SynopsisThe spat between the Kotak group and the BharatPe founder over the Nykaa IPO point to some seamy aspects of IPO financing for HNIs. Though regulators are conscious of the excesses, they seem to be wary of rocking the boat before the jumbo LIC IPO.

On the day of listing of One97 Communications in November, Ashneer Grover was seen bashing the aggressive pricing strategy of Paytm’s parent on business channels. The fintech giant, which had raised over INR18,000 crore in one of India’s largest initial public offerings, had tanked on listing day.

Grover’s overt criticism of a rival was a tad unusual in the big boys’ club of the listed universe. His startup BharatPe competed with One97’s Paytm in several areas and was on the lookout to become a bank in partnership with Centrum.

What did not get much attention at the time was Grover’s penchant to dabble in the IPO markets as an investor. His overtures, though, did not go without repercussions.

A couple of months later, on the eve of the broadcast of reality show Shark Tank India, where Grover is one of the judges, an audio in which Grover was heard swearing to kill a Kotak Mahindra Group employee got leaked.

Though Grover initially rubbished it as a handiwork of social-media pranksters, statements put out by Kotak Group confirmed such an interaction and exchange of legal notices between the lawyers of both sides.

Copies of the legal notices reviewed by ET Prime not only showed Grover’s track record of dabbling in several recent IPOs, but also brought to fore the underbelly of INR90,000 crore IPO-financing industry.

Nykaa IPO

The dispute arose in one of the most talked-about and successful public issues of last year — FSN Ecommerce, the parent of beauty e-tailer Nykaa. Grover and his wife wanted to put in bids for an eye-popping INR500 crore. These numbers are not small even for a person of Grover’s profile.

