SynopsisAhead of going public, Ola has been aggressively launching businesses and has worked hard to show profits in cab hailing. But under the sheen of profitability and expansion is a shrunk core business, a patchy record of diversification, and high churn in the workforce.

In November, three news items appeared about Ola that were unrelated to its frenzied electric-scooter launch. The cab-hailing unicorn sold 1,000 cars on its newly floated used-car exchange platform in two days during Diwali. It piloted a 15-minute grocery delivery. It reported operating profit for the first time.

Ola chief Bhavish Aggarwal has been simultaneously orchestrating two events of pivotal importance for both his companies: the mass-market electric-scooter launch by Ola Electric and the public listing of Ola, the flagship cab-hailing company incorporated as ANI Technologies Private Ltd.

Amid concerns raised by expert automotive reviewers on the market readiness of the scooter and talk of production delays, Ola Electric has postponed the delivery of the two-wheeler to the first batch of customers to the second half of December. It cited semiconductor shortage as the reason for the delayed delivery. That is baffling, as the company has so far maintained that it had procured enough chips and ensured “supply-chain optimisation, including the critical components”. Also, chip shortage has a lag effect, it would not derail production plans at the last hour.

Similarly, the draft red herring prospectus (DRHP) filing at one point of time was expected in October, but will likely happen in the first quarter of 2022 and the listing may take place by the middle of the next year. The public-listing process is being led by Ola group CFO GR Arun Kumar and chief of strategy Amit Anchal. A number of key personnel, including Ola mobility business CFO and general counsel left the company recently amid the IPO preparation.

While Ola has been aggressively launching businesses and has worked hard to show profits in cab hailing in the run-up to going public, under the sheen of profitability and expansion lies a shrunk core business, a patchy record of diversification, and high churn in the workforce. In such a backdrop, will it be able to get investors to buy its shares?

Prepping up to go public

Despite the common brand under a single founder and free flow of management talent between both the companies, Ola and Ola Electric are separate companies. After the latest funding round, Ola has a mere 5% stake in Ola Electric, according to startup database Tracxn. However, Ola hopes that the frenzy around the launch of electric scooter rubs off on its IPO. Inspired by Zomato’s successful listing, Ola internally targeted a valuation of around USD15 billion.

That brings to focus Ola’s current valuation. ET reported that Ola’s recent secondary round of USD500 million, in which Warbug Pincus, Temasek and founder Bhavish Aggarwal bought Ola shares from some of the existing shareholders, was at 35%-50% discount of the previous round of funding at USD5.5 billion-USD6 billion valuation two years ago. Ola hasn’t yet disclosed the valuation in this secondary round in July. The US mutual fund Vanguard Group, an investor in Ola, in two back-to-back reports, including its latest one for the first half of this year, marked down its valuation to around USD3 billion, private-equity deal news site Capital Quest reported. Meanwhile, the latest reports suggest it is in talks for a ‘pre-IPO round’ at USD7 billion valuation.

