Credit guarantee scheme for banks need of hour, ex RBI chief Duvvuri Subbarao

“Government needs to consider spending on livelihood support, improving and expanding medical infrastructure, and provide standing guarantee to banks to lend and give loans,” Subbarao said in a panel discussion on the financial sector, hosted by the Confederation of Indian Industry (CII).

“Government needs to consider spending on livelihood support, improving and expanding medical infrastructure, and provide standing guarantee to banks to lend and give loans,” Subbarao said in a panel discussion on the financial sector, hosted by the Confederation of Indian Industry (CII).

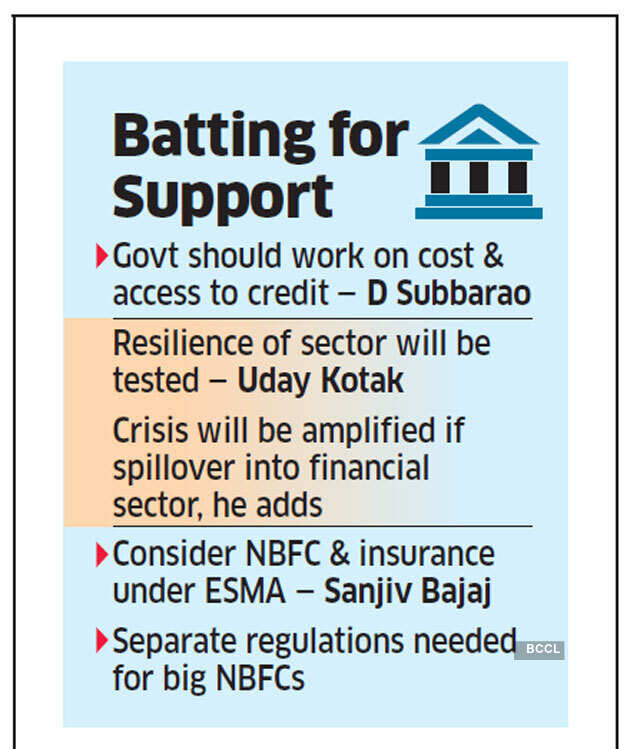

Elaborating on the required financial sector reforms, Subbarao said rationalisation of the cost of credit for all kinds of borrowers and the access to credit should be part of government’s objectives.

Given the highly leveraged nature of the financial sector, a spillover of the crisis from the real sector would have a disproportionately large impact on other sectors of the economy, according to Uday Kotak, managing director of Kotak Mahindra Bank, who was a part of the panel discussion.

Speaking for the non-banking finance companies (NBFC) sector, Sajiv Bajaj, chairman of Bajaj Finserv, felt that NBFCs and insurance should come under the Essential Services Management Act to ensure access to core financial services in the current scenario.