SynopsisReliance Capital is the seventh ADAG company facing bankruptcy proceedings. At one point, it was the third-largest financial company in India after HDFC and ICICI. So, what caused its fall, and why an early resolution is crucial?

It marked the beginning of one more high-profile insolvency resolution when the National Company Law Tribunal (NCLT) admitted the Reserve Bank of India’s (RBI) plea to initiate bankruptcy proceedings against Reliance Capital on December 6 last year. RBI had superseded Reliance Capital’s board the month before, citing defaults and governance issues. The company owes its creditors over INR23,666 crore, majority of the amount through bonds under the trustee Vistra ITCL India.

While there are many twists and turns that led Reliance Capital to where it is today, the original script started quite differently.

At his first shareholder meeting on August 17, 2005, after the split of Dhirubhai Ambani’s empire between his two sons — Mukesh Ambani and Anil Ambani — the latter, who inherited the financial business, declared that Reliance Capital had become the third-largest financial company in India after HDFC and ICICI.

Soon, all the heads of various businesses — from insurance to lending and mutual fund (MF) to broking — were given targets to become industry leaders, recalls a retired banker. The growth engine pushed Reliance Capital’s stock to a high of INR2,925 on January 10, 2008, valuing the company at INR70,392 crore. This was much higher than HDFC Bank, which was worth INR61,791 crore on that day. But then, the 2008 global financial crisis happened which destroyed all the appreciation in the share price since 2005.

The Reliance Anil Dhirubhai Ambani Group (ADAG) got another shot at growth after Japanese giant Nippon Life, a late entrant into the Indian life-insurance and MF market, bought a 26% stake in the life venture for USD680 million, valuing it at INR11,500 crore in March 2011. It soon bought another 26% in the MF business for INR1,450 crore, valuing it at about INR5,600 crore. Things looked up for the group once again and the annual report for FY12 spoke of evaluating opportunities to set up a bank.

But Anil Ambani’s ambitions were not just limited to the financial sector. He was simultaneously scaling up in half a dozen sectors including power, telecom, media, and infrastructure. Reliance Power, Reliance Communications, and Reliance Infrastructure, companies that were reporting net profit till FY16, began to clock losses in the subsequent years. For instance, for FY18, Reliance Communications, which had total borrowings of INR47,234 crore, reported a net loss of INR23,839 crore. Its sales were at INR4,395 crore, down 42% over the previous year, according to ETIG data.

The fall after the rise

But amid this, it appeared briefly that Reliance Capital might take on the mantle of the group’s flagship. The company reported a net profit of INR1,353 crore and had reserves of INR1,3890 crore for FY16. The next generation, Jai Anmol Ambani, was brought into the Reliance Capital board on August 23, 2016, and the stock saw a brief uptick. It rose 40% by September 27 the same year. Anil Ambani described this as the “Anmol effect” during the company’s AGM. In fact, on August 1, 2018, Reliance Capital had emerged as the most valuable entity among group companies, shows ETIG data. Its market cap was at INR10,315 crore, compared with INR10,075 crore for Reliance Infrastructure, INR9,060 crore for Reliance Power, INR4,048 crore of Reliance Communications, and INR1,051 crore for Reliance Naval and Infrastructure.

But things took a wrong turn in March 2017 when Reliance Capital lost its triple-A rating following the company’s decision to demerge its lending business and reclassify itself as a core investment company. In July that year, it emerged that Reliance Capital had lent substantial amounts to distressed group company Reliance Communications. The twin collapse of IL&FS in September 2018 and subsequently Dewan Housing Finance Corporation Ltd (DHFL) in July 2019 added to the woes, drying up funds for non-bank finance companies.