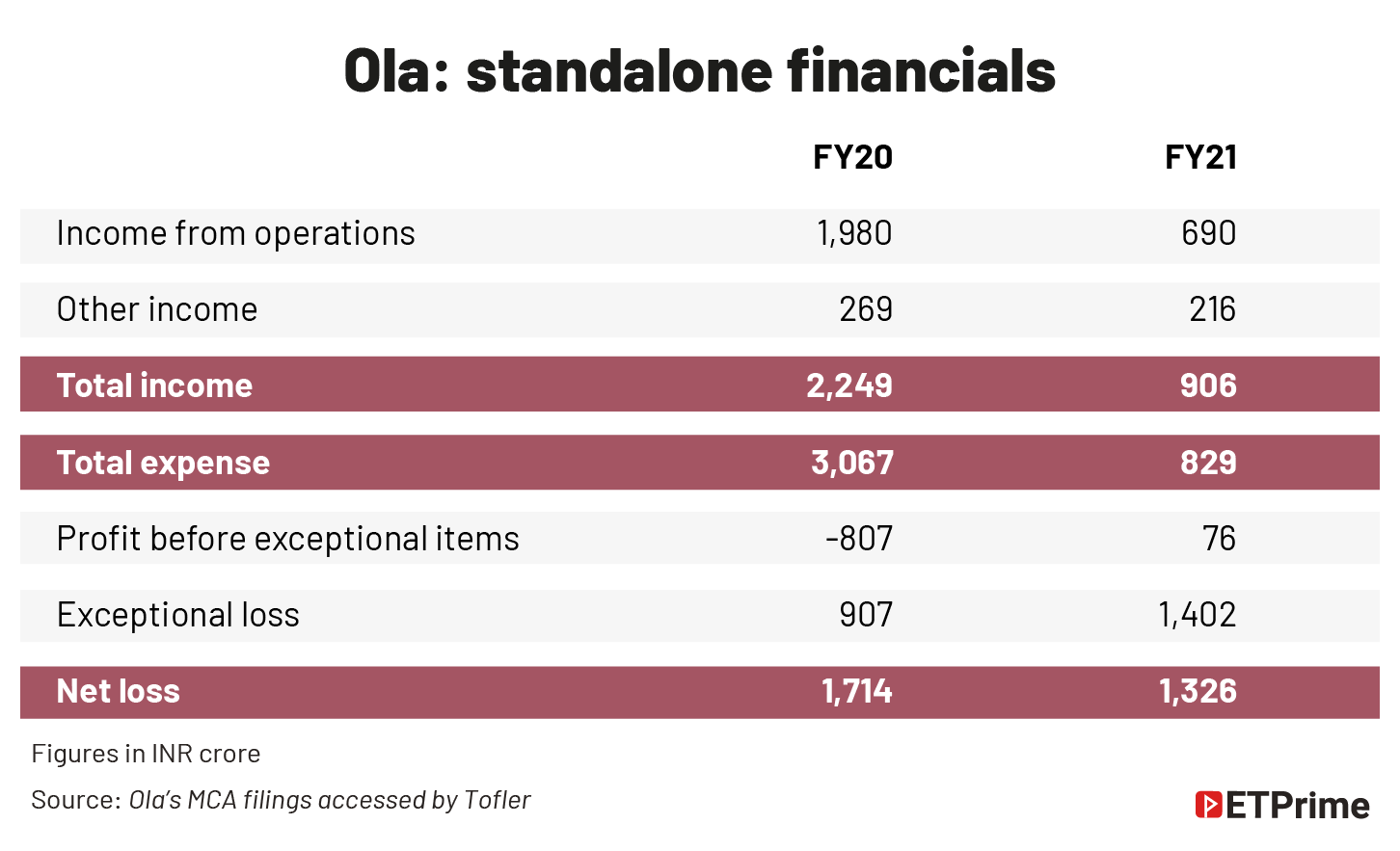

While its valuation question remains, much like its awe-inspiring push for the scooter launch, Ola has been preparing the ground for a stellar public listing. In that background, the company reporting operating profit is significant. Filings of Ola’s financials accessed by Tofler shows that the small operating profit of INR76 crore for FY21 is on a standalone basis after the core business of cab hailing shrank to just a third of what it was a year before. The losses on account of investments it made in subsidiaries and associate companies and the money it loaned to them, termed as exceptional items, which amount to INR1,402 crore, makes its total losses less by about 20% from the previous year while total revenue, which includes non-operating income, is down by about 60%.

