Costlier oil also weighing on sentiment; analysts see no let-off in volatility

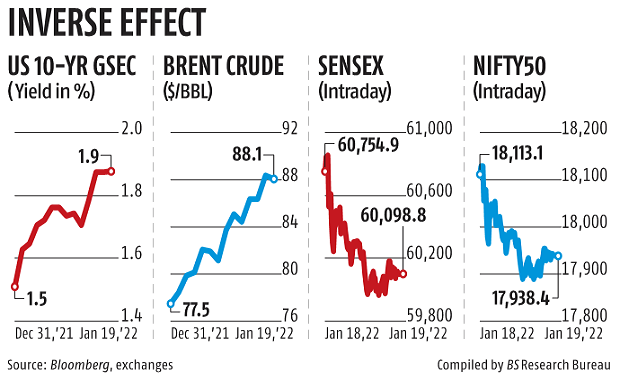

The benchmark indices on Wednesday declined about 1 per cent for the second day in a row amid risk aversion triggered by the spike in the US bond yields, which investors see as a precursor to the end of the easy money regime.

The 10-year US Treasury yield inched towards 1.9 per cent overnight, with experts seeing it hit 2 per cent

by March.

The benchmark Sensex ended the session at 60,099, following a decline of 656 points or 1.04 per cent. The index has come off 1,210 points, or 1.93 per cent from its 2022 high of 61,309, recorded on Monday.

The Nifty50 fell 174 points or 0.9 per cent to end the session at 17,938.

Analysts said rising yields and interest rate hikes could make emerging markets equities and currencies unattractive. Besides surging yields, India faces another headwind in the form of spiralling oil prices.

The global Brent crude traded around $88 per barrel, the highest since October 2014. Rising crude prices could stoke inflationary pressures further as India is one of the biggest crude importers.

Both foreign portfolio investors (FPIs) and domestic institutional investors (DIIs) have turned net sellers in recent trading sessions.

On Wednesday, FPIs sold shares worth Rs 2,705 crore; DIIs were net-sellers to the tune of nearly Rs 200 crore.

Both foreign portfolio investors (FPIs) and domestic institutional investors (DIIs) have turned net sellers in recent trading sessions.

“Rising yields and geopolitical tensions are going to keep the markets on tenterhooks. FPIs have been sellers for a while now, and of late, DIIs have joined the bandwagon. As long as this double whammy continues, I don’t see much scope for the markets to escape volatility. They may pare losses if the Budget comes out as expected. But I do not see the prospect of the markets going dramatically higher from this level,” said U R Bhat, co-founder, Alphaniti Fintech.

Speculation is rife that the Federal Reserve may deliver more than a quarter-percentage-point hike in March to combat inflation. Inflation has forced central banks across the world to fight price rise. This quick shift after terming inflation as

transitory has shocked the equity markets.

Meanwhile, the UK’s consumer price inflation rate surged to the highest since 1992, putting the Bank of England under more pressure to respond.

“The market is likely to continue with its consolidation until inflation fears loom. Also, major events like the upcoming Budget and various state elections could lead to higher volatility in the coming days. Hence, we advise traders to be cautious and remain stock and sector selective. Investors can use a dip in the market as an opportunity to accumulate quality stocks for a long-term portfolio,” said Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services.

The market breadth was weak, with 1,494 stocks advancing and 1,917 declining.

More than two-thirds of Sensex stocks dropped. Infosys was the worst-performing Sensex stock and ended the session with a decline of 2.7 per cent. Asian Paints fell 2.7 per cent, and Hindustan Unilever slipped 2.4 per cent. Eleven sectoral indices on the BSE ended the session with losses. IT and tech stocks declined the most by 1.95 per cent and 1.8 per cent, respectively.