Synopsis–Scores of compliances, land and labour challenges and tedious bureaucratic processes doesn’t quite tantamount to efficiency for businesses in India. A range of policies and reforms is the need of the hour to uplift India’s position in a real sense.

Ashwini Anand recalls the time when he set up his first startup, Investopresto, in Singapore in 2011. The entire process of setting up the company was completed in a quick 24 hours — a time duration which is unthinkable in India.

The company shut in 2014, but Anand looks back at the time as one replete with efficient and hassle free processes. Starting off his own venture in India in 2016, Monsoon CreditTech, a machine learning-powered loan underwriting and pricing platform, Anand admits to the huge ‘cultural change’ he experienced after coming back. “I did everything in Singapore on my own. But after coming back, I realised that no matter how qualified you are, we would need professionals who are up to date with laws. One has to set aside a budget for CA and lawyers here,” he quips.

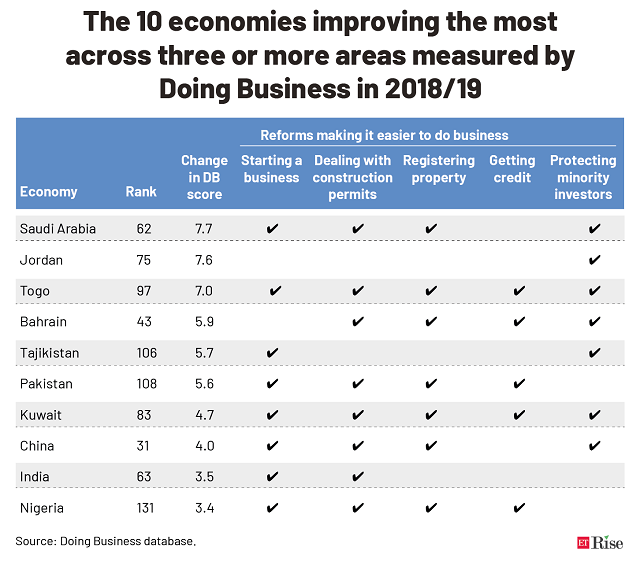

Anand’s views may seem contrary to the World Bank’s Ease of Doing Business ranking in 2020, in which India jumped 14 positions and ranked 63rd among 190 countries. In fact, as per the survey, India was among the economies which showed the most significant improvement in ‘Doing Business 2020,’ along with countries like China, Nigeria and Kuwait.

The ground reality, however, tells a contrastingly different story. The scores of compliances needed to set up a business in the country, complex land and labour hurdles and long delays in bureaucratic processes clearly speak of the glaring gaps that remain.

What can be done?

Speaking at Resurgence TiECon Delhi–NCR on Wednesday, Piyush Goyal, Minister of Railways, Commerce & Industry, Consumer Affairs and Food & Public Distribution touched on the topic of Ease of Doing Business scores (which are done by the World Bank) for SMEs, mid-size companies and startups.

“We’ve had state level rankings and now will go at district level to rank different stakeholders and our ministry is working in close coordination with policy makers to ensure that on-the-ground impact is felt by entrepreneurs, startups and small businesses,” said Goyal.

Global consultancy McKinsey in its report, ‘India’s turning point’, last year had stated that though India rose from 130th overall in 2016 to 63rd in 2020, Indian companies continue to face obstacles in doing business that restrict their productivity. It stated that these could range from payments that are sometimes significantly delayed; limited efficiency in export-import processes and compliances that make exporting twice as long a process as in some other emerging economies; duplication of compliances from both central and state authorities across processes and time consuming compliance stipulations for tax payments that can require 250 hours or more.

Delving into further insights, the report gave examples that could help improve the situation manifold. “Several issues and obstacles that companies face could be resolved if the government adopted global best practices in relevant areas. For example, to simplify and expedite tax payments, we could extend the existing electronic filing system, creating a one-stop shop for a range of taxes. An “e-governance for business” mission at the state government level would be required to improve the ease of doing business at the local level across a large number of cities and towns within each state,” it said.

