SynopsisFor Covid-stricken small businesses, the ECLG scheme was to be a savior. After eight months, the results may be mixed.

On May 13, 2020, the Indian Finance Minister Nirmala Sitharaman announced a 3-lakh crore collateral-free loan scheme called ECLG scheme. Part of the self-reliant India mission, the biggest fiscal component of the Rs 20-lakh crore AatmaNirbhar Bharat package was meant for businesses having Rs 25 crore outstanding loan or Rs 100 crore turnover. Thereafter, the government on November 26 came up with another set of measures billed as ECLGS 2.0.

Under this, it not only extended the scheme’s duration till 31 March, 2021, but also broadened its scope. As part of the additional measures, the government extended the ECLGS scheme to the healthcare sector and to 26 sectors identified by the Kamath Committee.

More importantly, under ECLGS 2.0, entities with outstanding credit above Rs 50 crore and not exceeding Rs 500 crore as on February 29, 2020, which were less than or equal to 30 days past due as on February 29, 2020 were eligible.

With these tweaks and additional measures, the government was clearly aiming to offer a fresh lease of life to Covid-hit small businesses. Now, looking at the latest official update on the scheme, it’s clear that the flagship scheme, in over eight months of existence, has achieved considerable success in terms of its intended aims.

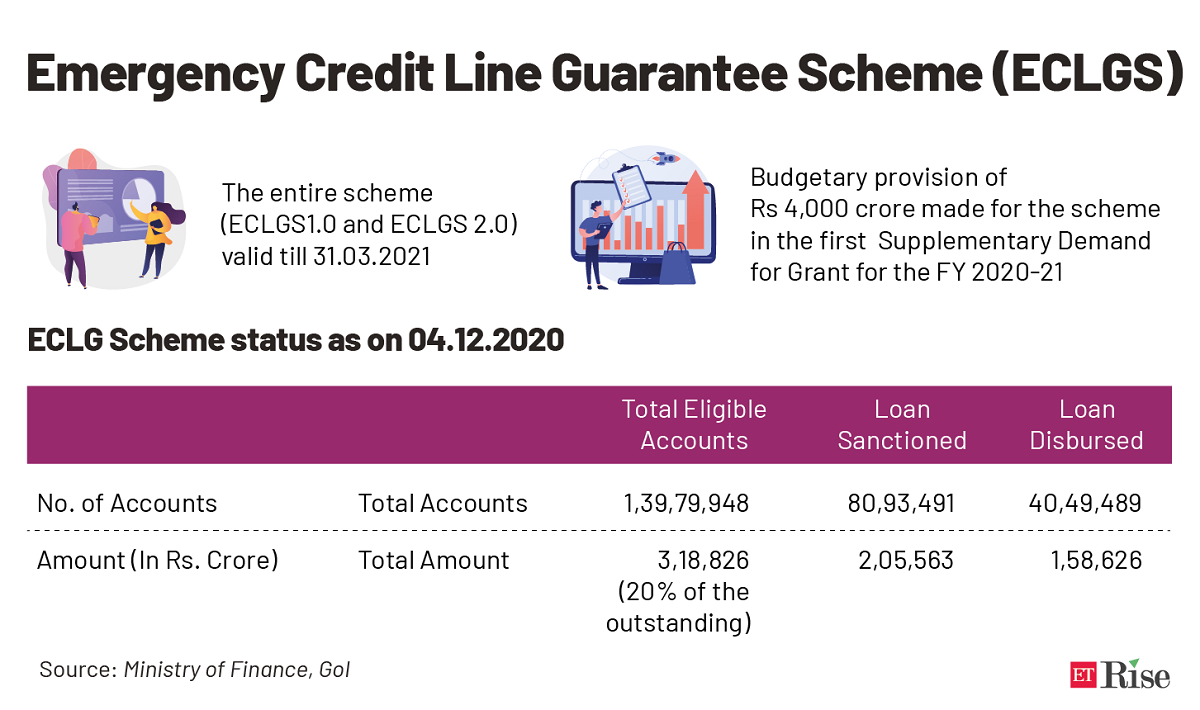

“Under ECLG scheme, as on December 4,.2020, as reported by Public Sector Banks, top 23 Private Sector Banks and 31 NBFCs, additional credit amounting to Rs 2,05,563 crore has been sanctioned to 80,93,491 borrowers, while an amount of Rs 1,58,626 crore has been disbursed to 40,49,489 borrowers,” the government’s recent release said.

With the scheme being operational for about eight months, it is now possible to analyse the performance of the initiative and figure out if it has resulted in a material change on the ground.

The industry experts that ET spoke to maintain that despite the scheme’s several lingering issues, the timely financial support, per se, has been a great help to Covid stricken MSME firms. According to Anil Bhardwaj, Secretary General of Federation of Indian Micro Small & Medium Enterprises (FISME), the scheme was “well-timed and well thought”.

