SynopsisA study shows the gross NPAs of almost all private and PSU banks have stabilised in the September ’21 quarter as the post-second Covid wave economic recovery spreads.

Non-performing assets (NPAs) have been a constant hindrance to the growth of banks. The negative impact of NPAs affects banks’ profitability, liquidity and solvency positions. Ultimately, it also hampers their ratings. On account of Covid-19, the position of NPA-burdened banks has worsened.

In October 2021, Moody’s Investors revised the outlook for the Indian banking system to “stable” from “negative” after the Q2 FY22 performance, based on the banks’ stabilising asset quality and improving capital drive. This development makes it important to analyse the asset quality trends of the major banks in India. It is vital to assess how the pandemic impacted the asset quality of private and PSU banks. It is also important to know how the asset quality trends have changed at the end of the moratorium period, when the bad loans started reflecting in the banks’ NPA accounts.

Here are the top 15 banks, according to market capitalisation, that have been considered for the analysis.

| No | Bank Name | Market Cap (Rs Cr) | Balance Sheet Size as of Sept ’21 (Rs Cr) |

| 1 | HDFC Bank Ltd. | 8,31,248 | 18,44,845 |

| 2 | ICICI Bank Ltd. | 5,22,244 | 12,76,002 |

| 3 | State Bank of India | 4,32,665 | 46,91,917 |

| 4 | Kotak Mahindra Bank Ltd. | 3,70,415 | 4,08,432 |

| 5 | Axis Bank Ltd. | 2,18,565 | 10,50,738 |

| 6 | IndusInd Bank Ltd. | 72,695 | 3,80,492 |

| 7 | Bank of Baroda | 46,672 | 11,76,664 |

| 8 | Bandhan Bank Ltd. | 44,762 | 1,16,347 |

| 9 | Punjab National Bank | 43,769 | 12,65,907 |

| 10 | Canara Bank | 38,324 | 11,99,133 |

| 11 | Yes Bank Ltd. | 34,451 | 2,88,523 |

| 12 | Union Bank of India | 31,987 | 10,61,894 |

| 13 | IDFC First Bank Ltd. | 31,194 | 1,72,502 |

| 14 | The Federal Bank Ltd. | 18,771 | 2,06,874 |

| 15 | RBL Bank Ltd. | 11,410 | 1,04,474 |

Market Capitalization as of December 15, 2021

Gross NPA & Net NPA Trends

Since the start of the pandemic in March 2020, the collection efficiency of banks has been affected considerably. Moreover, borrowers failed to repay loans. Nationwide lockdown and Covid restrictions hampered production and capacity utilisation of manufacturers, caused job losses and dampened demand, resulting in subdued sales. This impacted the top line of companies. Also, rising raw material inflation dragged down operating margins and bottom line of the companies. In such a situation, companies with debt struggled to repay the interest on loans. The situation led to rising bad loans, increasing the gross non-performing assets (GNPAs) of the lenders.

Here is a detailed QoQ trend of the GNPAs of the top 10 private banks and the top 5 PSU banks over the previous 6-7 quarters:

ET CONTRIBUTORSAs private banks mostly have retail-oriented loan books, their NPA levels are much lower than that of PSU banks, which have a higher exposure towards corporate loans. The credit risk is much higher for PSU banks.

HDFC Bank is a clear winner here. Despite having 60% of the loan book as wholesale loans, it has the least GNPAs among all these banks. Looking at a strong economic growth outlook — and due to dampened retail and consumer credit growth amid the pandemic — the bank has been tapping the wholesale credit growth opportunity over the last 6-8 quarters as part of its growth strategy. Thus, HDFC Bank is growing with a proactive approach driven by liability franchise (retail focus, CASA deposits) & assets and credit growth (wholesale-focused with high credit rated corporates).

The trend at the end of the moratorium period in the December ’20 quarter showed a steep rise in the gross NPAs of Bandhan Bank — from 1.54% in September ’20 to 7.10% in the December ’20 quarter. The gross NPAs of the lender have been consistently rising QoQ since the last 4 quarters and stood at a whopping 10.8% as of September ’21. This is mainly driven by Bandhan’s micro lending-led portfolio, which constituted almost 66% of its loan book as of Q2 FY22. The micro loans stress pool and the erosion in asset quality were because its collection efficiency was affected in Assam and West Bengal regions, where the bank does a large part of its business.

