SynopsisEleven shareholders will hold just above 9% each initially, and this would mean that no single shareholder has more than 10% in promoting stake. More shareholders could join at a later date.

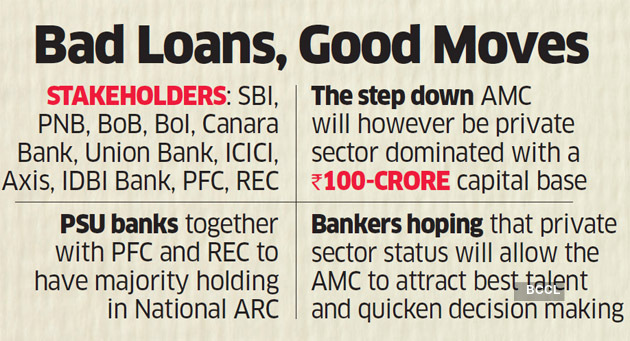

Nine banks and two non-bank lenders, including the State Bank of India (SBI), Punjab National Bank (PNB) and Bank of Baroda (BoB), are coming together to jointly invest Rs 7,000 crore of initial capital in a proposed bad bank that aims to help extract funds stuck in bad loans. Two other state-run financiers of power projects will also own stock in the bad bank, three people familiar with the talks told ET.

Canara Bank, Union Bank of India and Bank of India will join their larger state-run peers as investors in the bad bank. ICICI Bank, Axis Bank and Life Insurance Corp of India (LIC)-owned IDBI Bank are also among the shareholders. State-owned Power Finance Corp (PFC) and Rural Electrification Corp (REC) will also be equal shareholders in the new company.

“All the 11 shareholders will hold just above 9% each initially, and this would mean that no single shareholder has more than 10% in promoting stake. More shareholders could join at a later date, which could dilute the stakes further for the existing investors,” said a person familiar with the plan.

ET had reported on February 22 that about a dozen lenders, including REC and PFC, will be approached for equity participation in the bad bank. The exact shareholding and quantum of capital infusion has not been reported earlier.

NARC Expected by Next Quarter

Banks with the maximum amount of legacy bad loans are among the shareholders in the dedicated asset reconstruction company (ARC). Bankers expect the new entity to be up and running by the first quarter of the new fiscal.

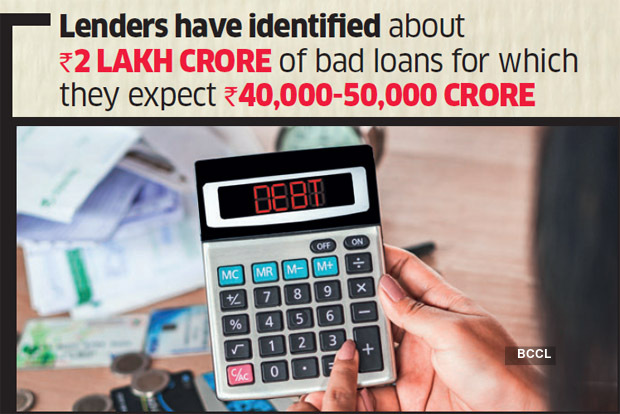

Lenders have identified about Rs 2 lakh crore of bad loans for which they expect Rs 40,000-50,000 crore. These assets will be transferred to the new ARC at 15% upfront cash, about the level of capital being infused into the company.

“The Reserve Bank of India (RBI) wanted this ARC to fit into the existing structure for these companies and after consultations, care has been taken that there is no special treatment for this entity,” said a second person involved in the discussions. “For example, RBI was sceptical of the 15:85 structure. To address that, the government is guaranteeing the security receipts (SRs). RBI also wanted a market determined price discovery; so we have adopted the Swiss challenge method to ensure robust price discovery.”

SRs are issued by ARCs to banks during the purchase of bad loans. They are redeemed at the time of recovery of the loans. Under the Swiss challenge method, new bidders are allowed to better an initial bid following which the first bidder is given a chance to either match or improve on the highest bid. Banks have also blocked the domain name National ARC, logging a request for government approval.

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now