SynopsisThe media company filed three complaints against its former advisor Sanjay Dutt and his Quantum Securities in 2013-14. Seven years on, Sebi has banned not only Dutt and his company, but also issued similar orders against NDTV promoters Prannoy Roy and Radhika Roy over violation of insider-trading regulations. There was one key transaction that proved to be the Roys’ undoing.

They called the same school alma mater. They knew each other for decades. They had common friends and even “family relations”. Yet, when they fell out, the fight was bitter and prolonged, even turning ugly at times. One used words “disgruntled” and “shoddy” for the other in return of accusations of insider trading and money laundering.

Prannoy Roy and Sanjay Dutt are chartered accountants. They both went to the elite Doon School, at different points of time. Though the similarities probably end there, their paths crossed professionally in 2006-07, when Roy, a celebrated journalist-turned-entrepreneur, invited Dutt, a Doon classmate of his colleague Vikram Chandra, the then chief executive of his newly formed NDTV Networks Plc, to help raise capital for the group’s expansion plans.

Fourteen years and umpteen battles later — some shadow, some real — spanning across media, government agencies, regulators, and courts, they all find themselves staring at bans from transacting in stock markets and disgorgements running into several crores.

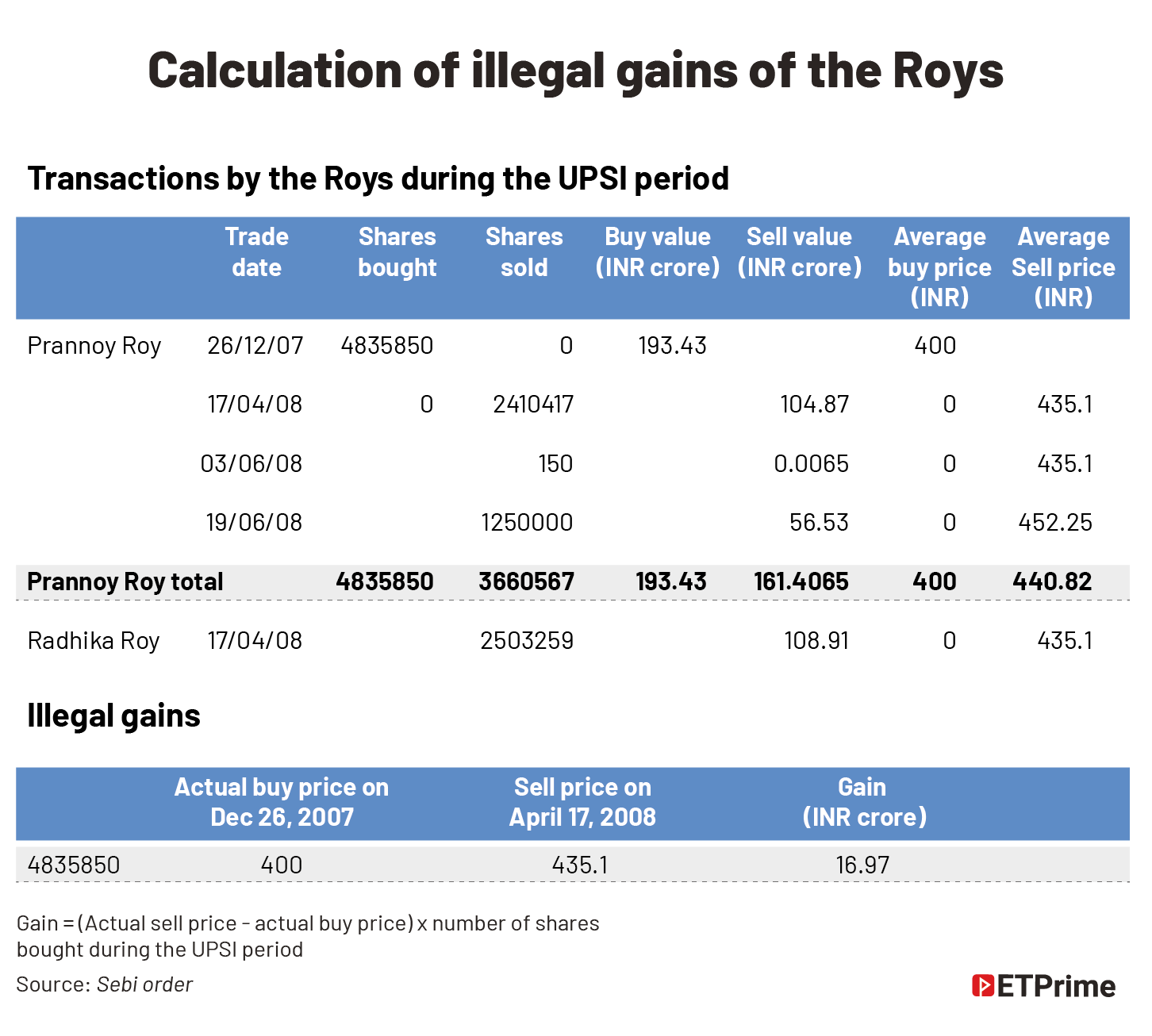

In a set of three late-evening orders that many missed on Friday, the Securities and Exchange Board of India (Sebi) found Roy, his wife Radhika, Dutt, his wife Prenita, and corporate entities associated with the Dutts guilty of violating insider-trading regulations. The regulator also ordered disgorgement of INR16.97 crore with interest at the rate 6%per annum. The interest alone works out to over a crore of rupees a year, taking the total liabilities of the Roys to around INR29 crore today.