IDFC First Bank also reported a steep rise in gross NPAs in the December ’20 quarter: retail asset NPAs rose significantly QoQ from 0.79% in September ’20 to 3.88% in December ’20. The bank is currently going through a transition phase of asset restructuring from wholesale to retail. IDFC First is also one of the major lenders to Vodafone Idea. In line with the government’s support to telecom players, by offering a moratorium of four years, the lender is expected to get regular repayments from Vodafone Idea in the coming quarters.

India’s largest bank in terms of balance sheet, State Bank of India is having stable and lower gross NPAs when compared with other PSU banks, mainly because of its prudent credit assessment.

The gross NPA of almost all private as well as PSU banks covered in the analysis stabilised QoQ in the September ’21 quarter due to cascading effects of economic recovery after the second Covid wave.

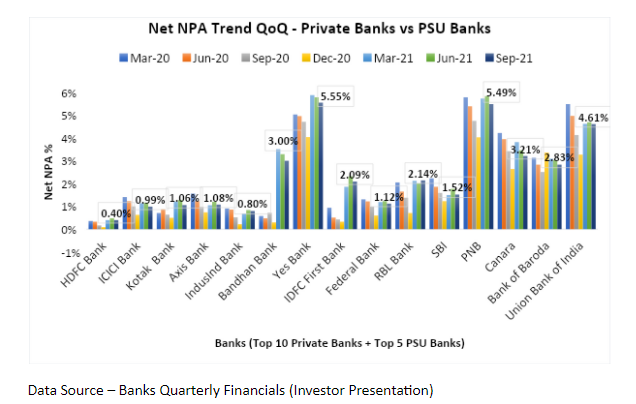

The net NPA trend shown below is also in line with the gross NPA movement.

ET CONTRIBUTORS

Banks with higher gross NPAs are better prepared with higher provisioning, ranging 80-85%. The net NPA levels have lowered in line with the rise in provisioning.

Deep Dive into Segment-wise NPA Trends – Retail NPA & Corporate NPA

To analyse segment-wise NPAs trends, let’s segregate private and PSU banks.

A. Retail NPA

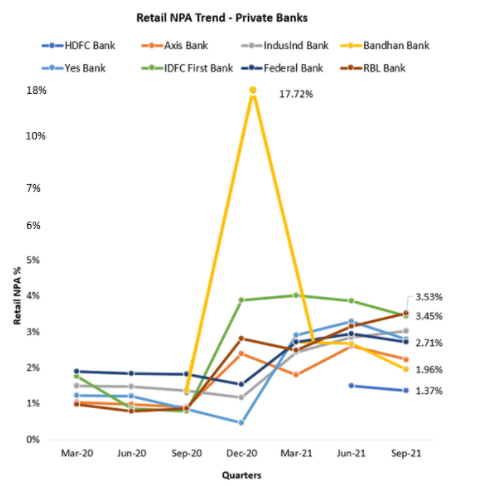

ET CONTRIBUTORSData Source – Banks Quarterly Financials (Investor Presentation)

(Note: Segment-wise NPAs are not available for ICICI Bank, Kotak Mahindra Bank. In the case of HDFC Bank, Retail NPA is reported for 3 quarters – Sept-20, Jun-21, and Sept-21. While Retail NPA of Bandhan Bank is calculated)

* The Y-axis is not as per scale to accommodate outliers.

As shown in the graph, retail NPAs of private banks were stable in the March ’20, the June ’20 and the September ’20 quarters, on account of the Reserve Bank of India (RBI)’s moratorium for borrowers. After the end of the moratorium, retail gross NPAs of IDFC First Bank, Bandhan Bank, RBL Bank and Axis Bank rose significantly in the December ’20 quarter. Those of Federal Bank, IndusInd Bank and Yes Bank jumped in the March ’21 quarter.

This sudden QoQ jump in retail gross NPAs was majorly due to the addition of moratorium bad loans, which started reflecting in the NPA accounts since the December ’20 quarter. The quality of retail loans has deteriorated, but to a limited degree because large-scale job losses have not occurred.