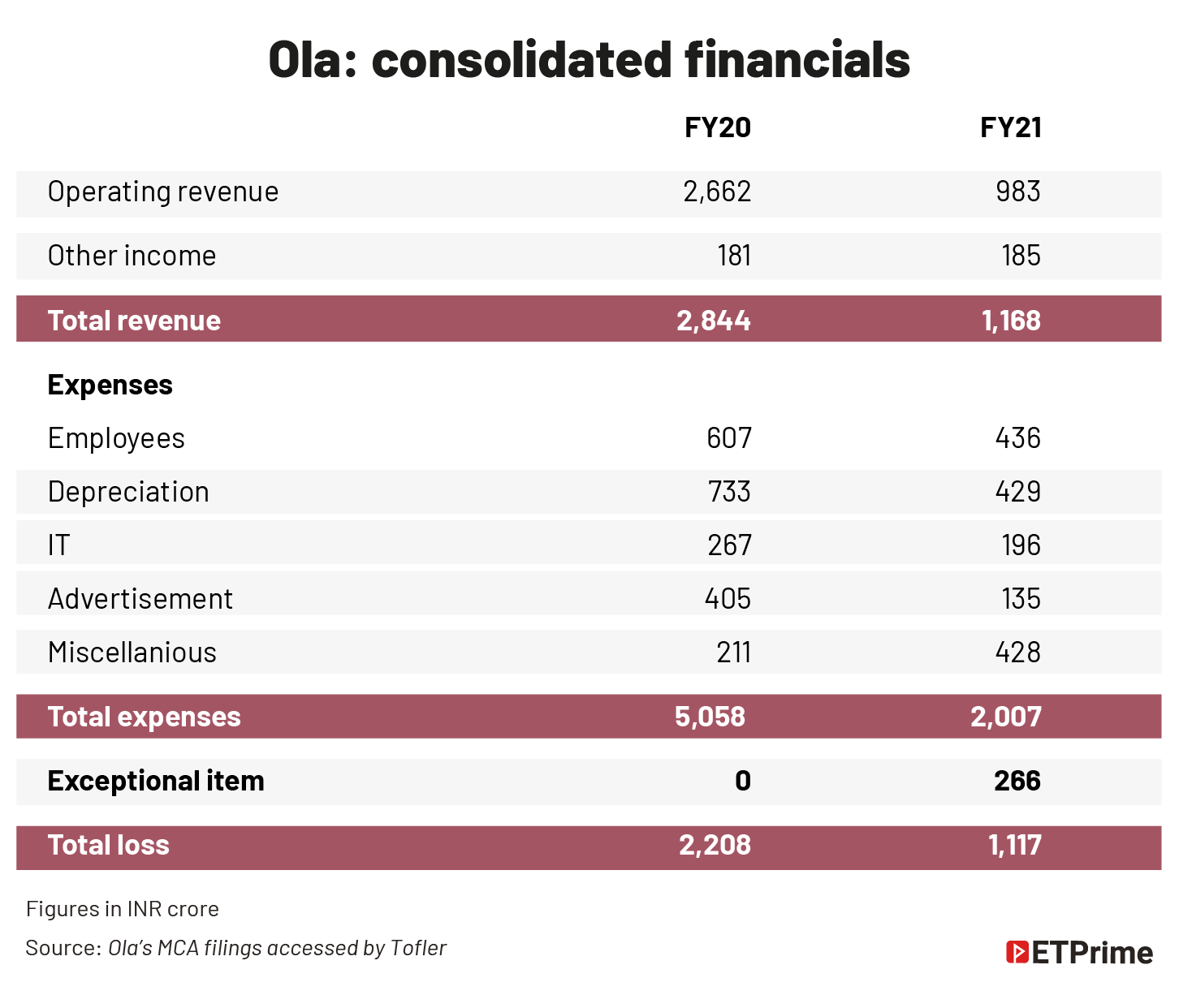

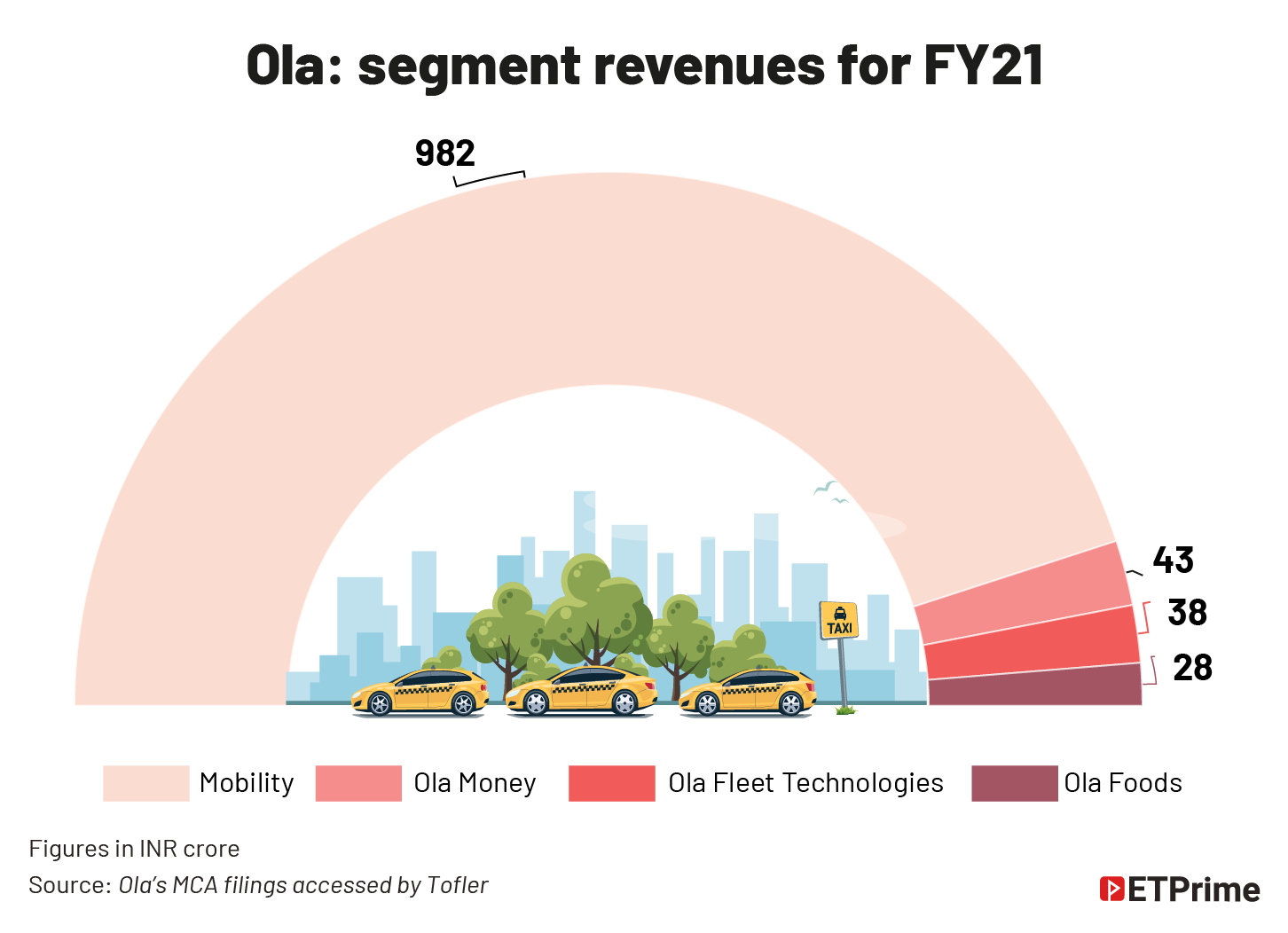

In sum, while Ola faces challenges in the core business, its efforts to expand other businesses brought it heavy losses and very little revenues. The consolidated financials explain it better. Despite attempting to diversify over the years, 90% of Ola’s revenue comes from cab-hailing. It reported revenue from three other businesses — wallets, leasing, and food. Earnings from all of them combined, in other words Ola’s non-cab hailing revenue, last year was just a little over INR100 crore.

Ola has been trying to make inroads into all these segments for the past six years, with little success. With ride insurance and pay-later offers, Ola’s financial-services business is solely dependent on the main business. Exiting food delivery after multiple attempts and huge losses, Ola Foods is building a dark-kitchen chain and fully controlled delivery of its own items, but it is a small player at the moment. Ola Fleet Technologies, which leases cars to its drivers, registered INR654 crore losses last year, as its fleet of several thousands of cars were mostly lying idle.