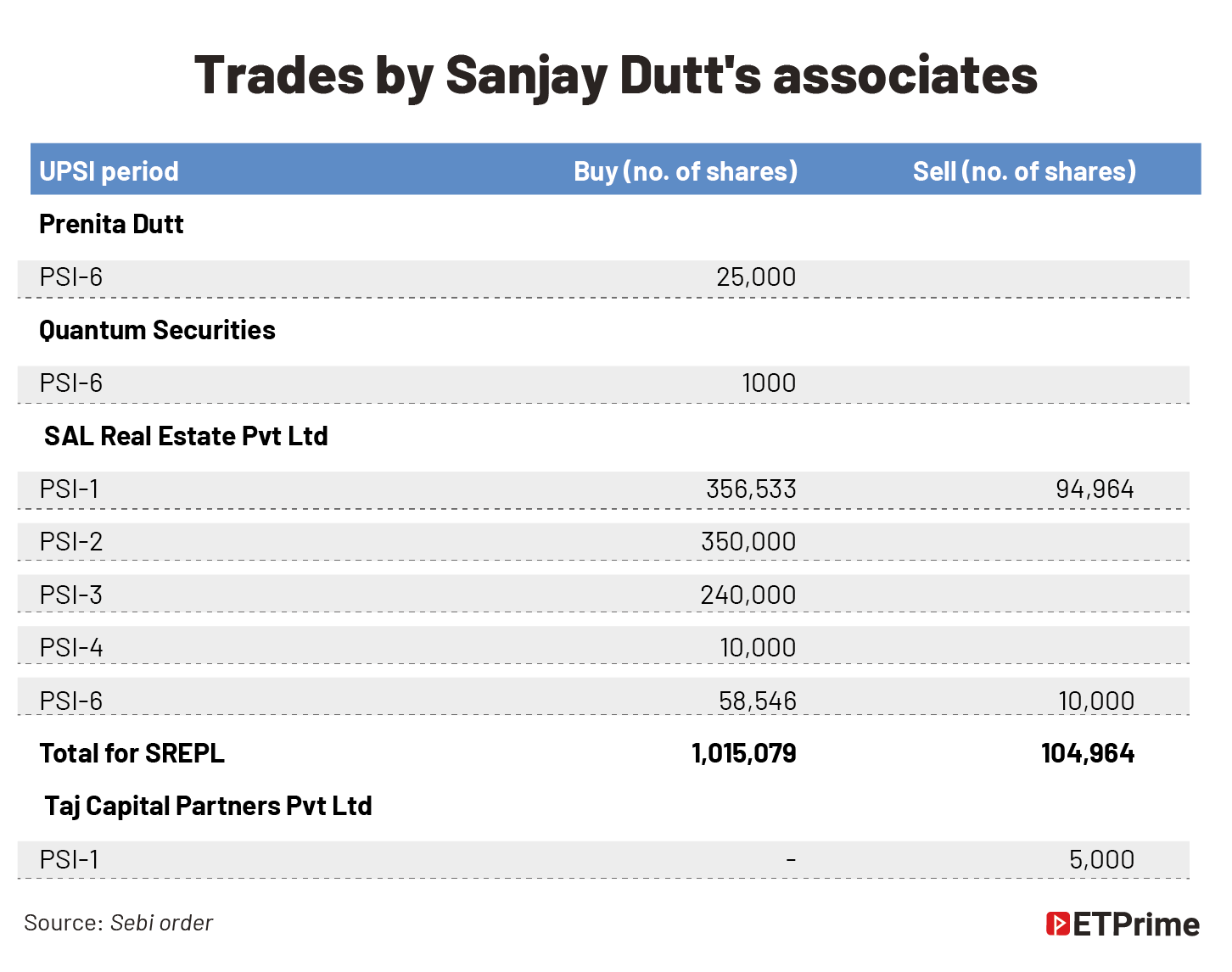

Dutt and his associates were asked to repay alleged illegal gains of over INR2.2 crore with interest. They all also face a two-year ban from dealing in the securities market.

Chandra and two others were barred for a year and would be disgorged of INR88 lakh.

While they all are likely to go for the appeal process, the orders tell a tale of a bull-market-dream-turned-nightmare.

Dream run

May 17, 2004, is known in stock market circles as Black Monday. The Sensex crashed a record 842 points and trading had to be halted twice, as investors grew nervous about the country’s growth prospects and reform agenda after the defeat of the BJP-led coalition in the general elections.

NDTV listed the bourses two days later. Despite the general mood, the oversubscribed issue managed a premium listing at INR99 (over the offer price of INR70). The pessimism in the markets withered away after Manmohan Singh, the original economic-reforms architect, took the mantle of prime minister.

As foreign investments started flowing back, a turbo-charged bull market ensued. Within two years, the NDTV stock had doubled in price, it now had an English-news channel and a Hindi-news channel, and had launched a business-news channel called NDTV Profit. The Roys, journalists at the core, had done all they could as masters of the news business.

But, the bull market was not done yet. As stock prices kept reaching new highs, promoters like Roy came under pressure to feed this valuation frenzy. Buoyed by the overall business confidence and interest shown by global investors in the India growth story, they ventured into unchartered territory.

By mid-2006, the Roys were toying with the idea of a Murdoch-like global empire spanning across the entire broadcast space, including non-news areas such as lifestyle, general entertainment, and travel. “Our dream is to have an Indian version of a global channel that can take on CNN and the BBC,” Roy was quoted in a Forbes article.

Such a dream meant raising a lot of capital — and that was where Dutt came in.

Advisor on call

Roy picked Vikram Chandra, the then head of his business news channel to lead these growth initiatives and incubate the new venture. Chandra, a top bureaucrat’s son like many early NDTV recruits, started his career as a reporter with Newstrack in 1991. He joined NDTV in 1995.

Managing editor of NDTV Profit and CEO of the nascent NDTV portal, Chandra was still spending a lot of hours broadcasting. He needed someone who could handle the nitty-gritty of corporate finance. He didn’t have to look far.

Dutt, his classmate from Doon, fit the bill, and was quickly roped in.