In the latest quarter (September ’21), all private banks’ retail NPAs seemed to have stabilised on the back of improved collection efficiency and regular repayments by borrowers. Asset quality in the retail segment is expected to improve further as economic activity normalises.

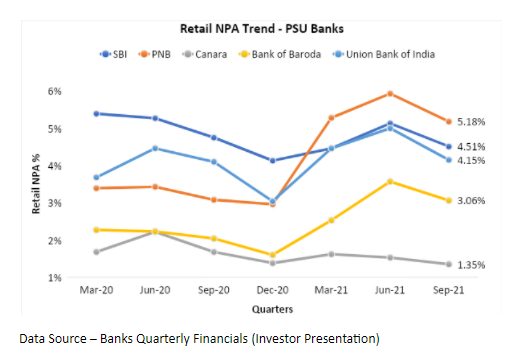

ET CONTRIBUTORS

In the case of PSU banks too, retail NPAs were stable till December ’20, after which they started rising consistently QoQ till June ’21 and stabilised in the September ’21 quarter.

B. Corporate NPA

Unlike retail NPAs, the corporate NPA trend of private banks seemed to have consistently declined (Axis Bank), though at a slower pace and a much stable level (RBL, Federal Bank).

The exception is Bandhan Bank. Here, we have considered the EEB NPA (micro loans’ NPA) while plotting the graph for Bandhan Bank. After the end of the moratorium period, the micro loan NPAs of Bandhan Bank rose from 0.20% in September ’20 to 7.80% in the December ’20 quarter. It has been rising for the past four quarters and was at an epic 13.56% as of September ’21.

Axis Bank’s corporate NPAs have been consistently declining since March ’20, depicting its stress management measures have been effective. HDFC Bank’s corporate NPAs are at the lowest level in the industry. It shows the bank was managing its corporate loan book in a very efficient and structured way.

ET CONTRIBUTORSData Source – Banks Quarterly Financials (Investor Presentation)

* The Y-axis is not as per scale to accommodate outliers.

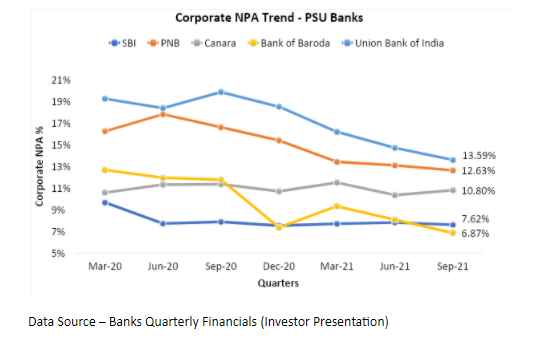

In the case of PSU banks, all five lenders’ corporate NPA trends have been declining consistently over the past four quarters. The quality of corporate loans has improved, which indicates the banks have recognised and provisioned for all legacy problem loans in this segment.

ET CONTRIBUTORSAlso, the recent DHFL recovery is expected to add confidence and optimism to the banking system. As the economy is opening up, there will be a steady improvement in credit growth. In the first half of FY22, credit growth was at 6.7%. It is expected to improve, mainly driven by retail credit, more robust economic activity as well as improving risk appetite and demand across credit segments.

Many other factors are expected to be conducive to drive credit growth. The key drivers are commodity inflation, improving capacity utilisations, low interest rates and ample liquidity with banks. The focus on manufacturing and fresh capital expenditure through the Make in India programme, government’s fiscal push and the willingness to spend — driven by more robust GST tax collections — will also help credit growth. Lastly, the corporate sector and the promoters have deleveraged and are now ready for a fresh round of capital expenditure and capacity expansions.

The retail NPAs of private and PSU banks are stabilising, after rising significantly in the post-moratorium period, and are expected to recover further. The declining trend of corporate NPAs over the past 4-5 quarters is an encouraging sign for the banks, and in line with the overall economic recovery.

(Gaurav Jain & Parimal Ade are Founders, InvestYadnya.in. Views are their own)

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)(Originally published on Dec 20, 2021, 04:52 PM IST)

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now