Diversification amid doldrums

Ola has now made a start in used-car sales and experimented with grocery delivery. This diversification strategy is at the heart of Aggarwal’s original mission. While the low take rate makes profits tough in ride hailing, the regular use of the app by its customers should present it an opportunity to offer them other digital services. That did not pan out the way it was envisaged. ET Prime had earlier reported about Ola’s multiple unsuccessful experiments in being more than just a ride-hailing company. Three years later, the story is starker: The core business has shrunk while the adjacent offerings haven’t taken off yet.

Be it fintech (Paytm, PhonePe, et al.), dark kitchens (Rebel Foods), used cars (Cars24, Spinny, Droom) or quick commerce (Swiggy Instamart, Grofers, and others), the competitors have established dominance. These startups, most of them well-funded unicorns, have resources and dedicated manpower to scale in these businesses, which are their core offerings.

That is where the human resource side of Ola’s business comes into sharp focus. Its highly unstable management, with top managers including CXOs leaving within months in several cases, poses questions on its ability to execute its ambitious projects. Ola reported employee turnover — the churn in its workforce — of 55% and 35% in FY20 and FY21, respectively. This volatility is all the more visible in its senior management. The CXOs whose exit was mentioned earlier left the company within months of joining. Gaurav Porwal left before completing a year in his position as COO. Rohit Munjal, chief human resource officer, too moved on. The spate of top exits that happen at regular intervals not only create bad optics but exhaust the existing managerial workforce.

A large section of people in Ola’s ranks multitask to compete with Paytm, Rebel Foods, Grofers, and Cars24 in their respective domains while running its core mobility business, according to several former executives. Several of the top leaders are handling multiple key functions. Founder and CEO Aggarwal has been focusing mostly on his other venture Ola Electric for quite some time. Dinesh Radhakrishnan, who joined six months ago to lead engineering at Ola Cabs, took up the additional role of CTO at Ola Electric following exits in that company. Similarly, Arun Sirdeshmukh, who joined in April as business head of Ola Electric to build online delivery of scooters, has become CEO of Ola Cars. The chief product officer, chief people officer, and chief marketing officer work in both the companies. In sum, several key executives, including some who joined recently, straddle two separate companies. In Ola’s disclosures, Ola Electric is neither a subsidiary company nor an associate. It is a company in which its directors are interested.

Supply challenge in ride hailing

In the meantime, Ola is staring at some level of saturation in the core ride-hailing business. For instance, in FY20, its revenue from cab hailing grew just 6% from the previous year. It then drastically decreased in the pandemic year. Filings show as of August this year, at 488,000, its number of active drivers remained 20% lower than the pre-pandemic level. A significant chunk of them are three-wheeler and bike taxi drivers where ticket size and commissions are low. This suggests cars on the platform could be about 300,000. Unable to repay their loans, many drivers gave up their cars and exited taxi service. Any large-scale attempt at improving supply is expensive, as exemplified by the fate of the leasing arm Ola Fleet Technologies. That will seriously affect the profitability matrix. But expanding the core mobility platform is critical to increasing engagement on the platform to drive many adjacent businesses that Ola wants to develop.

Among all the businesses it started recently Ola places an emphasis on the used-car vertical for an obvious benefit. An average ticket size of a transaction would be about INR500,000 while its average ride fare is INR150. So car sales would help the company bump up gross transaction value, that would help make up for the lost volumes of ride hailing.

Ola’s cumulative losses over the past 10 years is about INR17,500 crore. Accounting for the rupee’s valuation against the dollar during this period, Ola may have burnt at least USD2.5 billion and would still need money. Amid talks of a big round before an IPO, the company is understood to be in talks for debt to the tune of USD500 million.

Ola is an evolving story with several moving parts. As the Paytm IPO shows, India’s markets may not have the risk appetite for businesses that are in many ways figuring themselves out. The question is simple: Is this the best moment for Ola to go public?

(Graphics by Sadhana Saxena)

(Originally published on Dec 2, 2021, 12:01 AM IST)

The latest from ET Prime is now on Telegram. To subscribe to our Telegram newsletter click here.