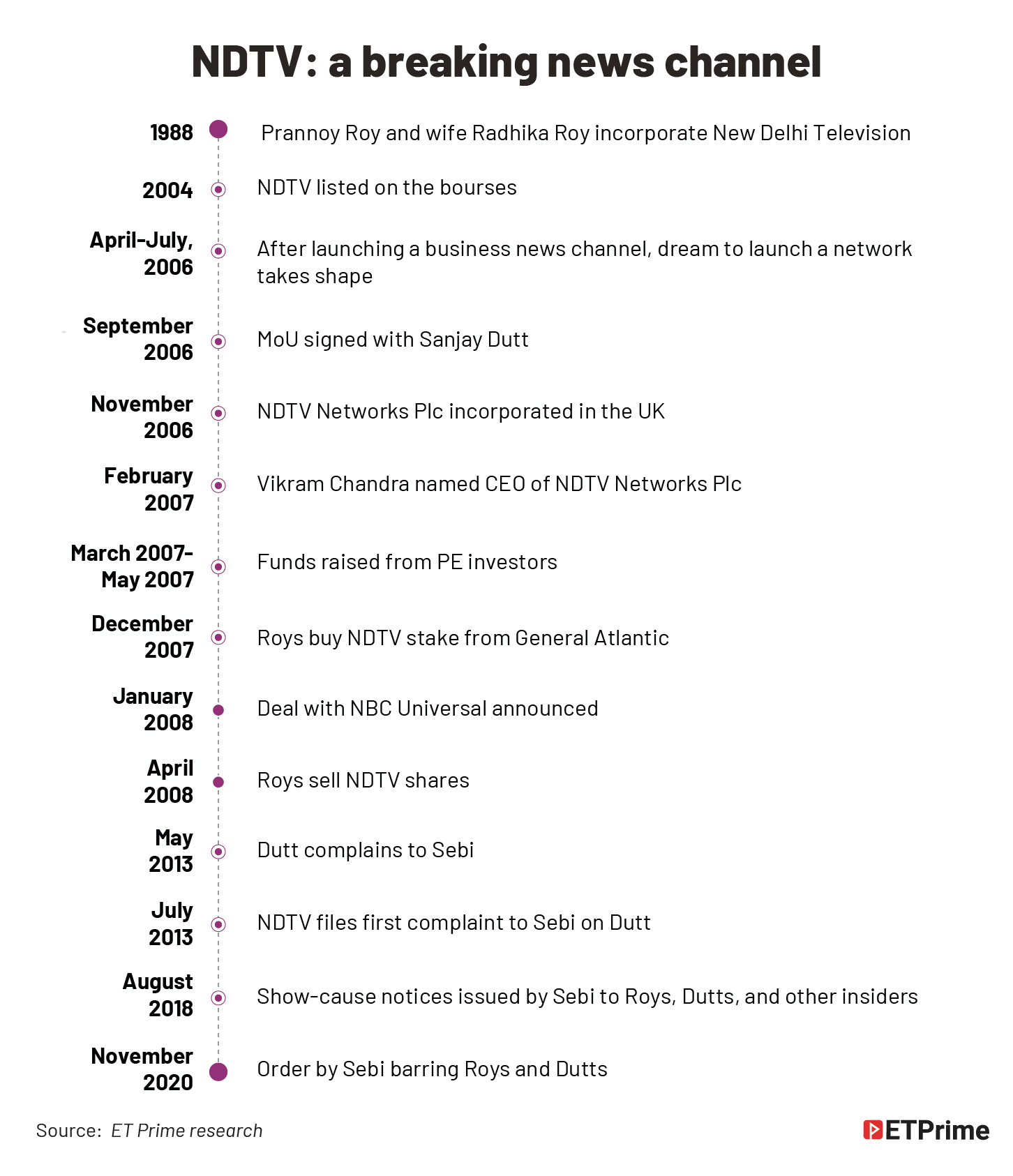

A memorandum of understanding (MoU) was inked on September 1, 2006, and within two months, NDTV Networks Plc was incorporated in the UK. In February 2007, Chandra was named the CEO of this company.

According to the arrangement, Dutt was an “on-call and in-house” advisor and a team member of the NDTV group. His scope of work included “complete responsibility and accountability for the corporate finance and strategic planning function” of the company.

People aware of these arrangements say that essentially Dutt’s responsibility was to help raise around INR1,500 crore.

Dutt helped chart a structure of five companies under the NDTV Networks umbrella. NDTV Network also owned 50% in NDTV Media Services with Genpact for media-process outsourcing.

Things were proceeding smoothly, and the Sensex kept scaling new highs through 2007. Investors saw value in the NDTV story. Lehman Brothers, Goldman Sachs, CSFB, and eight other private-equity players acquired close to 24% stake in NDTV Networks for USD120 million, valuing it at over INR2,200 crore then. The deal was announced in April 2007.