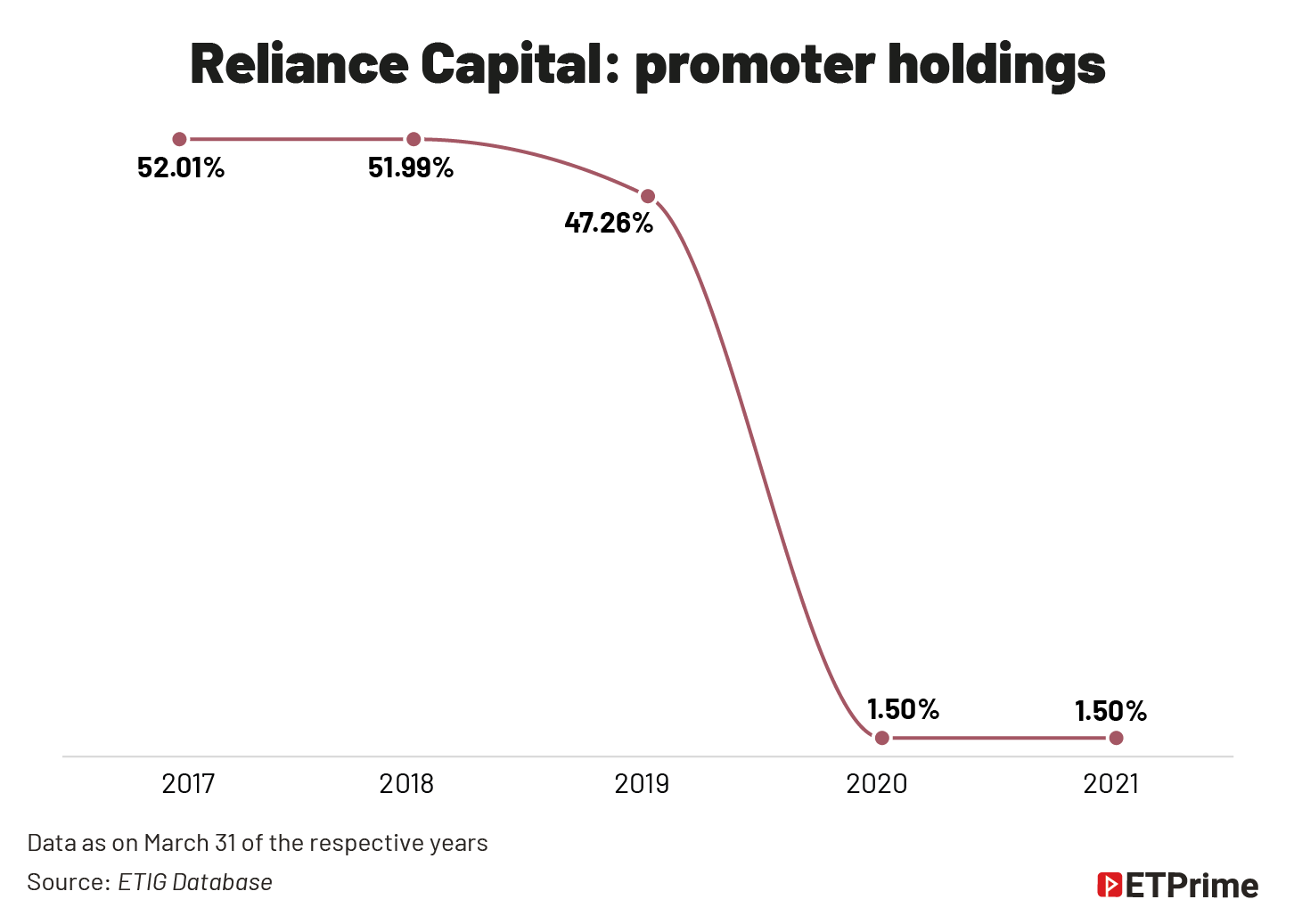

More headwinds came when PwC refused to sign the FY19 balance sheet of Reliance Capital and its subsidiary Reliance Home Finance and resigned as auditors in April 2019. This raised suspicion among lenders. Another bad news came when rating agency CARE downgraded Reliance Capital to default in December 2019. By March 2020, the company ceased to have any owners as promoter shareholding fell to 1.5% from 47.48% a year ago.