Improving India’s perception on this aspect would also mean taking stock of the tedious bureaucratic processes that act as a deterrent for businesses. Seen in the context of starting a domestic business in India, for example, the time taken can range anywhere between 18-30 days on an average in the case of non-regulated sectors. This duration goes up when it concerns FDI or any of the regulated sectors.

KR Sekar, Partner, Deloitte India says that it is important that both the Central and State governments work hand in hand to minimise bureaucratic delays and expedite the processes. “For example, it takes more time at Central and State level in land allotment for corporates. Second, there is a perception about uncertainty around Indian laws. While we should applaud the government for making bold reforms including GST/ AatmaNirbharBharat package/new labour code etc, the approach of the bureaucracy towards businesses also needs to sync up with the reforms of the government,” he highlights.

Land and labour reforms

Needless to say, addressing the issue of land and labour reforms which can help elevate India’s position in this domain will be imperative for progress. The tonnes of paperwork and the varied licenses and registrations needed at every step to set up a factory in the country, for instance, acts as a huge barrier for firms eyeing India. Vivek Agarwal, Partner – Infrastructure, Government and Healthcare, KPMG says India’s biggest challenge is a British legacy system of presumptive titling to transfer land ownership. “In a presumptive titling system, execution of a sale deed is not definitive proof of ownership, which needs validation through land records. Land records have been poorly maintained, in part on account of manual records. The pace of digitisation of land records in India has been painfully slow,” he states.

Such a presumptive titling system coupled with unclear land records leads to a high quantum of litigation. Agarwal adds that moving to a conclusive titling system where land transfers are unambiguous, would greatly reduce the judiciary’s burden of land disputes and witness rationalisation of land rates.

Contentious debate has also always surrounded the subject of labour laws and reforms. In fact, the earlier central labour laws led many firms to continue to remain small. “Once you cross 20 employees, you need to register with the Employees Provident Fund Organization (EPFO) and a range of other compliances also come into the picture. Lot of entrepreneurs prefer to hire contractors instead in such a scenario,” reveals Anand of Monsoon CreditTech.

Now with the coming of the four labour codes – Industrial Relations Code, Code on Occupational Safety, Health & Working Conditions Code (OSH), Social Security Code and Code on Wages – from April 1, better transparency of processes is expected. Agarwal mentions a caveat, though. “The central government’s initiative to unify the labour code will ease compliance as it promotes uniformity in labour laws. However, the labour codes need to strike a delicate balance between pro-industry legislation and securing employees’ legitimate rights to avoid labour unrest as recently witnessed in a southern state,” he says.

Budget 2021

Experts whom ET Digital reached out to have hoped that the upcoming Budget will factor in changes that can help streamline things better for businesses. Agarwal feels that the Budget, besides ease of doing business, should also encourage decision makers to debate the cost of doing business and industrial productivity.

Substantiating his view, he gives the example of India’s iron and steel sector, saying that India has one of the lowest costs for converting iron ore to steel globally. “Unfortunately, the industry’s competitiveness is lost by the time it reaches foreign shores due to the compounding effect of dependency on imports, tariffs on key manufacturing inputs, high logistics cost and low technology penetration. Some of these factors can be offset in the short term provided the discussion in policy circles is on competitiveness of the product in global markets,” he rationalises.

Besides this, strategies to incentivise technology adoption in manufacturing, enhancing labour productivity and GST sops for MSMEs were other suggestions mooted. “The GST slabs should be reduced and if possible some rates must be revisited. Simplification of processes is just as necessary. As much of the process should be online and automated so that companies can carry out the exercise in quick time,” Kishan Jain, Director, Goldmedal Electricals says.

For India to be truly ‘AatmaNirbhar’, the focus clearly has to be on creating an internal network that promotes self sufficiency and seamless processes which reduce the burden of compliance. And with India’s aim now to catapult itself in the top 50 in World Bank’s Ease of Doing Business Index by next year, such a focus may only prove beneficial in the long run.

Share the joy of reading! Gift this story to your friends & peers with a personalized message. Gift Now