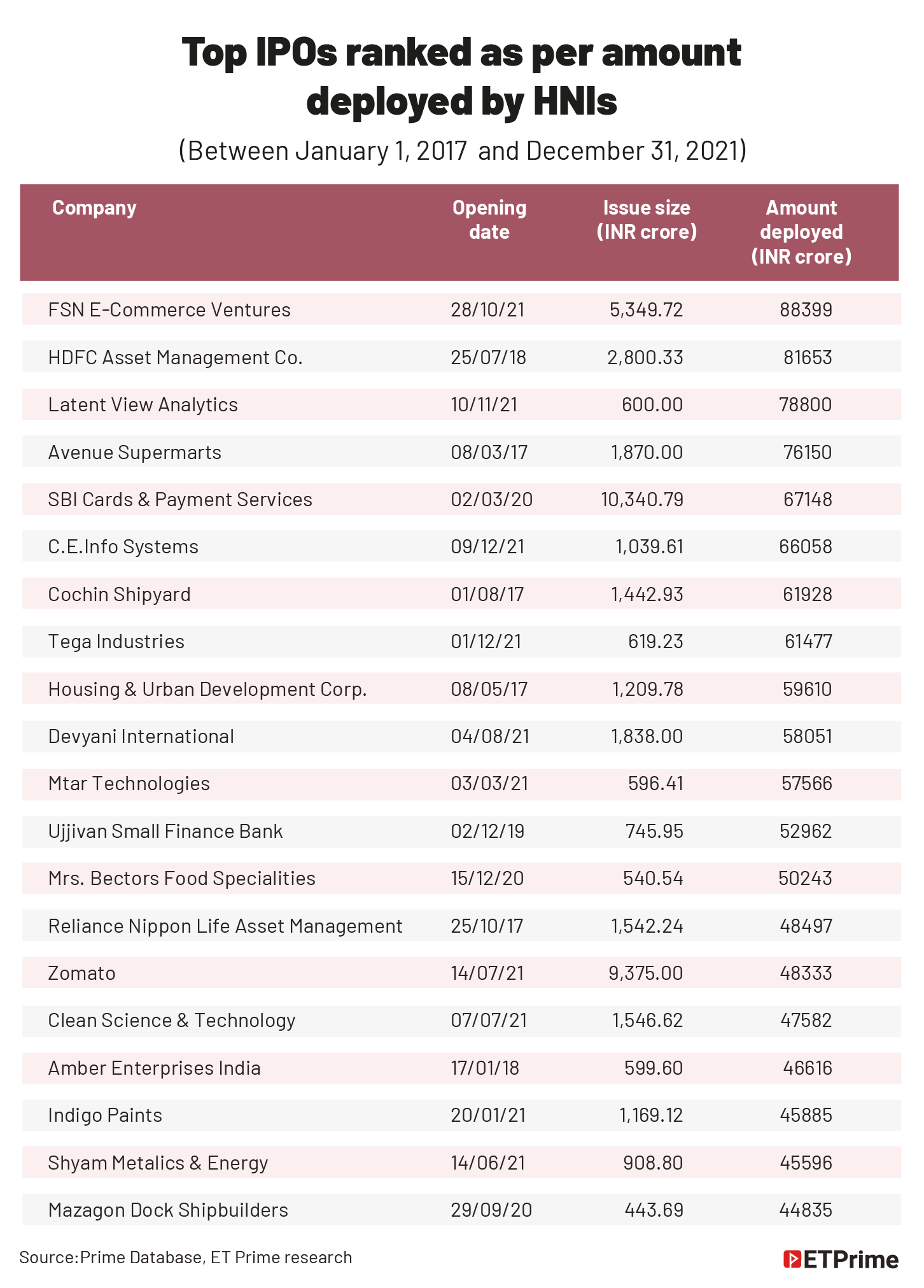

The IPO of FSN Ecommerce was a landmark in more ways than one. As far as the IPO financing market was concerned, it made a record for funds deployed in the HNI portion, with subscriptions topping INR88,000 crore.

According to an analysis of data provided by Primedatabase.com, this was the highest in the last five years and much higher than the INR81,000 crore seen by HDFC Asset Management Company in 2018 and INR76,150 crore recorded by Avenue Supermarts, DMart’s parent, a year before that.

High net worth investors (HNI) or non-institutional investors (NII) have 15% of an issue earmarked for them. These investors are not defined by their net worth or capacity to invest but by the amount of their subscriptions. A subscription worth INR2 lakh or more is classified as one under the NII category.

Unlike the retail category, share allotments are made through a lottery system when there is an oversubscription in the HNI category, the allotments being pro-rata or proportionate. This means the higher the subscription, the higher the chances of allocation. This is where financiers who lend for the short term have stepped in.

“At the time of the Nykaa public issue, there was an IPO almost every day of the week. In such a situation, the pricing power of an NBFC goes up. It would say, ‘here is my rate, take it or leave it’.”

— Arun Kejriwal, founder, Kejriwal Research and Investment ServicesThus, in the INR5,300 crore IPO of FSN, about INR800 crore was reserved for HNIs. The portion was oversubscribed 110.16 times, sucking out INR88,000 crore worth of funds from the market. This unprecedented demand and the following spike in the rates must have led to the dispute, say people who watch the IPO market closely.

Big boys’ game of IPO financing

Select players in the market, who have captive non-banking finance companies (NBFC), dominate the IPO-financing space. Being a deposit-taking NBFC, Bajaj Finance has low cost of funds, and is said to be the leader in this business, with a book of about INR15,000 crore. It is followed by Kotak, IIFL, and Motilal Oswal, which have large broking operations and wealth-management businesses. Incred Capital and Tata Capital have also stepped up their game in this market in recent times.

“Together, these players were comfortably absorbing a demand of INR60,000 crore-INR65,000 crore. For these NBFCs, these were risk-free short-term opportunities,” says a distribution head of a listed securities firm. “We lend only to people who have sufficient net worth. Once the shares are allotted, the funds come back to us in a week’s time. Market rates hover around 7.5%.”