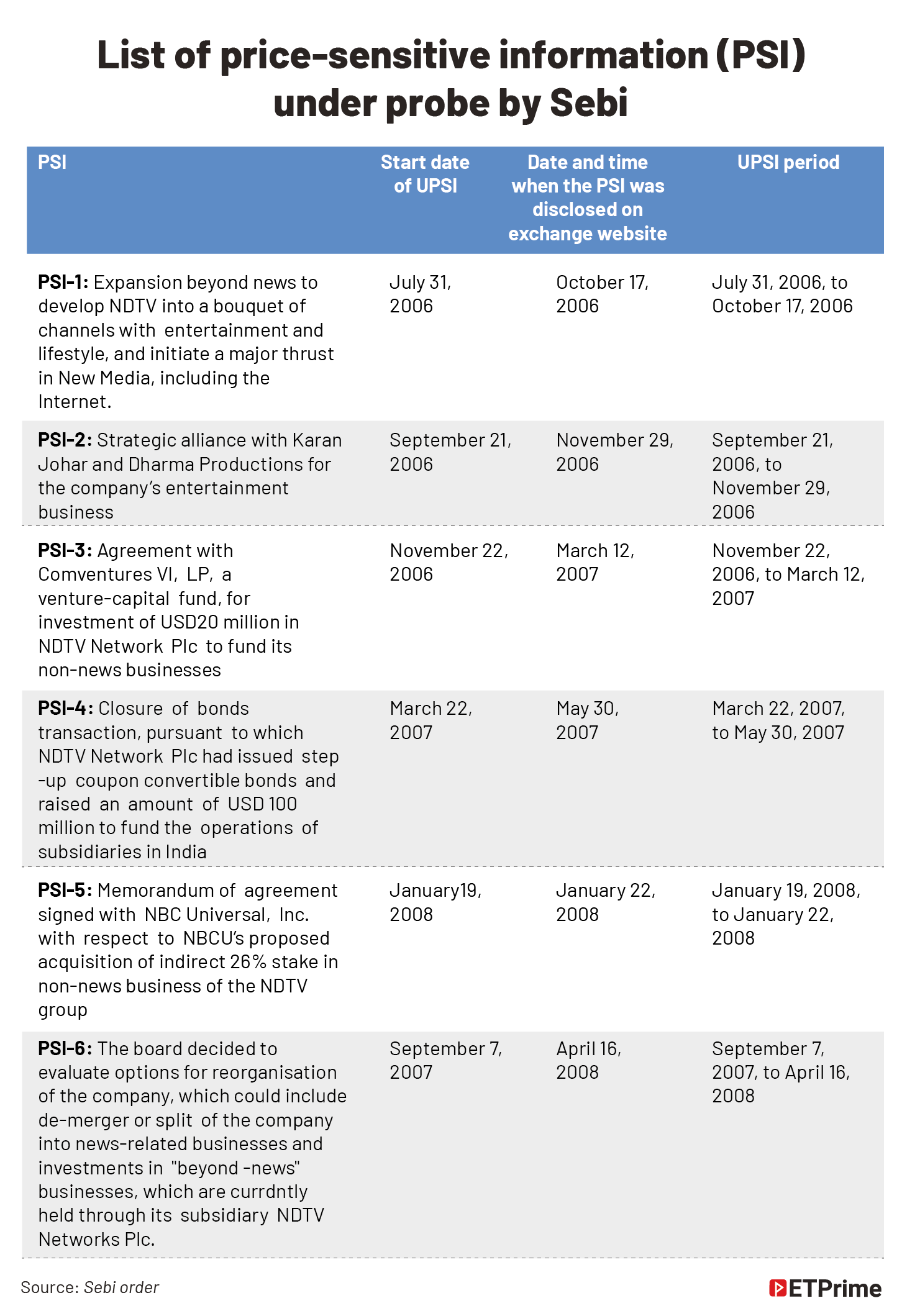

During this time, Dutt was a part of the strategic team behind the decisions, which were of price-sensitive nature and were unpublished. He was directly involved in the discussions pertaining to vital business strategies and business reorganisation of the company.

Dutt also used to be a part of a mail group within the company with whom unpublished price-sensitive information of the company was being shared. All these convinced Sebi that Dutt had direct access to and was in possession of unpublished price-sensitive information of NDTV during his tenure.

The unravelling

By the second half of 2007, troubles had started showing up in the sub-prime mortgages market in the US. But bulls in India had not given up yet. Decoupling theories and continuing foreign inflows kept hopes alive. Dutt and the Roys pushed for the second lap of disinvestments in the UK company. This time, GE-backed NBC Universal was to pick up 26% stake in NDTV Networks Plc, with an option to raise the stake to 50%.