This made lenders very uncomfortable. They made attempts to recover their dues and tried to classify Reliance Capital group companies as willful defaulters, but they failed to win a court approval in August 2020. It was only last November that the Reserve Bank of India superseded the board of Reliance Capital citing defaults and governance issues.

What’s left

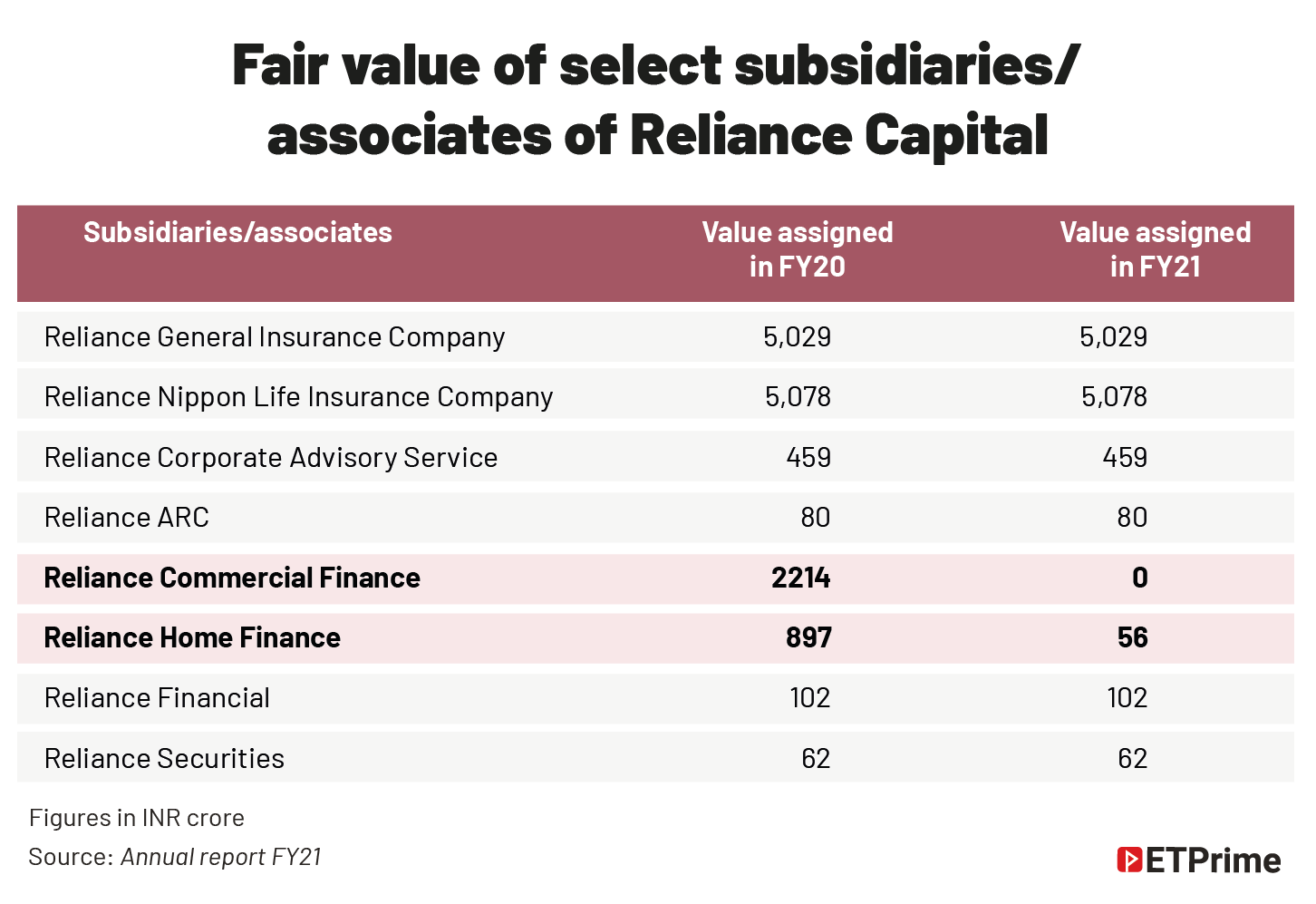

What makes this resolution unique is that Reliance Capital by itself has zero value. What is left is Reliance Capital’s stake in 20 subsidiaries and five associates. Here again, 95% of the value comes from two companies — Reliance Nippon Life Insurance, where Reliance Capital owns 51%, and Reliance General Insurance, which is a 100% subsidiary. Then there is Reliance Asset Reconstruction Company and Reliance Securities, the retail broking firm. While Reliance Home Finance and Reliance Commercial have relatively large balance sheets, bad loans have wiped out their net worth and they still owe money to creditors.

Unlike DHFL, which was acquired by the Piramal Groupfor INR34,000 crore in September last year, Reliance Capital does not have a meaningful loan book. As much as INR7,972 crore loans were impaired, according to the company’s latest annual report.

DHFL lost a big chunk of its value after forensic auditors said that some large loans have disappeared down a black hole. Global accounting and consulting firm BDO India is doing a similar transaction audit on Reliance Capital. The outcome of the audit could add fresh uncertainty to realising value.

The challenges in unlocking value

There is no framework for a group resolution yet. While a company undergoing liquidation can be sold part by part, the Insolvency and Bankruptcy Code (IBC) 2016, permits selling the company as a single unit.

Lenders say inviting bids for Reliance Capital using the value of the subsidiaries has its own challenges. Those interested in insurance may not be interested in the broking business. The alternative is to invite offers separately for each subsidiary and the holding company. The resolution professional (RP) will need both lenders and the NCLT to approve the sale of each unit. Some of the loss-making companies such as Reliance Money Solutions and Reliance Wealth Management will have to be clubbed in a single pool to be sold as a portfolio.