But trouble came when several issues opened close to each other in October. The Nykaa issue, which opened on October 28, was followed by the INR1,200 crore Fino Payments issue the next day, and INR5,700 crore PB Fintech (parent of PolicyBazaar.com) on November 1. Sigachi Industries (INR125 crore) and SJS Enterprises (INR800 crore) also opened on November 1.

This pushed up the interest rates.

“New-tech platforms (like Zomato, Nykaa, Policy Bazaar) that came to the market made the NBFCs greedy. The rate of interest shot up from 7% to 10%-11% suddenly. As an NBFC, I am only doing inward-outward work – borrowing from someone and lending it. They are trying to earn a higher spread by looking at the demand,” says Arun Kejriwal, who heads an eponymous research firm that specialises in primary markets.

Kejriwal says the problem in this particular issue (Nykaa IPO) was also similar — as the demand for the issue went up, spreads also went up. “At the time of the Nykaa issue, there was an IPO almost every day of the week. In such a situation, the pricing power of the NBFC goes up. It would say, ‘here is my rate, take it or leave it’.”

Grover’s grouse was that he had planned to put in a margin of INR20 crore and take a loan of INR500 crore (INR250 crore each for himself and wife), but could not participate because Kotak went back on its promise at the last moment, citing “erratic FII movements” and “very high lending rates”.

Going by HNI bids for the Nykaa IPO, the Grovers’ INR500 crore bid would have fetched an allotment of about INR4.5 crore worth Nykaa shares.

A back-of-the-envelope calculation shows that even with interest rates as high as 15% (double of the usual rates), the Grovers would have walked home with a gain of around INR3 crore, since the Nykaa stock doubled on listing.

But that is in hindsight. For some reason, the warring parties were not on the same page leading to the last-minute withdrawal of the offer.

Was there someone more important vying for the same funds?

Links to the grey market

Market participants agree that funding happens rampantly in the HNI space and leveraged applications such as these are by design speculative. “These funds come with a cost and require that you have to square off on listing day. Question is not borrowing per se. But the amount of borrowing. At present, a single application runs into hundreds of crores and such applications crowd out the genuine investors,” says a member of a primary-market advisory committee of a market regulator.

A glance at the stocks that debuted in the week of Nykaa’s debut tells its own story. Of these, only Sigachi managed heavy oversubscription (163 times) in the HNI category. It also had a bumper listing, with the stock gaining 270% on listing day.

SJS Enterprises (1.82 times HNI bids) and Fino Payments (0.15 times) both ended the listing day with losses of around five percent. PB Fintech, which gathered HNI bids of around eight times, listed with a 22.7% premium.

With IPO markets remaining buoyant for over two years now, there are urban legends of how a Kandivali-based investor has now earned enough to scout for an apartment in upmarket Bandra.

But even in a one-sided market where stock prices have gone up consistently over the last couple of years, investing in IPOs is not without its risks. “There have been issues which are oversubscribed but have bombed in the listing day and vice versa. Ideally this should not happen because oversubscription means a lot of demand for the issue. This shows there are factors unseen at play,” says an IPO-market veteran.

For example, the CarTrade IPO which Grover mentioned in his legal notice was oversubscribed 39.83 times in the HNI portion and about 14 times overall. Yet, it ended the listing day with 7.3% losses.

Another recent issue which did not match the hype was that of RateGain Travel Technologies. As against HNI subscriptions of 41 times, the stock tanked 19.88% on listing. Tega Industries, an INR600 crore issue, saw oversubscriptions of over 661 times for HNI portion. It returned listing day gains of 60%.

Even in a highly successful issue such as Nykaa, the leveraged players might not have made outsized returns because of the high funding costs, says Kejriwal. “In many of these issues, funding cost was higher than listing gains.”

This is where the grey market comes in. People taking these large bets try to hedge their exposures with the grey market. Market participants say select brokers in Ahmedabad, Jamnagar, Rajkot and even in Mumbai and Delhi offer unofficial buy-sell rates for IPOs currently open.