Even as this deal was in works, the Roys bought an 8% stake in the India-listed NDTV from General Atlantic, triggering an open offer. This transaction, at the top of the bull market just a month ahead of the big crash, proved to be their undoing. In hindsight, all troubles the celebrated journalists had to go through and their battles with Dutt could be traced back to this one act in December 2007.

Their effort to fund these purchases — first through an Indiabulls loan, then an ICICI Bank loan, and finally the Vishvapradhan structure involving funding from Reliance — got them in trouble with several central agencies like the Income Tax Department, CBI, and the Enforcement Directorate. ET Prime had discussed some aspects of the Vishvapradhan structure here.

Even Friday’s Sebi order on the Roys revolves around this General Atlantic transaction.

The Roys’ trades

Sebi’s orders say the Roys were in possession of the UPSI (PSI-6), the board decision to “evaluate options for the reorganisation of the company, which could include de-merger/split of the company into news-related businesses and investments in ‘beyond news’ businesses, which are currently held through its subsidiary NDTV Networks Plc.”

Sebi found that the Roys purchased 4,835,850 shares of NDTV while in possession of an UPSI-6 during the UPSI period and sold shares of NDTV within 24 hours of public disclosure of the said price-sensitive information (PSI) to the stock exchanges, which is borne out by undisputed facts.

But for their purchases of those 4,835,850 shares on December 16, 2007, while in possession of UPSI, which triggered the obligation of an open offer, there would not have been any necessity for them to enter into the sale transaction of NDTV shares on April 17, 2008. “Thus, unquestionably the imputed insider trading of December 16, 2007, had a direct link with the sale transaction of April 17, 2008 (pursuant to a trigger of an open offer under the Takeover Regulations, 1992) as those purchases of shares of NDTV made on December 16, 2007, led to the consequent sale of shares on April 17, 2008. Admittedly, the noticees had traded only in the shares of NDTV,” the Sebi order stated.

IN a statement after the order, NDTV said the Roys would file an appeal against the Sebi order.

Dutt’s trades were scattered over different entities as seen in the graphics. Ironically, Sebi’s orders against both Dutt and the Roys refer to the complaints made by NDTV. “The instant SCN has been issued pursuant to an investigation conducted by Sebi, which got triggered on account of receipt of certain complaints from NDTV on July 16, 2013, (1stcomplaint), December 27, 2013 (2ndcomplaint), and January 9, 2014 (3rd complaint), inter alia alleging that Mr. Sanjay Dutt and certain related entities viz. QSPL and SREPL were involved in dealing in securities of NDTV in violation of provision of the PIT Regulations,” the regulator stated. Dutt is going for an appeal.

Chandra, who has since parted ways with NDTV, runs a video news portal called Editorji, and seems to have become collateral damage in the crossfire.

The investigation covered the period 2006 and April 2008, when the share price of NDTV went from 195 to 379, an increase of 94%. Curiously, the Sebi orders do not refer to complaints filed by Dutt himself.

After the ill-fated open offer, Dutt had a showdown with the Roys and exited in a huff without even a proper termination. Stuck with lakhs of NDTV shares, he has been writing to the company seeking various details. His grouse was that the Roys went back on their commitments to pay him his fees of around INR30 crore.

Months before NDTV’s first complaint in March 2013, he had written to the Sebi chairman and key officials complaining about NDTV.

During the defence, Roys’ counsels sought to understand how the probe into a complaint against Dutts had turned into a show-cause notice against them. They argued that issuing an SCN without instituting a separate investigation amounted to procedural irregularity.

“In fact, the investigation report betrays that no separate distinct investigation report is in existence, but rather that in the course of investigating the complaint made by NDTV against QSPL and SREPL, certain alleged statements were made by those under investigation, which have culminated in the present SCN, which in fact provides a pointer to or explains the circumstances in which no copies of such statements are forthcoming to the noticees,” the counsel argued, adding that Sebi has knowledge of the “personal vendetta wreaked by the promoters of QSPL and SREPL, i.e., Mr. Sanjay Dutt and his associates, which is the subject matter of a series of litigations to the knowledge of Sebi”.

They emphasised that they were not allowed to inspect statements made by Dutt or to cross-examine him, violating the principles of natural justice.

However, Sebi whole-time member SK Mohanty brushed aside these arguments.

(Graphics by Sadhana Saxena)