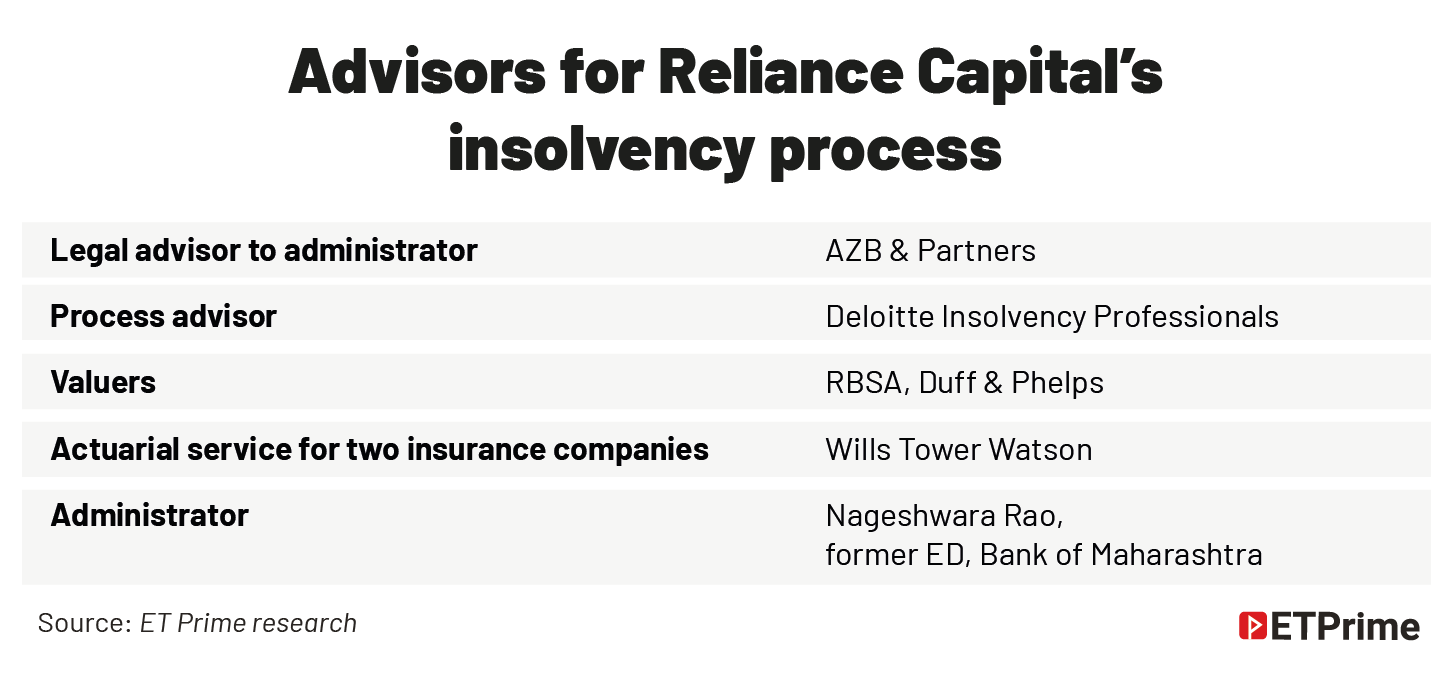

The RP has appointed actuarial firm Wills Tower Watson to value the life- and general-insurance business units. RBSA Advisors and Duff & Phelps have been tasked with providing both liquidation and fair value for each remaining subsidiary as well as a consolidated valuation.

Even before the company was admitted for insolvency, creditors to Reliance Home Finance and Reliance Commercial Finance had approved the sale of the companies to Authum Investment and Infrastructure. It is not clear what view the NCLT will take on this out-of-court resolution of the subsidiary when the parent’s fate is still being decided.

An early resolution is crucial, because with every passing day, the group companies risk losing customers and talent. Insurance is particularly sensitive to customer confidence as the entire premise is based on the promise to pay. The FY21 annual report shows that the fair value of investment subsidiaries was INR10,831 crore, down from INR13329 crore a year ago. Lenders fear the value would have fallen further after admission to insolvency. Even with a INR10,831 crore fair value, the recovery would be below 45% of their dues.