HNIs who take these leveraged bets try to hedge them by squaring these off with the grey-market players. This is the reason for the huge amount of delivery trades on the listing day. The price discovered at the opening bell on listing day is used to net off the trades in the grey market.

Market players say that the entire game is skewed in the favour of the lending institutions that set the rules of the game. They are able to dictate the margins, interest rates, and choose who they lend to. “We don’t lend to everyone. We limit it to our top 100 clients. If the AUM (assets under management) is less than INR25 crore, we don’t touch them,” says the distribution head quoted earlier.

Recently, one of the larger financing players put a condition that the borrower has to pay the brokerage he would incur on listing day for selling the allotted shares to be paid upfront as a condition for lending. But demand for such funding remains high.

Regulatory concerns

In October, Sebi put out a consultation paper expressing these concerns.

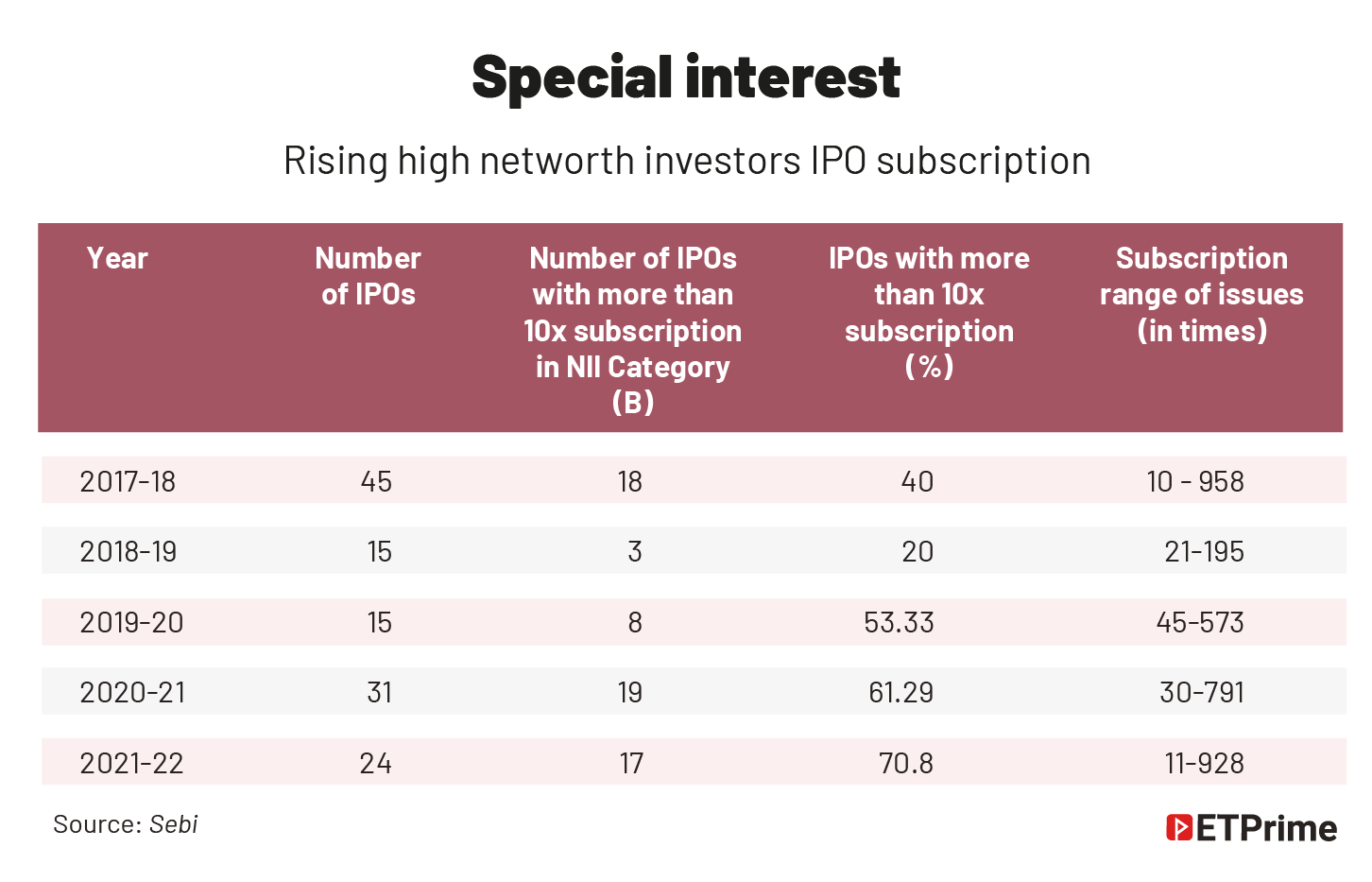

According to data put out by the regulator, the number of issues where oversubscription was more than 10 times was going up. From 40% in 2017-18, this number had shot up to 70% of the issues.

“It is observed that a few large NIIs are able to crowd out smaller NIIs for allotment in an IPO. In the NII category, the proportional allocation creates incentives to make applications of higher bid amounts in this category. Thus, applicants in the NII category are reportedly leveraging for making applications of higher bid amounts, which results in higher oversubscription in the NII category,” the regulator said in its paper, adding that the higher bids also have the effect of crowding out the lower bids in the NII category.

Sebi also observed that the range of oversubscription in the NII category, (for IPOs having more than 10x subscription) was also increasing consistently from the maximum of 195 times of the NII category, in FY18-FY19 to a maximum of 928 times of the NII category in FY21.

Further, from an analysis of oversubscribed IPOs, it was observed that in 29 IPOs, around 60% of the applicants in the NII category on average did not get any allotment. In a few cases, applications for as large as INR75 lakh were also unable to get allotment.

Sebi recommended that one-third of the allocation earmarked for NIIs shall be for application sizes from above INR2 lakh to INR10 lakh. Two-third shall be for applications above INR10 lakh. The discussion paper threw open the question on the methodology to be followed for such allocations.

