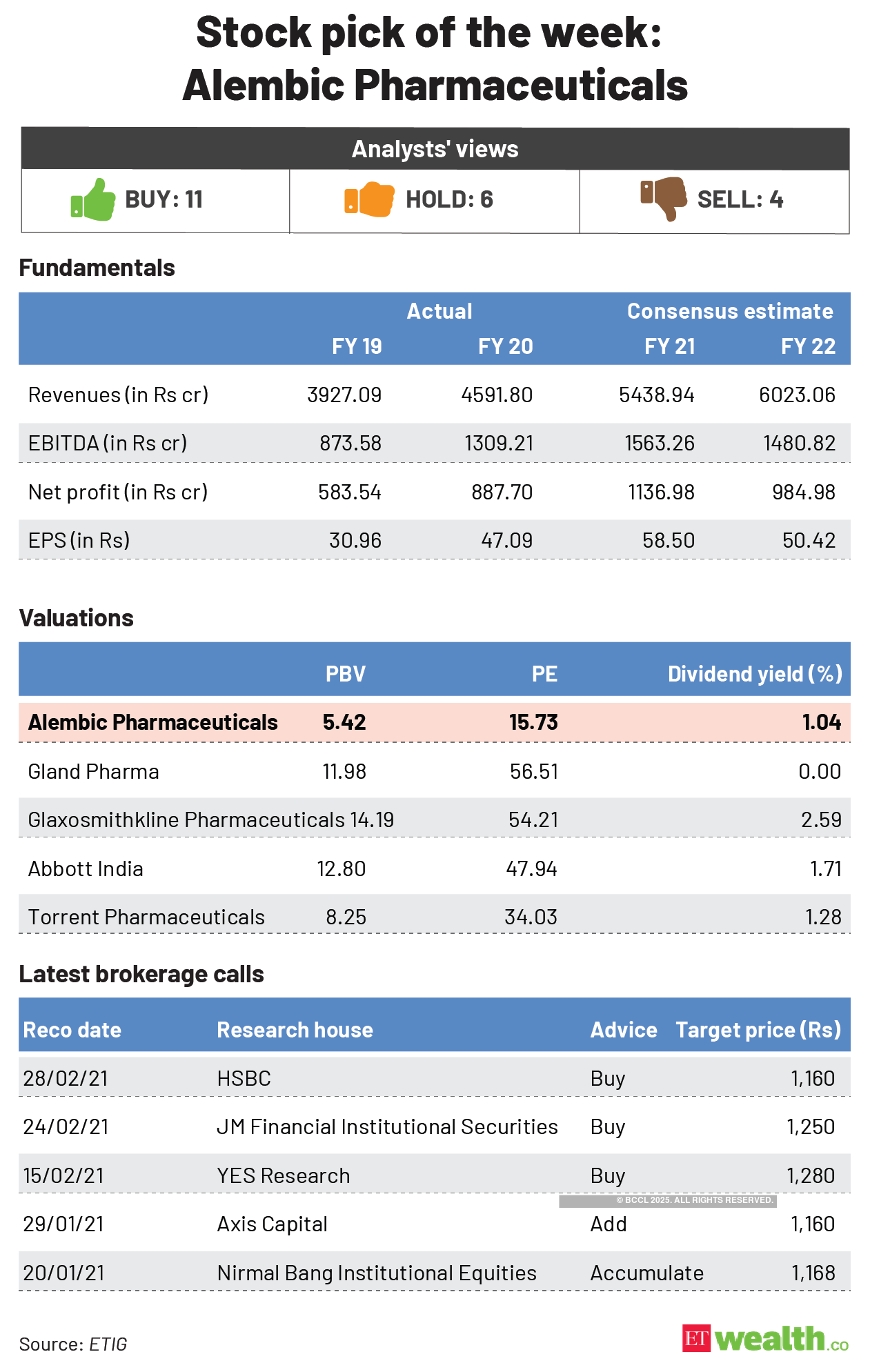

Synopsis-Alembic Pharma is looking forward to high growth with API and RoW businesses reporting decent growth. Besides, new products in pipeline and company’s reasonable valuation as compared to its peers have made it a favourite of analysts.

Alembic Pharmaceuticals was able to report only muted results for the third quarter of 2020-21. Its consolidated revenues grew by only 9% y-o-y. Despite the growth in ex-sartans portfolio, the US revenues stagnated around $70 million due to price fall in sartans portfolio. Sartans are drugs used for high blood pressure and heart failure. Though its consolidated net profit jumped up 25% y-o-y, it was majorly because of a milestone payment received by its subsidiary Rhizen Pharma during the quarter.

Despite the muted third quarter numbers, analysts are getting bullish on Alembic Pharma for various reasons. First, after consolidating at current levels for few more quarters, the US growth is expected to pick up once again. The company has filed 16 abbreviated new drug applications (ANDA) and received final approvals for 12 during the first three quarters of 2020-21. Since six of these final approvals came in the third quarter, Alembic Pharma is expected to launch five new products in the fourth quarter. Alembic is hopeful about the US FDA inspection in its new facilities in the next two quarters, after which these facilities will be able to contribute to the US sales in next 12-18 months.

Second, domestic business, active pharmaceutical ingredient (API) business and sales from the rest of the world (RoW) business should continue to report decent growth. The domestic formulations business was able to report 14% y-o-y growth during the third quarter. Though the company launched three new products in India during this quarter, most of the growth came from better performing older brands. The domestic sales contribute around 30% of its revenues and high margin speciality products contribute a major part of it (54% of domestic sales).

API and RoW businesses reported y-o-y sales growth of 15% and 21% during the third quarter. Though both were down q-o-q, it was because of bumper sales during the second quarter due to global disturbances. API business is expected to report only normal growth going forward because Chinese API supplies have started coming back to the market. Alembic Pharma want to increase its API portfolio by taking advantage of the government’s push for manufacturing.

Price fall after the muted third quarter numbers and the resultant fall in its valuation (Alembic Pharma is valued reasonably among mid-cap pharma companies) is another reason why analysts are getting bullish on this counter now.

Selection Methodology: We pick up the stock that has shown the maximum increase in “consensus analyst rating” during the last 1 month. Consensus rating is arrived at by averaging all analyst recommendations after attributing weights to each of them (ie 5 for strong buy, 4 for buy, 3 for hold, 2 for sell and 1 for strong sell) and any improvement in consensus analyst rating indicates that the analysts are getting more bullish on the stock. To make sure that we pick only companies with decent analyst coverage, this search will be restricted to stocks with at least 10 analysts covering it. You can see similar consensus analyst rating changes during the last one week in ETW 50 table.