Recovery: easier said than done

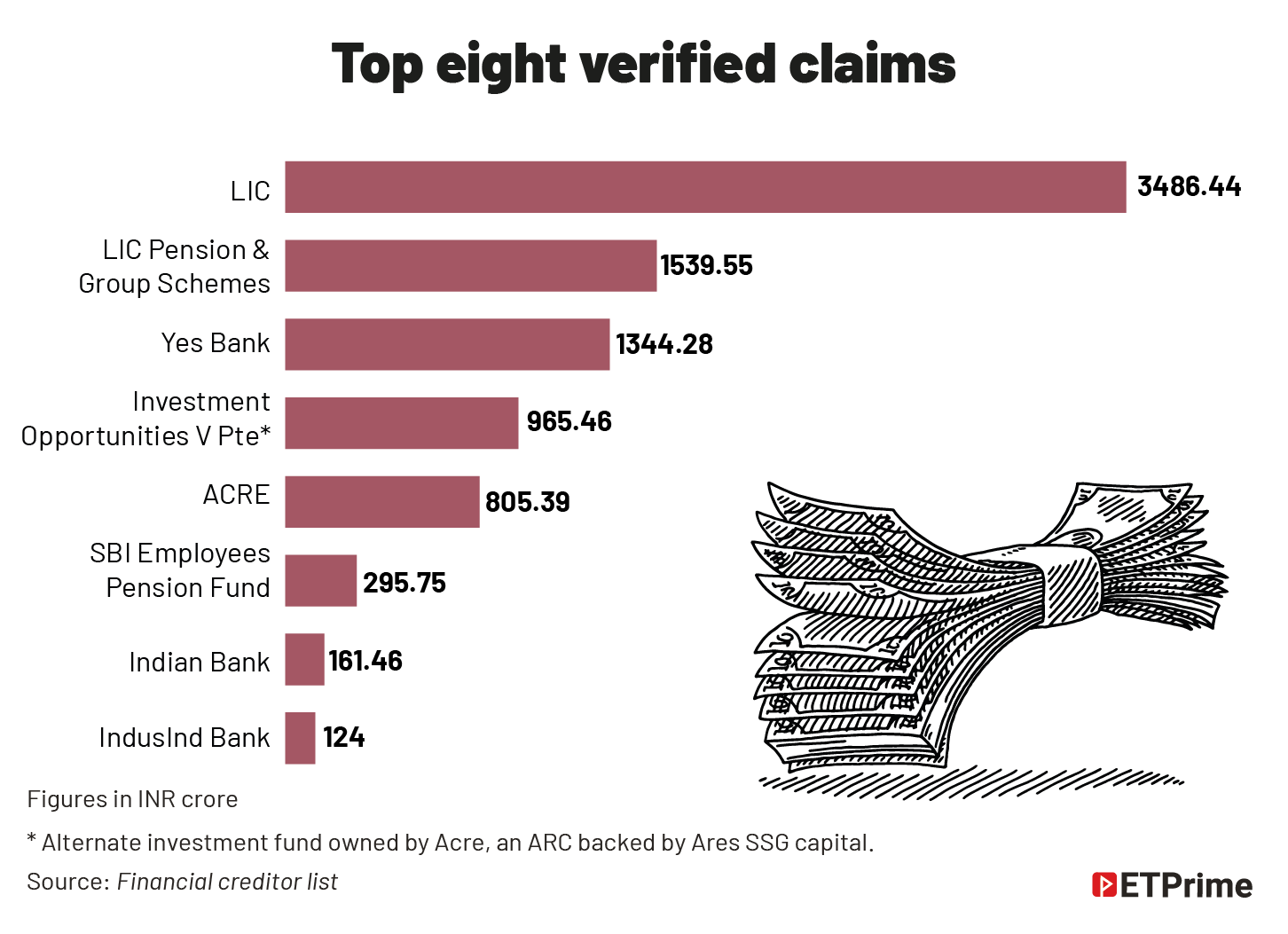

The other issue for the administrator is the fragmented nature of the debt. Around 96% of the debt (INR23,666 crore) pertains to widely held bonds. At least 66% of these creditors by value must vote in favour for any resolution to pass. Even Life Insurance Corporation of India, the single-largest debtor with an exposure of INR3,485 crore or 14.7% of total debt, would not move the needle.

Going by the value at which some lenders have sold their loans, they are expecting a very small recovery. Ares SSG Capital-backed Assets Care & Reconstruction Company acquired INR624 crore loans from HDFC and Axis Bank and INR490 crore bonds from Axis Bank at 27-28 paise on a rupee. This could set a benchmark for the kind of recovery lenders can expect.

Reliance Capital is the seventh ADAG company facing bankruptcy proceedings. With each of them at different stages, lenders have not recovered their money in any of the companies so far. The other six companies are Reliance Communications, Reliance Telecom, Reliance Infratel, Reliance Communications Infrastructure, Reliance Naval & Engineering and E Complex.

In December 2020, a steering committee of bondholders sought to sell the Reliance Capital subsidiaries. They received 90 expressions of interest but there was not much progress, according to the company’s latest annual report. Vistra ITCL, the trustee to bondholders, said in its letter dated June 23, 2021, that Reliance Capital “refused to provide cooperation on all points”, stalling the sale process.

Given that the administrator will be in control with the backing of the RBI, there is hope the outcome would be far better.

(Graphics by Sadhana Saxena)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.