Waiting for the LIC IPO?

In December, Sebi’s board meeting cleared the proposal to split the HNI portion into two. The press release also mentioned a lottery system would be adopted.

Kejriwal feels the lottery system could be introduced for the smaller HNIs, but those above INR10 lakh could still be allotted on a proportionate basis.

But there is a fear among merchant bankers that even these could be moved to the lottery system. Sebi is yet to come out with a notification that will give clarity on these matters. The date on which the new rules will take effect is unclear.

RBI, in the meantime, has announced that IPO financing will be limited to a maximum of INR1 crore per applicant. Some investment bankers feel this could curb speculative bets to a great extent.

“If we can usher in a long-term investment culture, moving away from short-term listing gains, it would be a big boon for the market and we would witness immense wealth creation for investors at large,” says Mahavir Lunawat, founder of mid-market investment-banking group, Pantomath Capital.

However, it is no secret that some issuers and merchant bankers believe these leveraged bets and the frenzy in the HNI category influence price discovery and help companies achieve targeted valuations.

With the government looking to get a bang for its buck at the mammoth IPO of Life Insurance Corporation of India, none of these reforms is coming in a hurry. While RBI has set a safe date of April 1, 2022, for its INR1 crore rule to take effect, Sebi is yet to come up with the official notification of its plan for HNI category.

Even if these rules are implemented, market players will find their ways to circumvent them, some feel.

“It is difficult to regulate it from one side. Unless there is a unified regulator that has a 360-degree view, there will be ways to circumvent,” says a primary-market advisory committee member. “For example, you can have the INR1 crore rule. But how will you implement it unless you ask the applicant to disclose the source of his money? He can always route funds borrowed for other purposes.”

While regulators mull over it, Grover has to find ways to kiss and make up with his pals from the investment-banking community, of which he was once part, for them to chalk up a stellar listing for his own company’s IPO, if and when he plans to roll it out.

(Graphics by Sadhana Saxena)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.