This is a document which spells out terms and conditions of the transaction, specifying rights and obligations of both buyer and the builder.

“Absence of an uniform model form for agreements leads to agreements continuing to be tilted heavily in favour of developers which has become a prevalent practice,” asserts Gupta. The Supreme Court recently asked the central government to draft a model agreement that states can adopt to protect the flat buyers from remaining at the mercy of the realtors.

How builders mislead

Builders often entice prospective buyers with lofty promises of living in the lap of comfort and luxury, with a slew of amenities at their disposal. Glossy brochures showing enticing artist impressions and lavishly decorated sample flats reel in buyers. But the finished product often makes for a sobering view. To be sure, RERA captures this aspect in its purview. Parikh asserts, “RERA provides that any representations made in any manner, whether in the form of a brochure or sample flat, the developer has to deliver.” So complaints regarding false promotions have declined. However, the quality of work is often poor. Unless there is a glaring defect, the law will not come into play. The Act only provides that the developer must rectify any structural defect or workmanship defect for a period of five years from the date of handing over of possession to the buyer. Often, defects like seepage do not immediately come to the fore.

At times, developers get sanctions only for part of the project but continue to sell other units for which approvals are pending. For instance, a 30-storey tower in a project may have got approval only up to the twentieth floor. This puts the buyers in upper floors at risk. Thankfully, builders can no longer unilaterally alter sanctioned plans or layouts. RERA stipulates that any change either to the building plan, design or the layout of the property can only be undertaken with the approval of two-thirds of the buyers in the project, points out Gupta.

Another grey area exploited by developers is in the payment plans. The popular construction-linked payment schedule offered by builders seeks regular instalments from the buyer at various stages of completion of the project. Often, such payment demands are made without actual completion of all related work and is based on certification issued by a builder-appointed agency. Buyers end up paying the entire money even as actual construction lags far behind. Similarly, carpet area of the flat finally handed over by the builder is also certified by their own architect. The actual measurements may turn out to be very different. With RERA authorities also not keen to step in and take proactive action against obvious builder malpractices, buyers are left to fend for themselves.

Limited disclosures

Experts also point out how RERA has offered homebuyers little by way of transparency. Homebuyers still do not have access to all details about a particular project or builder that they can rely upon. Ritesh Mehta, Senior Director, Head -West, Residential Services & Developer Initiatives, India, JLL, observes, “While RERA took care of the delivery and fulfilment of the commitments made, the clarity on financial closures is still not there.” He insists RERA does not capture financial stability of a builder that can indicate the firm’s credibility in terms of project completion. Further, a proper background verification of the developer should be given on the website with total square feet delivered beforehand to understand the profile of the developer well before making a purchase decision, Mehta insists.

Neha Gupta, Principal Associate, Athena Legal, points out that homebuyers are also kept in the dark after the purchase, with no means for tracking progress of ongoing project work. Substantial number of developers refrain from opting for title insurance citing unavailability of insurance providers, points out Ashoo Gupta. Title litigations and absence of insurance adversely impacts timely completion of projects, leading to stalling of the projects and ultimately affecting the homebuyers

What homebuyers should do

Homebuyers clearly still need to be on their guard when buying under-construction flats. Do not be under the impression that a RERA registered project is free of problems. It is vital that you do the basic due diligence like checking title, ongoing litigations, approved plans and layouts, proposed date of delivery of possession, carpet area, etc. Check if the particular wing and floor that you are interested in has got requisite sanction. Homebuyers should also carefully read the builder-buyer agreement especially for provisions regarding change in building plan or layout and not agree to the same unless undertaken by the developer only with prior written consent of two-third of homebuyers, insists Gupta. Thakur asserts that homebuyers must check the contract for leeway offered to the builder in case of a delay in situations like pandemic-related lockdowns. Further, check for any restrictive exit clauses in the agreement that limits your freedom to sell the property for a certain time frame or when construction work is ongoing.

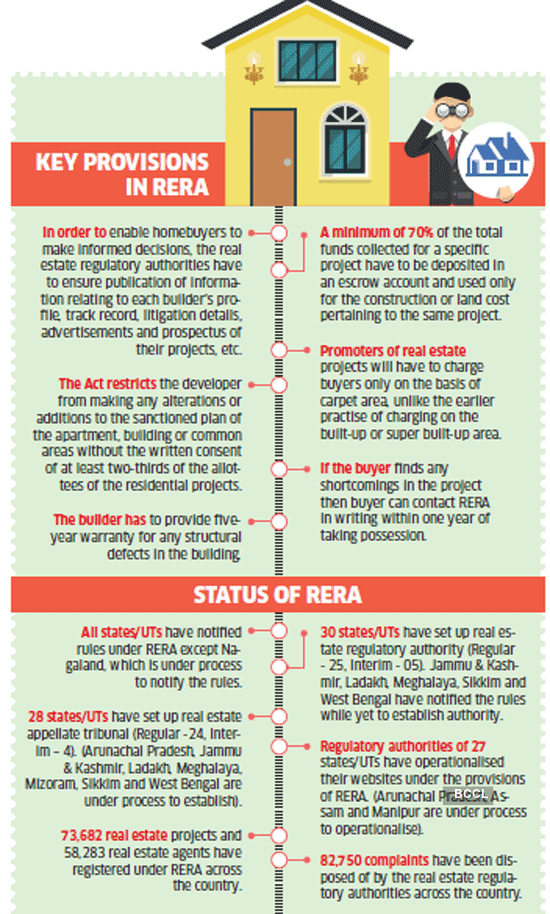

Key Provisions in RERA

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now