Asked if he thinks the scheme has achieved its intended result, Bhardwaj asserts that the uptake of close to two lakh crore in just a few months is hugely significant. “The money raised by MSMEs went into strengthening the supply chains and helping the economy rebound. Of course, we would have wished if some kind of ‘money on tap’ scheme was also available to MSMEs who had not taken loans, but needed it during or post-Covid. However, many informal sector MSMEs would not have survived, and we would know of their fate in coming months,” he says.

What borrowers feel

To gauge the actual borrowers’ experience of availing the loan under this scheme, ET Digital reached out to the beneficiaries of the scheme who provided their first-hand account.

Pradeep Choudhary, CEO, Multi Decor India (MDIPL), a manufacturer of prefabricated buildings, says as soon as the scheme was announced, the firm approached its bank for details. But they were informed that it would take some time before actual details would be available. “There was no clarity on the scheme and its details. Even banks could not answer our queries,” Choudhary highlights.

The ECLGS loans come with several riders, which put borrowers in a bind. “Apart from standard riders, banks forced us to take insurance for an equivalent value of the loan. Although it was backed and secured by the government, the bank made us sign insurance papers as well,” reveals Choudhary.

Asked how long it actually took for the disbursal to arrive and did the time lag impact the firm’s working capital cycle, Choudhary underlines that the whole process took over 45 days. He flags that the delay affected the firm’s relationship with its vendors on ongoing projects. “Since working capital is seriously hampered during these troubled times, we were forced to let go of some projects,” he says.

(Un)ease of doing business hurting borrowers

Ease of doing business is still a big concern for businesses. Ask any small business owner in the country’s hinterlands, and the overwhelming view is clear that despite the nation’s rapid strides on the ease of doing business index, knocking at banks’ door remains a big ask for borrowers.

Despite the government’s consistent reassurances, a high level of red tape, regulatory and compliance burden still acts as a hindrance for MSMEs, On the issue Choudhary emphasises that when the world is moving forward with e-application and online format for almost everything, loans should have been made compulsory online with live tracking facilities as re-validating and verification process takes its own time.

“Bankers were asked to upload all applications to NCGT trust site. As informed by the bank, its website was down and under maintenance for almost one week, and all applications from HDFC Bank were delayed during this process. If the government truly wants to support MSME, they need to put their trust in people and remove redtapism,” he stresses.

Public sector banks were at the forefront in lending to small businesses.For many borrowers, the paperwork required was a big pain point. Amandeep Singh, Director, Life Essentials Personal Care Pvt Ltd, and a beneficiary of the ECLGS scheme,ECLGS scheme, says, “The reliance on commercial CIBIL was an issue as many banks do not remove entries even after loans have been paid. Also, large sums are shown erroneously which require painful follow up to get corrected.”

Singh, however, adds that fortunately in his case, the loan application process turned out to be very smooth. “The documentation is not cumbersome, and the bank (Bank of Maharashtra in its case) also seemed clear on its intention to help,” Singh says. The sanctioning and disbursal for him, however, took about 1-2 months.

The bottom-line

As micro-entrepreneurs having no banking history or the required level of turnover aren’t eligible for the scheme, a view held by many is that the scheme’s benefits might not be trickling down to players in the informal economy. SMEs that are eligible for the scheme say they would have liked a longer payback tenure and at funding at zero interest rate.

Saurabh Agarwal, Professor of Accounting & Finance & Principal, IIF College of Commerce and Management Studies, says the ECLGS 2.0 is intended to stir economic revival and prevent job cuts by supporting entities who have an outstanding credit above Rs 50 crore. “Micro entrepreneurs are not the target group of this scheme. The scheme is targeted at SMEs by preventing any defaults on their part. The scheme will prevent many SMEs from going out of business. The scheme’s benefits will far outweigh its costs. The benefits will trickle to the last mile if companies do not close, and those in jobs continue to get work and paid,” says Agarwal.

Experts also maintain that given the scheme’s rather satisfactory performance, it has got all the right ingredients making it fit to be extended to even first time borrowers in due course.

According to Arvind Sharma, Partner, Shardul Amarchand Mangaldas & Co. the ECLG scheme’s numbers are “impressive”, and this is despite the fact that only 10% of MSMEs in India have access to formal credit facilities and a majority of MSMEs are not part of the banking system.

“Given that the Scheme intends to provide 100% guarantee coverage to the member lending institutions with no additional collateral from the MSMEs, it is reasonable that the credit facilities are initially extended to eligible MSMEs which have exposure with banks” Sharma says, suggesting the scheme may also be extended to the first time borrowers at the opportune moment.

(Illustrations by Sadhana Saxena)